Realty Executives Midwest

You’ve been waiting for what feels like forever for mortgage rates to finally budge. And last week, they did – in a big way.

On Friday, September 5th, the average 30-year fixed mortgage rate fell to the lowest level since October 2024. It was the biggest one-day decline in over a year.

According to Mortgage News Daily, this was a reaction to the August jobs report, which came out weaker-than-expected for a second month in a row. That sent signals across the financial markets, and then mortgage rates came down as a result.

Basically, we’re seeing signs the economy may be slowing down, and as certainty grows in the direction the economy is going, the markets are reacting to what is likely ahead. That historically brings mortgage rates down.

But this isn’t just about one day of headlines or one report. It’s about what the drop means for you.

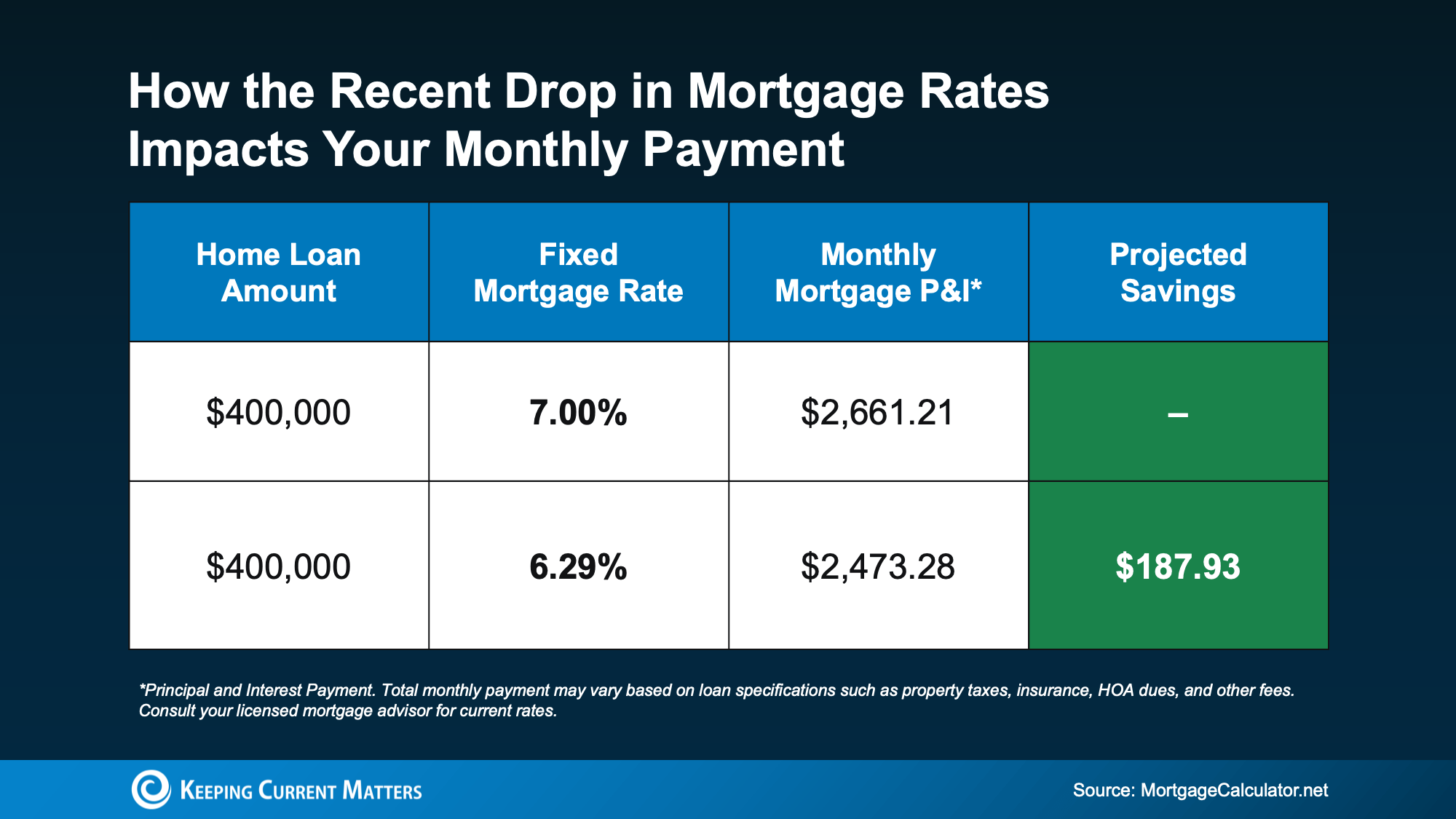

This recent change saves you money when you buy a home. The chart below shows you an example of what a monthly mortgage payment (principal and interest) would be at 7% (where mortgage rates were in May) versus where rates roughly are now:

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

That really depends on where the economy and inflation go from here. Rates could drop lower, or they could inch up slightly.

So, make sure you’re connected with a good agent and trusted lender. They’ll keep a close eye on inflation indicators, job market updates, and reactions to upcoming Fed policy to gauge where mortgage rates may go from here.

But for now, focus on this. While no one can say for sure where rates are headed, the fact that rates broke out of their months-long rut is a good thing. If you’ve been feeling stuck, this could make the start of a new chapter. As Diana Olick, Senior Real Estate and Climate Correspondent at CNBC, says:

“Rates are finally breaking out of the high 6% range, where they’ve been stuck for months.”

And that’s gives you more reason to hope than you’ve had in quite some time.

This is the shift you’ve been waiting for.

Mortgage rates just saw their biggest decline in over a year. And if rates stay near this level, it could make a home you couldn’t afford just a few months ago feel possible again.

What would today’s rates save you on your future monthly payment? Connect with an agent or lender so you can find out.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

According to Fannie Mae, 90% of buyers don’t actually know what credit score lenders are looking for, or they overestimate the minimum needed.

Let that sink in. That means most homebuyers think they need better credit than they actually do – and maybe you’re one of them. And that could make you think buying a home is out of reach for you right now, even if that’s not necessarily true. So, let’s look at what the data really says about credit scores and homebuying.

