Realty Executives of Northern Arizona

Vision and Early Planning:

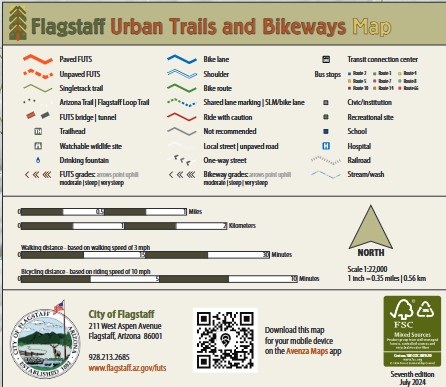

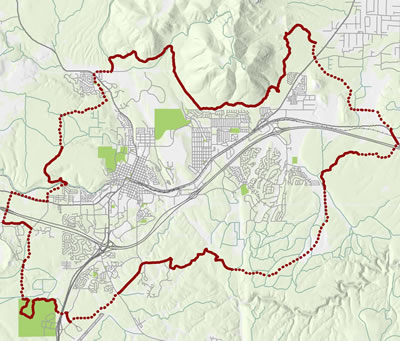

The idea for FUTS emerged in the 1980s as part of a broader urban planning effort to promote outdoor recreation and sustainable transportation in Flagstaff. With Flagstaff’s growing population and its strong outdoor culture, city planners envisioned a network of interconnected trails that would allow people to walk, hike, and bike throughout the city without relying on cars.

The plan aimed to take advantage of Flagstaff’s beautiful natural setting, including its forests, mesas, and proximity to landmarks like the San Francisco Peaks, and to create a system of trails that would link parks, schools, and neighborhoods.

Gradual Expansion:

The city continues to expand FUTS as part of its regional transportation plan, which promotes non-motorized travel and aims to reduce Flagstaff’s environmental impact by encouraging biking and walking.

Specifics of the FUTS Trail System:

Trail Types:

Popular Trails:

In summary, FUTS was created through careful planning and collaboration over decades, with the goal of connecting Flagstaff’s residents and visitors to both the city and its surrounding natural landscapes. It’s an essential part of Flagstaff’s identity, offering a way to explore the area’s beauty while promoting sustainable transportation.

Come see us when you are looking to buy or sell in Northern Arizona, or have real estate questions. We have on-site Realtors available in our office in historic downtown Flagstaff daily Monday - Saturday.

Fixing and flipping (Fix n Flips) real property is a bustling part of the real estate market! Investors, buyers, and many real estate licensees, regularly engage in these opportunities. The key to a successful flip is speed and economic prudence. Savvy investors identify projects, make cost-efficient improvements, and resell quickly. Yet, it can often be a race to the finish and a recipe for problems with inherent risk for those involved. Consider the following:

Lack of Knowledge About a Property. An investor most likely will not have lived in the property and thus, have little historical data. In turn, the invistor often refuses to provide a Seller's Property Disclosure Statement ("SPDS"). This is not a wise position, or in the best interest of the investor and others involved. To explain:

Practice Pointer. Licensees on both sides of the transaction should request copies of all contractor invoices. Further, licensees for the buyer should advise the buyer to review the licensing history of the contractors through the Arizona Registrar of Contractors ("ROC"). This advice should be given in writing and it should only be the buyer that conducts any research and due diligence with the ROC, not the licensee. This exercise allows the buyer to confirm that only licensed contractors performed work and said contractors are still in business and/or do not have a disciplinary history.

Licensee as a Principal. It has become common for some licensees to utilize their market expertise and participate in Fix n Flips as a principal. If choosing to do so, the following is important:

Ultimately, with Fix n Flips it is always best practice to be well versed in the heightened level of risk that a licensee and their respective clients encounter with fix transactions.

For many, the start of the year is a wonderful opportunity to refresh their living spaces. Aside from cleaning your home, tidying and decluttering might also be at the top of your list.

Decluttering, albeit a daunting task, can be very rewarding. Letting go of items you no longer need or no longer serve their purpose frees up space in your home and your mind, leaving you feeling lighter and happier.

If you feel like decluttering is such a chore, it might be because you haven't found a method that works well for you. Understand that there isn't a "one-size-fits-all" decluttering solution. Tidying up your space will always depend on your time, energy, or interest, so you don't have to follow only one rule. Here we've rounded up five of the most popular and expert decluttering approaches to owning less, hopefully to make the task a little easier for you.

Whether you want to experiment with these methods to see what works best for you, or you already have a favorite approach but want to try a new one, the results will remain the same: your remaining items will have more meaning and you'll also have the chance to help others when you donate the ones you no longer need.

What is the KonMari method?

