Realty Executives Midwest

There’s one decision you’re going to make when you sell that determines whether your house sells quickly, or it sits. Whether buyers make an offer, or scroll past it. Whether you walk away with the maximum return, or you end up cutting the price later.

And that’s your asking price.

If you’re thinking of moving and trying to figure out what your house may sell for, it’s tempting to start with an online home value tool. They’re fast, free, and easy. And you don’t have to talk to anyone. But here’s the problem: they don’t know your house.

And that can be a bigger drawback than you realize.

Online tools often lag behind the market. They look in the rearview mirror, relying on closed sales and delayed information. And in that sense, they’re using incomplete data.

That’s not a miss in how these systems are built. Some information just isn’t available online. Bankrate explains:

“While these tools can be a useful starting point, keep in mind that they typically do not provide the most accurate pricing. Algorithms can only rely on the information available; they can’t account for things like a home’s condition or renovations made since the last public information was updated.”

They can’t see:

So, while they may do a good job in some cases, they can’t be as accurate as a local agent who has boots on the ground day in and day out.

In a market where buyers have more options, a seemingly small margin of error can cost you thousands if you price too low, or weeks of lost momentum and time if you price too high.

If you want to sell for the most money and in the least amount of time, you don’t want the fast answer on how to price your house. You want the right one.

That’s why the savviest homeowners today don’t rely on algorithms when it actually matters. They rely on people, specifically trusted local agents.