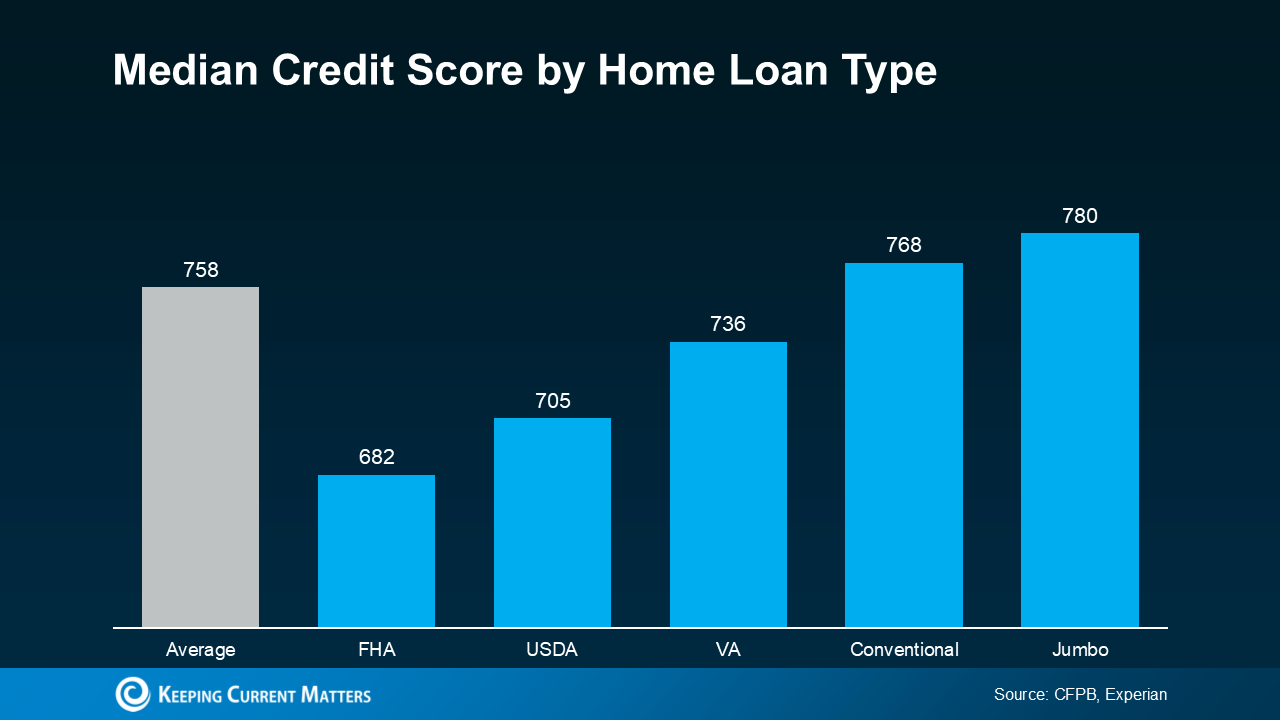

There’s no universal credit score you absolutely have to have when buying a home. And that means there’s more flexibility than most people realize. Check out this graph showing the median credit scores recent buyers had among different home loan types:

Here’s what’s important to realize. The numbers vary, and there’s no one-size-fits-all threshold. And that could open doors you thought were closed for you. The best way to learn more is to talk to a trusted lender. As FICO explains:

Here’s what’s important to realize. The numbers vary, and there’s no one-size-fits-all threshold. And that could open doors you thought were closed for you. The best way to learn more is to talk to a trusted lender. As FICO explains:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use . . .”

When you buy a home, lenders use your credit score to get a sense of how reliable you are with money. They want to see if you typically make payments on time, pay back debts, and more.

Your score can impact which loan types you may qualify for, the terms on those loans, and even your mortgage rate. And since mortgage rates are a big factor in how much house you’ll be able to afford, that may make your score feel even more important today. As Bankrate says:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

That still doesn’t mean your credit has to be perfect. Even if your credit score isn’t as high as you’d like, you may still be able to get a home loan.

And if you talk to a lender and decide you want to improve your score (and hopefully your loan type and terms too), here are a few smart moves according to the Federal Reserve Board:

Your credit score doesn’t have to be perfect to qualify for a home loan. But a better score can help you get better terms on your home loan. The best way to know where you stand and your options for a mortgage is to connect with a trusted lender.?

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

If your house is on the market but you haven’t gotten any offers you’re comfortable with, you may be wondering: what do I do if it doesn’t sell? And for a growing number of homeowners, that’s turning into a new dilemma: should I just rent it instead?

There’s a term for this in the industry, and it’s called an accidental landlord. Here’s how Yahoo Finance defines it:

“These ‘accidental landlords’ are homeowners who tried to sell but couldn’t fetch the price they wanted — and instead have decided to rent out their homes until conditions improve.”

And right now, the number of homeowners turning into accidental landlords is rising. Business Insider explains why:

“While there have always been accidental landlords . . . an era of middling home sales brought on by a steep rise in borrowing rates — is minting a new wave of reluctant rental owners.”

Basically, sales have slowed down as buyers struggle with today’s affordability challenges. And that’s leaving some homeowners with listings that sit and go stale. And if they don’t want to drop their price to try to appeal to buyers, they may rent instead.

But here’s the thing you need to remember if renting your house has crossed your mind. Becoming a landlord wasn’t your original plan, and there’s probably a reason for that. It comes with a lot more responsibility (and risk) than most people expect.

