Realty Executives Midwest

Some home improvement projects should take precedence over others when selling your home. Here are the most recommended and their associated costs.

When you’re ready to sell your home, you’ll want it to sell as quickly as possible for the maximum amount of money. To that end, most homeowners will undertake some type of home improvement project, whether it's simply cleaning and depersonalizing or something more involved. But determining and prioritizing what needs to be done and what it will cost can be overwhelming.

That’s why we’ve compiled a list of the home staging projects real estate professionals recommend before placing your home on the market. We’ve organized these projects by cost, so you can prioritize what best fits your budget. Using data from the National Association of Realtors (NAR) Profile of Home Staging 2023 and the latest costs from Fixr.com cost guides, you can make an informed decision about how to best prepare your home for selling.

5 Most Recommended Projects for Selling a Home in 2023

Real estate experts and home staging professionals advise their clients on what their home needs in order to increase the chances of attracting buyers. Here are the 5 projects that they most recommend.

1. Professionally declutter

An overwhelming majority of 96% of real estate experts advise that home sellers should have their homes professionally decluttered before inviting potential buyers for viewings. Decluttering a home helps make the space look larger and cleaner. Trying to ignore a lot of items makes it difficult to focus on the home's potential and can often make rooms feel cramped. To have a professional come and declutter your home will cost in the region of $450.

2. Entire home cleaning

One option most homeowners will want to consider is the second most recommended project. Having a professional clean the entire home is what 88% of real estate experts say is advisable when staging a home. It is also one of the most affordable projects listed at an average of $221. Having a clean home gives off a good first impression and allows the buyer to have a pleasant experience viewing the home. It also gives the feeling of a fresher, newer space.

3. Repair drywall

72% of professionals tell their clients to repair any minor damages. One common minor damage around the home is wear and tear to the drywall. This could include dents, holes, and scratches. Having this type of damage highlights how much the home has been lived in, giving it an older appearance than it may actually have. Repairing drywall carries an average cost of around $350, one of the cheaper projects on our list.

4. Repair damaged shingles

Replacing or repairing damaged shingles is another minor repair that 72% of pros recommend. First impressions are vital when selling a home, and although curb appeal, in general, is not listed, it is a vital part of selling a home. The roof forms a huge part of curb appeal, and this is a minor repair that has a significant impact on buyers. The extent of the roof damage will affect the cost, but homeowners can expect to pay around $500 to repair damaged shingles.

5. Carpet cleaning

Having the carpet professionally cleaned gives it a new lease of life, leaving it smelling nice and looking fresh. A worn-down, dirty carpet can let the whole interior design of a room down. This is why 71% of experts say they recommend this project. Cleaning the carpet in 2 bedrooms is the most affordable project listed, costing around $180 on average, making it a desirable option for home sellers.

Weighing Up Expert Recommendations vs. Cost

While some projects may be advisable, they may also be costly. Depending on the budget you set yourself for sprucing up your home for sale will dictate which home improvements you prioritize. For example, entire home cleaning will probably get you the best bang for your buck due to its relatively low cost but high recommendation.

If you want to spend less than $500 on a single project, it would be wise to rule out regrouting the shower, which costs an average of $700, and only 30% of real estate pros recommend it. If you believe your home desperately needs landscaping but only want to splash out on one area, then the front yard would be a better option. It costs an average of $5,000 to complete, whereas the backyard is around $9,000, but both are recommended by 50% of experts.

Some good intermediate projects that 65% of home stagers suggest are paint touch-ups and depersonalizing the home. At the lower end of the cost scale, getting a professional painter to touch up necessary spots around the home will set you back around $200. Having a home stager/organizer come and depersonalize your home costs in the region of $500.