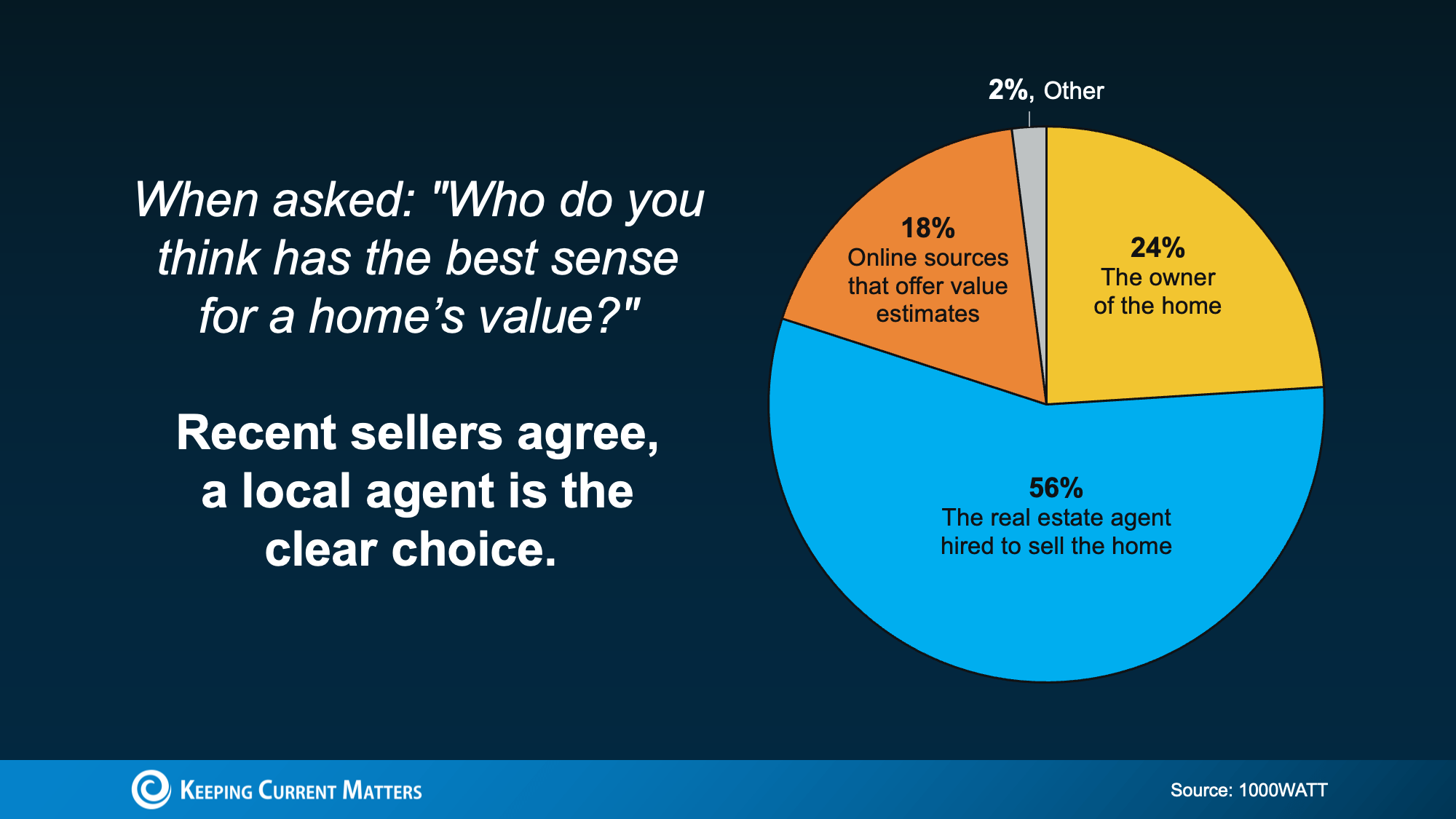

According to 1000WATT, sellers overwhelmingly believe real estate agents have the best sense of a home’s true value, far more than any automated tools.

That confidence isn’t accidental. As Bankrate puts it:

That confidence isn’t accidental. As Bankrate puts it:

“A professional appraiser or real estate agent can visit the home in person, assess the neighborhood as a whole as well as the individual property, perform more thorough market research, and consider subjective details.”

And those details matter. A skilled local agent doesn’t just pull reports. They know what’s happening right now:

And once an agent steps foot in your house, they may even find your online estimate undershot your value. So, if you stuck with the estimate you got online, you’d actually be leaving money on the table. And no one wants that.

While online tools can give you a rough starting point, only a local expert can give you a price that actually works.

If you want to know the right number for your house, not just the easiest one to find, connect with a local real estate agent.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

Painting the interior of your home is one of the best ways to add value without breaking the bank, but the colors you choose are crucial for maximizing value. According to design experts, cool neutrals are on their way out, and you’re much more likely to see added property value by going with warm grays and whites, or deep colors that reflect nature, like soothing greens.

Millennial gray has topped the list of paint colors for the better part of a decade, but according to a recent report from Fixr.com, 58% of design professionals now say these cool, blue-toned grays are some of the least desirable interior colors in 2026. Buyers now believe these grays lack personality and character, and they’re opting more for bolder hues.

The Better Alternative: Warm neutrals

Neutral colors will likely never be out of style, but according to 73% of experts, warm neutrals with undertones of red, orange, or yellow could help fetch a higher sale price.