So, if you find yourself toying with that option, ask yourself these questions first:

Just because you can rent it doesn’t mean you should. For example:

If any of those give you pause, it’s a sign selling might be the better move.

On paper, renting sounds like easy passive income. In reality, it often looks more like this:

As Redfin notes:

“Landlords have to fix things like broken pipes, defunct HVAC systems, and structural damage, among other essential repairs. If you don’t have a few thousand dollars on hand to take care of these repairs, you could end up in a bind.”

According to Bankrate, here are just a few of the hidden costs that come with renting out your home:

All of that adds up, fast.

While renting can be a smart move for the right person with the right house, if you’re only considering it because your listing didn’t get traction, there may be a better solution: talking to your current agent and revisiting the pricing strategy on your house first.

With their advice you can rework your strategy, relaunch at the right price, and attract real buyers to make the sale happen.

Before you decide to rent your house, make sure to carefully weigh the pros and cons of becoming a landlord. For some homeowners, the hassle (and the expense) may not be worth it.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

If you tried to buy a home a few years ago, you probably still remember the frenzy. Homes were listed one day and gone the next. Sometimes it only took hours. You had to drop everything to go and see the house, and if you hesitated even slightly, someone else swooped in and bought it – sometimes even sight unseen.

That kind of intensity pushed a lot of buyers to the sidelines. It was stressful, chaotic, and for many, really discouraging.

But here’s what you need to know: those days are behind us.

Today’s market is moving slower, in the best possible way. And that’s creating more opportunity for buyers who felt shut out in recent years.