The KonMari Method™ is probably one of the most famous decluttering methods, introduced by Japanese organizing consultant Marie Kondo in her 2014 bestselling book "The Life-Changing Magic of Tidying Up." She also starred in her own Netflix show, "Tidying Up With Marie Kondo."

The core principle of the KonMari method is simple--choosing what sparks joy. Instead of choosing what to discard, you are choosing to keep only the items that speak to your heart. Kondo recommends tidying by category and not by location, starting with clothes, then moving on to books, papers, komono (miscellaneous items), and, finally, sentimental items. To get started, collect every single item you own in a particular category and put them in a big pile. Gather all your clothes, for example, and then start the process of deciding what to keep. As you go through your belongings, Kondo suggests that you thank your items for their service before donating or throwing them away.

This method is also an effective way to make a lot of progress decluttering in specific categories across multiple areas of the house at once.

Who is it for?

Any drawbacks?

The KonMari method can be time-consuming since you will be sorting through your entire collection instead of focusing on a particular room or space. Additionally, this is not entirely a minimalist method as it can also encourage hoarders to continue keeping things they don't need, just because they think these items still spark joy in their lives.

What is the One-in, One-out technique?

This simple rule means that in each category, you can't add another item until you remove or donate one you already have. This can apply to books, clothes, shoes, sets of glassware, cutlery, and kitchen tools, among others. If you follow this method properly, you'll never accumulate more than you should and can keep the volume of your belongings constant.

Who is it for?

Any drawbacks?

Things can get out of hand when you use this rule as an excuse to purchase new items and bring more things into your home. If you continue to buy and just tell yourself that you'll get rid of something in its place, it can eventually lead to a never-ending cycle of buying and decluttering.

What is the 20/20 rule?

This rule is simple: If you are unsure about an item but it costs under $20 and could be replaced withing 20 minutes, you can declutter it.

Who is it for?

Any drawbacks?

You may not be able to apply this tactic to a lot of sentimental items, since if they are really sentimental, then they can't be replaced for less than $20 in 20 minutes.

What is the Swedish Death Cleaning method?

While this decluttering idea sounds morbid, the intention is important and meaningful. Swedish Death Cleaning was first introduced by Margareta Magnusson in her book Dostadning: The Gentle Art of Swedish Death Cleaning. Dostadning, or the art of death cleaning, is a Swedish phenomenon by which the elderly and their families set their affairs in order.

This method of decluttering is designed for those later in life and involves removing all non-essential items to ease the process for your loved ones once you've passed on. It's a wide-scale method to declutter your home, with suggestions that include dealing with larger items then moving down to smaller items (junk drawer, wardrobe), and then saving sentimental things for last. It allows you to keep the more precious items since you might decide to give them away to the special people in your life. Fans of this method see it as a gift to your loved ones, especially if you don't want to end up leaving your mess for them to deal with for months or even years.

Who is it for?

Any drawbacks?

It's worth noting that the Swedish Death Cleaning is designed to be slow, so expect that it can be a long and thorough process.

What is the four-box method?

As the name suggests, all you need here are four empty boxes that you will label with their purpose. While there are some variations, most experts include the following: keep, trash or throw away, donate, and sell. Other variations also include 'rehome' and 'undecided.'

This is quite an easy, straightforward, and flexible way to deal with your clutter as you can do it for however long and whatever frequency your prefer. You can also use the 'undecided' box if you are still unsure about any particular item. If you have several family members, they can have their boxes and even have them customized to the categories they need.

Who is it for?

Any drawbacks?

While this strategy is pretty straightforward, the problem comes when you become indecisive on a lot of items and everything ends up in the 'undecided' box. If you don't have the time or confidence to address them later, you might end up with piles of miscellaneous items that will either just stay in the box or clutter up other areas of your home. The key is to follow through with what you're supposed to do with your stuff according to the category they fall under. Also, you may need a little guidance when it comes to deciding on things that fall into one or more categories.

Gary Nelson Group

Before buying a house and beginning the search for a new home you need to consider how much house you can afford. This requires knowing your budget, a word that many of us dislike as it requires some work to create. Understanding if you can afford that new house can depend on current debts, income, and your lifestyle. No one wants to be ‘house poor,’ with a beautiful house but no ability to handle unexpected expenses or afford the day-to-day basics.

Determine Your Income

There is a difference between your gross and net income. Gross is what your employer says they will pay you, net income is what you are actually going to take home after taxes. A good start is to calculate your monthly income, taking into account salary, any bonuses and any other potential income sources, such as child support, alimony etc.

Calculate Your Debts

What do you currently owe? This may include car payments, student loans, and any credit card debt you are paying off over time. Lenders use a ratio called Debt-to-Income Ratio, and typically they want you to have a ratio of 36% or below including the home loan.