Whites on interior walls are an option for the less adventurous, but 23% of experts agree that the stark whites popular in the 2010s are on their way out. Buyers in 2026 want interior spaces to feel restorative and warm, and those “hospital” whites are anything but.

The Better Alternative: Soft or warm whites

Soft, creamy whites with those same undertones of red, orange, or yellow are better options, according to 73% of experts. These still create a clean appearance but offer more in the way of the calmness and wellness that buyers crave in 2026.

Color is good, but too much can be problematic in some cases. Experts say buyers are more likely to see overly bright and boisterous colors as an immediate renovation expense rather than a design choice they could embrace. Steer clear of bright hues on the exterior, especially, as these can tank your curb appeal and turn buyers off before they even give your home a chance.

The Better Alternative: Restorative Greens and Earthy Blush

If you can’t bring yourself to embrace the neutrals that are dominating interior color palettes in 2026, 66% of experts agree that you should choose “fresh botanical greens,” like sage or olive, or soft blushes with earth tones.

Buyers want natural colors inside and out, which is a big reason 37% of experts say that harsh red paint over brick exteriors is one of the worst exterior options if you’re looking to sell your home. Not only is the plastic-y look of traditional paint over brick not appealing, but savvy buyers understand that it can create moisture issues, which means more maintenance.

The Better Alternative: Natural Masonry Finishes in Warm Whites or Taupe

Raw brick is a popular option for natural texture and color, but experts also note that natural masonry finishes in warm parchment whites or taupe give your home desirable “Old World” charm while still allowing the porous brick to breathe. Buyers in 2026 equate that with high-end luxury.