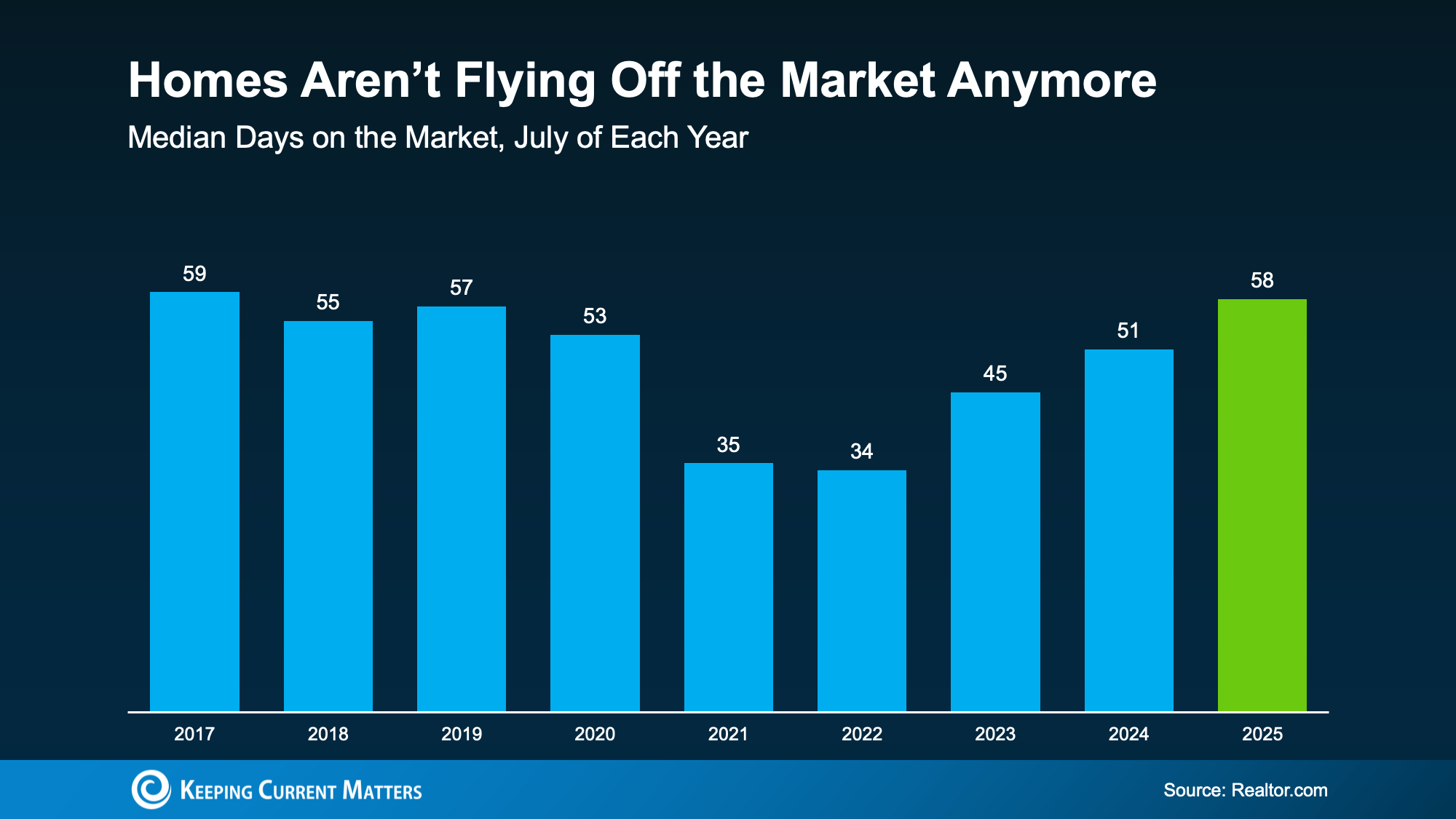

According to the latest data, homes are spending an average of 58 days on the market. That’s much more normal. And it’s a big improvement compared to the height of the pandemic, when homes were flying off the shelves in a matter of days (see graph below):

That means you now have more time to make decisions than you have at any point in the past five years. And that’s a big deal. Now, you’ve got:

That means you now have more time to make decisions than you have at any point in the past five years. And that’s a big deal. Now, you’ve got:

Time to think.

Time to negotiate.

Time to make a smart move without all the pressure.

Based on the data in the graph above, you have an extra week to decide compared to last year. And nearly double the time you would have had at the market’s peak.

Back then, fear of missing out drove buyers to act fast, sometimes too fast. Today, the pace is slower, which means you’re in control. As Bankrate puts it:

“For years, buyers have been racing to snag homes because of the fierce competition. But the market’s cooled off a bit now, and that gives buyers some breathing room. Homes are staying listed longer, so buyers can slow down, weigh their options and make more confident decisions.”

With more homes on the market and fewer buyers racing to grab them, the balance has shifted. Bidding wars aren’t as common, and that means you may have room to negotiate. And you can actually take a breath before you make your decision.

But, and this is important, it still depends on where you’re buying. Nationally, homes are moving slower. But your local market sets your real pace. Some states are moving faster than others. It may even vary down to the specific zip code or neighborhood you’re looking at. And that’s why working with an agent to know what’s happening in your area is more important than ever.

To see how your state compares to the national average (58 days), check out the map below:

“While national headlines might suggest a buyer’s market is taking hold, the reality on the ground depends heavily on where and what you’re trying to buy. Local trends can diverge sharply from national averages, especially when you factor in price range, property type, and post-pandemic market dynamics.”

A smart local agent can tell you exactly when to move fast and when you can take your time, so you never miss the right home for you.

If the chaos of the past few years drove you to hit pause, this is your green light. The market’s pace has shifted. You have more time. More options. More power.

And with the right agent guiding you, you’re in the best position you’ve been in for years.

Connect with a local agent to talk about what the pace looks like in your area, and if now could be the right time for you to re-enter the market.