Your Down Payment

People often believe they need 20% as a down payment, but this is no longer true, there are many loan products that require anywhere from 0-20% down. Veteran loans for example can require no down payment at all, then there are FHA, USDA, and many first-time buyer programs that require less and some that even give a grant towards the down payment. These grants can be income driven aimed to help make housing affordable to lower income families. The size of your down payment will impact your monthly payment: a larger down payment reduces the monthly mortgage amount.

Understand Your Mortgage Options

Loan types - you can have a 30-year or a 15-year mortgage, the shorter the mortgage often the lower the rate, as the principal gets paid off quicker and the risk is seen as lower. However, the payment will be higher as more principal gets paid off each month. Then you can consider an adjustable rate mortgage, common in many countries where the rate adjusts at set points during the length of the loan, often with a cap on the highest level of interest. Adjustable rate mortgages can run for 5, 7 or 10 year terms, with the loan being a 30 year repayment term. The alternative is a fixed rate mortgage set for the length of the 15 or 30 year repayment term. Interest rates are affected and set in relation to the bond markets. Then your credit score will also affect the rate you get offered. The higher score you have the lower rate you will be offered as you are considered a lower risk. Before you start looking for a house it is vital to get pre-approved. This allows you to know your purchase limits and what you can afford. If buying a town home with a monthly/yearly Homeowners Association fee this will also affect your monthly payment and affect your mortgage limit.

Ongoing Homeownership Costs

These are the costs you will pay over time as you own your home, such as property taxes and home insurance. Property taxes are calculated by the county, city and school district in which the home is situated. These can vary widely, so be aware this will affect how much house you can afford to buy. Homeowner insurance rates have been increasing over the last few years as insurers try to recoup the costs of claims from disasters and spread these costs a cross a wider group of insured homes. Some loans such as FHA loans require Private Mortgage Insurance (PMI) and this becomes a part of the monthly payment if you have a smaller down payment. Then there is the cost of home maintenance, usually a rule of thumb is to use 1-3% of the value of the home for maintenance and repairs. This may not be paid out every year, but replacing a roof or a heating system can be expensive even if only done every 20 years or so. When there is a Homeowners Association the monthly fee often takes into account some of the maintenance and repairs, but the lower the fee, often the less they cover. And of course, there is the cost of utilities such as water and sewage fees, heating costs, internet etc.

Using Online Calculators

NerdWallet (https://www.nerdwallet.com) provides an online calculator that provides PMI costs as well. Many banks also provide mortgage calculators and a simple search will give you plenty of options to select from. Much of what we have discussed you will need to calculate, (income, debts, down payment, loan term etc.)

Plan for Your Financial Comfort Zone

Lenders will often give you a limit that you can borrow, but this may not be what makes you feel comfortable or possible depending on your lifestyle. Consider if you want to eat out, plan a vacation etc. You do not need to borrow the maximum. Consider your personal goals, saving for retirement, travel plans, and setting up an Emergency Fund. There are always unexpected expenses, the need for a new car or a growing family. Many financial advisors suggest aiming to keep a cushion of 3-6 months of expenses as an Emergency Fund to protect against a loss of a job, or some other unexpected expense that might arise.

In conclusion, what you can afford is not just about what a lender says you can borrow, but what makes you feel comfortable financially as well.

If you have any questions about the home buying process, or questions about properties in Flagstaff and northern Arizona, come by our office or call us!

Geology: Walnut Canyon was formed primarily through the erosive power of water over the course of millions of years. The canyon itself was carved by Walnut Creek, which flows intermittently through the area, cutting through layers of Kaibab limestone and other sedimentary rock. The unique shape of the canyon, with its steep walls and tiered levels, provides natural alcoves and ledges, which later became the sites for human settlement.

Geology: Walnut Canyon was formed primarily through the erosive power of water over the course of millions of years. The canyon itself was carved by Walnut Creek, which flows intermittently through the area, cutting through layers of Kaibab limestone and other sedimentary rock. The unique shape of the canyon, with its steep walls and tiered levels, provides natural alcoves and ledges, which later became the sites for human settlement.

In 1915, Walnut Canyon was designated a national monument by President Woodrow Wilson to preserve the cliff dwellings and protect the cultural and natural history of the canyon. Today, visitors can hike the Island Trail to see the cliff dwellings up close, learning about the lives of the Sinagua people and the natural forces that shaped the canyon. Walking the trail's one mile round-trip provides access to 25 cliff dwellings.

When you are ready to buy or sell in northern Arizona, come by our office in historic downtown Flagstaff. We have Realtors available in person Monday through Saturday to answer any questions you may have about real estate and the area.