Choosing trendy interior paint colors in 2026 can help maximize your home’s appeal and even help fetch a higher selling price, even as we transition back to a buyer’s market. According to experts, warm neutrals and restorative greens are among the most desirable hues this year. Avoiding unusually bright colors, especially on the exterior, can also help you get top dollar for your home.

Source: Realty Executives

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

If you’re planning to buy a home this year, you may be focused on the spring market. And hoping that when spring does hit, you’ll see:

But here’s what most buyers don’t realize. Buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Here are three reasons why accelerating your timeline over the next few weeks could actually be a better play.

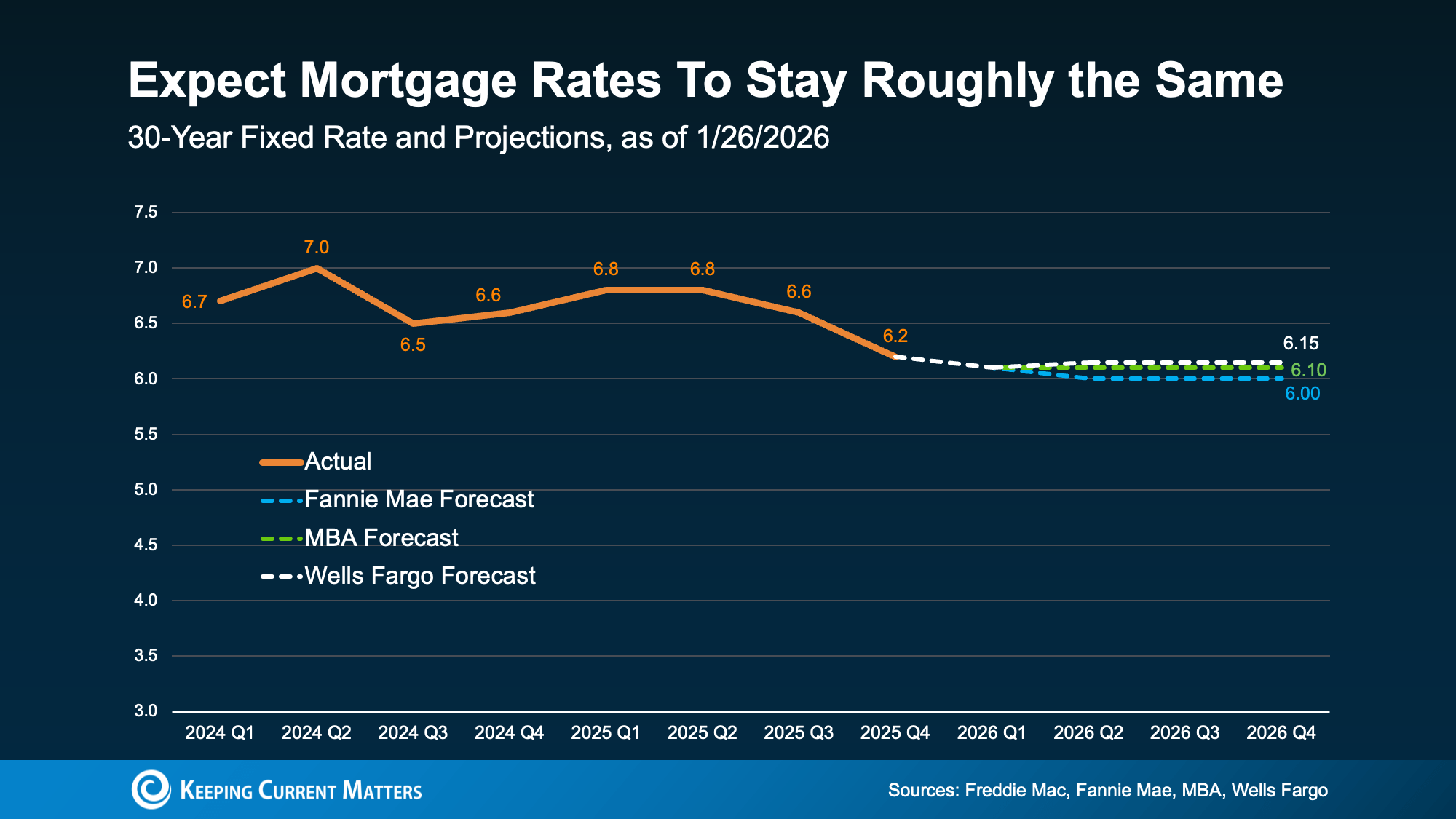

A lot of buyers are hoping mortgage rates will fall even further. But that’s not the best strategy. Here’s why. Experts are pretty aligned on this: rates are expected to stay roughly where they are.