Source:Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

Buying your first home feels like reaching a finish line, but it’s really a new beginning. There’s no property manager now, no one else to manage the repairs, or make seasonal calls. Maintenance is your job, and while the list can seem endless, most tasks boil down to small things done consistently. Start with a few clear habits and you’ll avoid the late-night leaks and expensive emergency visits that haunt unprepared homeowners. Below are a few hidden responsibilities and essential checks, each one simple but important, that every new homeowner should know.

Start with the easiest win in terms of hidden responsibilities: replace your furnace filter every 1–3 months. When filters clog with dust and pet hair, your HVAC system strains harder than it should, which wears it down and inflates your energy bill. A clean filter helps the system breathe, keeps air flowing, and ensures the temperature inside your home matches the thermostat on the wall. Most filters slide out with no tools, and you can write the change date right on the cardboard frame. Treat it like brushing your teeth. If you ignore it, the problems sneak up slowly until one day they aren’t so small.

Once in spring and once in fall, schedule a professional to come out and look at your system. These visits are more than box-checking. The benefits of regular AC tune-ups include catching refrigerant leaks, testing electrical components, and cleaning coils, all of which help your system last longer. A tune-up won’t guarantee that nothing breaks, but it reduces the odds that your AC fails during the first hot week of summer. Some companies offer maintenance plans, which can save you a little money and make scheduling easier. It’s a small bit of effort that pays off when you’re not sweating through July.

If you’ve never cleaned a gutter, it’s easier than it sounds, and more important than it looks. When gutters clog with leaves, rainwater spills over and pools near your foundation, creating the perfect recipe for erosion, leaks, or worse. Professionals recommend you safely clean gutters in fall, even if you don’t have big trees nearby. Use a ladder, gloves, and a hose if needed. It’s a satisfying job when you finish and even more satisfying the next time it rains and the water flows away exactly as it should.

Walk through your home on a chilly day and feel around your windows and doors. That creeping chill near the baseboard or sliding door? That’s heat leaving your house, and money going with it. Most of the time, it’s an easy fix. You can air-seal drafty windows and doors using basic materials like weatherstripping, caulk, or foam tape. Not only will your house feel cozier, but your heating system won’t have to work so hard to maintain a comfortable temperature. Do it once a year and you’ll notice the difference every winter.

That sound of a toilet running long after a flush is more than an annoyance— this hidden responsibility addresses wasted water and wasted money. Fortunately, this is one of the easiest repairs a homeowner can learn. You can fix a running toilet using just a few parts from the hardware store, often without tools. Inside the tank, the culprit is usually a flapper, float, or fill valve, all of which are inexpensive to replace. If you can follow a recipe, you can fix a toilet. And once you’ve done it, you won’t be afraid to open the tank again.

Dryer fires aren’t common, but when they happen, lint buildup is often the cause. While most people clean the lint trap, few take time to inspect the vent duct that runs out the back. At least once a year, inspect your dryer vent annually to make sure lint hasn’t built up inside the hose or outlet. Unplug the machine, disconnect the duct, and clean it with a vacuum or dryer brush. This simple task can make your dryer work faster, use less energy, and, most importantly, reduce fire risk. It’s one of the few chores that protect both safety and savings.

There’s a piece of plumbing you may not notice, but it quietly protects your entire water system. Backflow preventers stop contaminated water from reversing direction and flowing back into your clean supply, which is especially useful if you have outdoor spigots or an irrigation system. In certain situations, like a sudden pressure drop, unprotected lines can pull pesticides, dirt, or bacteria backward through the system. That’s why many municipalities require them. Whether or not yours does, having properly installed and functioning backflow preventers is a smart way to protect both your water and your peace of mind.

Homeownership doesn’t come with a manual, but it does reward attention. Start to address hidden responsibilities with these basic tasks, make them part of your monthly or seasonal rhythm, and you’ll avoid the stress and expense that comes from reacting instead of preparing. You don’t need to fix everything today. Just keep an eye on what matters and tend to it before it breaks. That’s the real work of owning a home—not just having it but caring for it.

Source: Realty Executives

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com