Forecasts throughout the industry all point to the same thing: rates are projected to be in the low-6% range this year (see graph below):

That’s not a bad thing, especially if you consider how much rates have already come down. Over the past 12 months, they’ve dropped roughly a full percentage point. And for many buyers, that means affordability has already improved more than they may realize.

That’s not a bad thing, especially if you consider how much rates have already come down. Over the past 12 months, they’ve dropped roughly a full percentage point. And for many buyers, that means affordability has already improved more than they may realize.

So why wait a few more weeks just for more buyers to jump in and act as your competition? You already have a window right now. As Chen Zhao, Head of Economics Research at Redfin, explains:

“House hunters should know that this may be near the lowest mortgage rates fall for the foreseeable future.”

Speaking of competition, the spring market is popular for a reason, but with popularity comes pressure. With more buyers active at that time of year, you’ll have to move faster once you find a home you like. And no one likes feeling rushed.

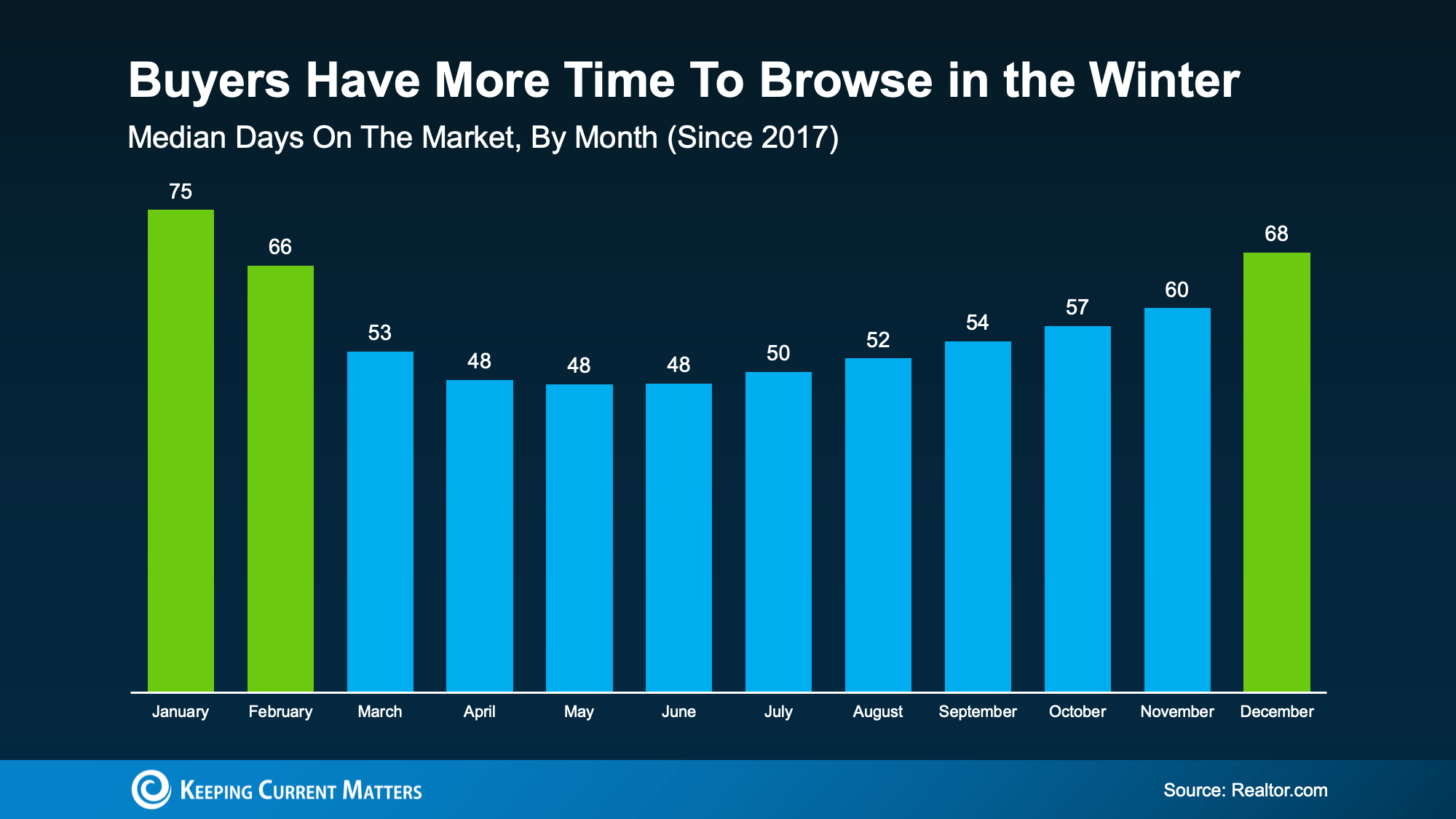

But buy now and you have more time to browse. Fewer people are looking, so homes sit longer.

You can see this play out in the data from Realtor.com (see graph below). In winter months, it takes an average of about 70 days for a home to sell. In spring? That drops to about 50 days. That’s a 20-day swing – and that pace is going to be more stressful.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

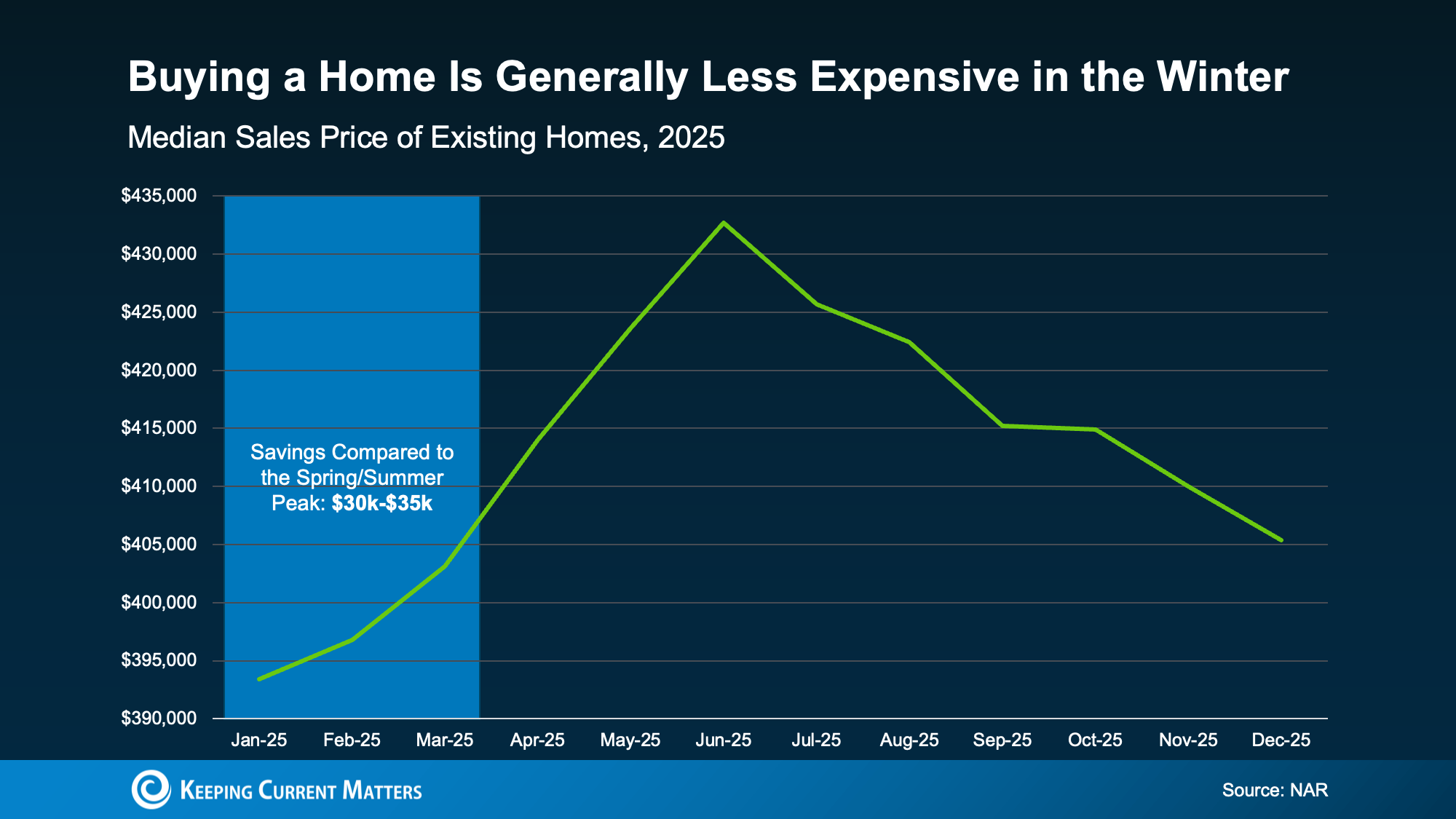

And here’s something most buyers forget to factor in. Prices usually respond to demand. So, when demand is higher, prices are too. Bankrate explains:

“Spring and early summer are the busiest and most competitive time of year for the real estate market . . . home prices tend to be steeper to reflect the increased demand.”

In fact, data from the National Association of Realtors (NAR) shows that in 2025, buyers who purchased in the beginning of the year saved roughly $30,000–$35,000 compared to those who bought when prices peaked in the spring or early summer.

And let’s be honest, for a lot of buyers today, every little bit of savings helps. That’s why buying just a few weeks earlier, before prices ramp up, will be better for you and your wallet.

And let’s be honest, for a lot of buyers today, every little bit of savings helps. That’s why buying just a few weeks earlier, before prices ramp up, will be better for you and your wallet.

Buying a few weeks before spring isn’t about rushing. It’s about choosing to be ahead of the curve and knowing you want more leverage, less stress, and meaningful savings.

If you’re ready and able to buy now and want to get the ball rolling, connect with a local agent.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

Planning to sell this spring? While you may be tempted to hold off until the first blooms or the spring showers hit, that’s actually waiting too long to get started by today’s standards.

Buyers have more options than they did a few years ago. So, it’s worth it to tackle repairs now and make sure your house is set up to stand out. Because you don’t want to be caught scrambling right before the spring rush. Or, running out of time to do the work your house really needs.

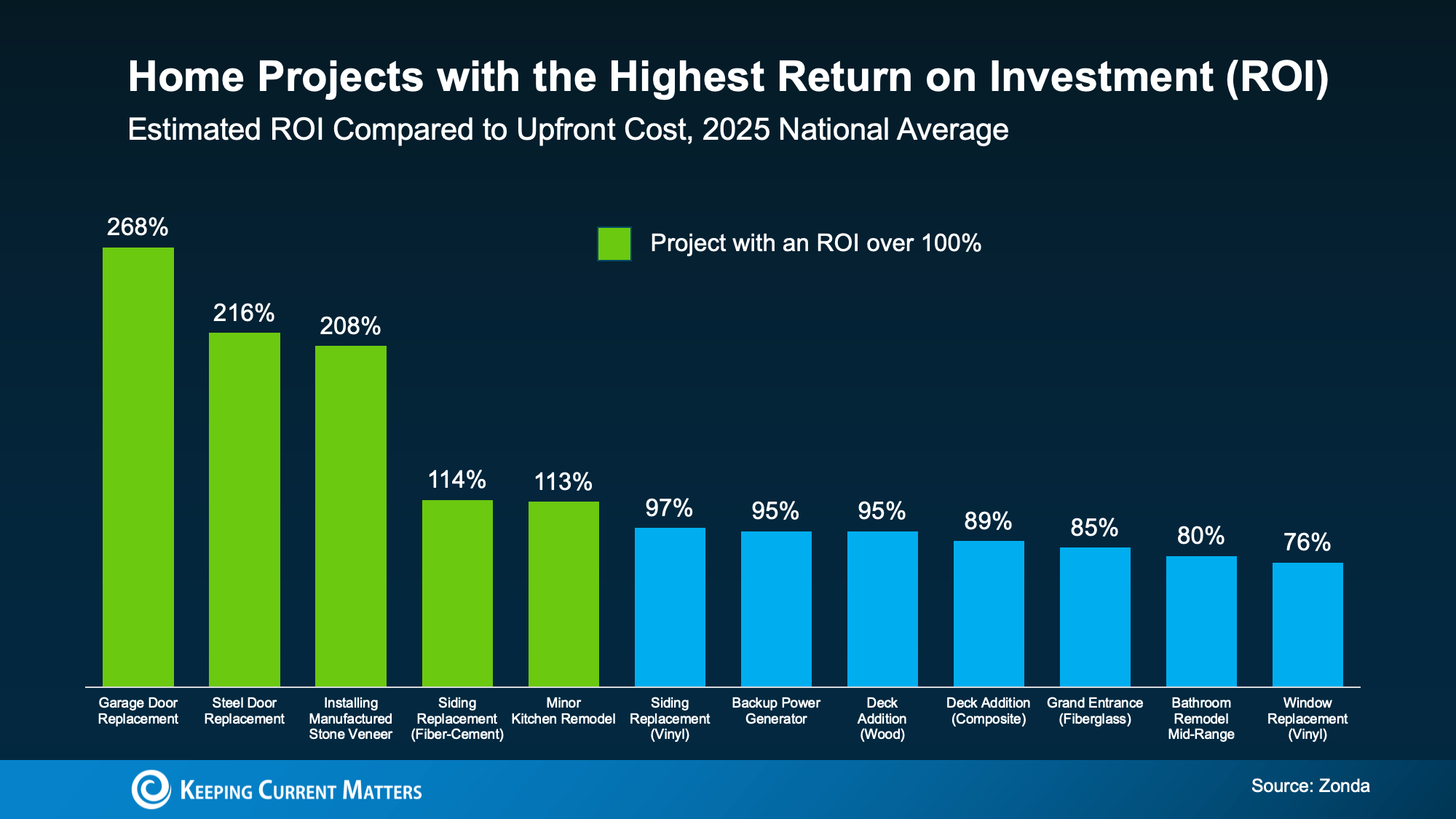

The key is focusing on updates that actually matter. And that’s exactly where return-on-investment (ROI) data comes in handy.

Every year, Zonda looks at which home improvements deliver the most bang for the buck when you go to sell the home. And the results can be a little surprising.

The green in the chart below shows the updates where sellers have the biggest potential to add value based on that research:

While there’s a wide range of projects represented in this data, the cool part is, some of the top winners aren’t big to-do’s. They’re just swapping out doors.

While there’s a wide range of projects represented in this data, the cool part is, some of the top winners aren’t big to-do’s. They’re just swapping out doors.

This goes to show little projects can have a big impact. So, you don’t have to spend a fortune. And you don’t need to tackle everything on this list. But in today’s market, doing nothing can work against you.

Now that buyers have more homes to choose from, a lot of them are going to opt for what’s move-in ready.

The best advice? Focus on what your house needs, whether it’s listed here or not – like the repairs you’ve been putting off. A front door or shutters in need of a little TLC. Piles of leaves in the yard. Scuffed up paint where your kids play inside. Those details matter too.

Mallory Slesser, Interior designer and Home Stager, explains it to the National Association of Realtors (NAR) this way:

“If you’re looking for affordable updates that pack a punch, dollar for dollar, I would say painting; changing out light fixtures; changing out hardware; maybe new draperies or window treatments. Those are all cost-effective ways to make a big statement. It really changes the space.”

These seemingly small things help buyers focus on the home itself – not the work they think they’ll have to do after moving in. And that’s paying off for other sellers. Buyers are often willing to spend more on homes that feel well cared for, updated, and move-in ready.

Here’s the important thing to remember. National data like this is a guideline. Buyer preferences are going to vary by location, price point, and even neighborhood. That means a project that boosts value in one area might be unnecessary (or even overkill) in yours.

That’s why the first step should always be to talk with a local real estate professional before you start.

An experienced agent can help you answer questions like:

That guidance helps you avoid over-improving and under-preparing.

If you’re looking to sell this spring, you still have time to make updates that help your home stand out – without taking on a full renovation.

If you’re not sure where to start, talk to a local about what makes sense for your house. A quick conversation can help you prioritize the updates that’ll pack the biggest punch.

What’s one upgrade you’ve been thinking about – and wondering if it’s worth it?

Owning a home comes with endless opportunities to enhance comfort, efficiency, and value. One of the simplest ways to achieve these goals is by investing in appliance upgrades. Modern home appliances aren’t just about convenience, they can save energy, streamline daily routines, and even increase your home’s long-term value.

Whether you’re preparing your home for family life, maximizing energy efficiency, or planning for resale, these five appliance upgrades are worth considering. Each offers practical benefits, and the right choices can make a tangible difference in your day-to-day living.

The refrigerator is often the most used appliance in a household, yet many homeowners delay upgrading it for years. Today’s models offer features far beyond simple cooling: smart temperature controls, energy-efficient designs, flexible shelving, and even connectivity with apps that monitor food inventory.

Why upgrade:

Older refrigerators can be energy hogs, sometimes using 30–50% more energy than modern ENERGY STAR-rated models. Upgrading not only reduces utility bills but also preserves your food better, minimizing waste.

Considerations:

Look for a model with adjustable shelving, humidity-controlled drawers, and separate temperature zones. Smart technology can also alert you if the door is left open or if maintenance is required. For families, this convenience alone can save time and reduce stress.

Your oven or range is another kitchen staple that benefits from modern technology. Upgrading to a newer model can improve efficiency, provide faster cooking, and even enhance safety features.

Why upgrade:

Many older ranges lack consistent heat distribution or precise temperature controls. Modern electric and gas ranges provide even cooking, self-cleaning options, and induction cooktops that heat faster while consuming less energy.

Considerations:

If you cook frequently, consider a range with double ovens, convection baking, or smart connectivity that allows remote preheating or recipe guidance. Induction cooktops are particularly efficient and safer for households with children.

A high-performing dishwasher does more than clean dishes—it streamlines a major household task while conserving water and energy. Many older dishwashers were designed before today’s energy and water standards, meaning they can be surprisingly inefficient.

Why upgrade:

Modern dishwashers are quieter, faster, and gentler on both dishes and the environment. Features like soil sensors, multiple cycle options, and adjustable racks make them versatile and convenient.

Considerations:

Look for ENERGY STAR-certified models and consider size relative to your household’s needs. Some premium models even allow you to customize cycles for specific items, such as wine glasses, pots, or delicate plates.

Laundry is one of the most frequent household chores, and upgrading your washer and dryer can transform the experience. New appliances offer improved cleaning, energy efficiency, and water savings—all while being gentler on clothing.

Why upgrade:

Older models can use more water and electricity than necessary and may take longer to complete cycles. Upgrading reduces both utility costs and the wear and tear on your wardrobe.

Considerations:

Front-loading washers often use less water and energy than top-loading models, while high-efficiency dryers reduce drying time. Smart washers and dryers can alert you when cycles are complete and provide remote monitoring, making laundry a little easier to manage.

While not a traditional “appliance,” a smart thermostat is one of the most impactful upgrades for any home. Heating and cooling typically account for the largest portion of household energy use, and a modern thermostat allows you to control these systems with precision.

Why upgrade:

Smart thermostats learn your schedule, adjust temperatures automatically, and can be controlled remotely via apps. This reduces energy waste, lowers bills, and keeps your home at a consistent, comfortable temperature year-round.

Considerations:

Choose a thermostat compatible with your existing HVAC system. Many offer integration with voice assistants or smart home platforms, adding convenience and even the ability to monitor indoor air quality.

While these five upgrades offer immediate benefits, a few overarching considerations can make your choices even more impactful:

Upgrading home appliances isn’t about keeping up with trends, it’s about improving the way you live every day. From refrigerators that maintain freshness, to ovens that cook efficiently, to smart thermostats that optimize comfort, modern appliances bring convenience, energy savings, and long-term value to your home.

For homeowners, making thoughtful appliance upgrades also reflects a broader approach to maintaining and enhancing your property. By combining practical investments with modern technology, you create a home that’s comfortable, functional, and appealing—both for your family and, potentially, for future buyers.

Even slight changes can make a significant difference. Start with the appliances that impact your household most, and let each upgrade build toward a more efficient, enjoyable, and valuable home in the years to come.

Source: Realty Executives

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com