Here is the complete list of projects, in order of most recommended:

| Project | % of Experts that Recommend | Cost |

| Professionally declutter | 96% | $450 |

| Entire home cleaning | 88% | $221 |

| Repair drywall (minor repairs) | 72% | $350 |

| Repair damaged shingles (minor repairs) | 72% | $500 |

| Carpet cleaning | 71% | $180 |

| Paint touch-ups | 65% | $200 |

| Depersonalize home | 65% | $500 |

| Painting walls | 57% | $8,700 |

| Landscape front yard | 50% | $5,000 |

| Landscape backyard | 50% | $9,000 |

| Regrout shower | 30% | $700 |

Listen to Advice to Sell Your Home

Ultimately the decision is yours when it comes to making improvements in order to sell your home. The projects listed are the most commonly recommended by real estate professionals whose experience and know-how can help guide you. The costs of each project can further help you determine which are the best fits for your budget.

Methodology

We took statistics from NAR’s Profile of Home Staging 2023 and combined the percentage recommendations with average costs from Fixr.com cost guides. For some projects, we broke them down into more specific home improvements in order to assign a specific project cost. For example, NAR’s report lists ‘landscaping,’ which we split into the front yard and backyard landscaping. For ‘minor repairs,’ we listed drywall repair and repair broken shingles. For ‘grouting,’ we opted for ‘regrout shower’.

Even though activity in the housing market has slowed from the frenzy that was the ‘unicorn’ years, it’s still a seller’s market because the supply of homes for sale is so low. But what does that really mean for you? And why are conditions today so good if you want to sell your house?

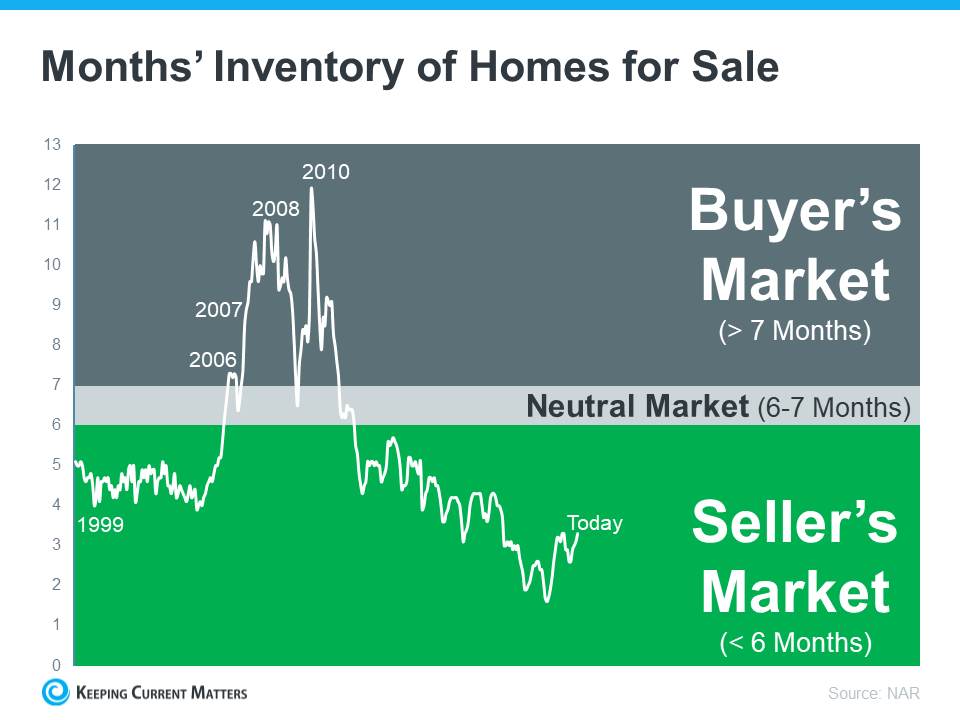

The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows housing supply is still astonishingly low. Housing inventory is measured by the number of available homes on the market. It’s also measured by months’ supply, meaning the number of months it would take to sell all those available homes based on current demand. In a balanced market, there’s usually about a six-month supply. Today, we have only about 3 months’ supply of homes at the current sales pace (see graph below):

As the visual shows, given the current inventory of homes, it’s still a seller’s market.

As the visual shows, given the current inventory of homes, it’s still a seller’s market.

Today, we’re nowhere near what’s considered a balanced market. In fact, the current months’ supply is half of what’s typical of a normal market. That means there just aren’t enough homes to go around based on today’s buyer demand.

As Lawrence Yun, Chief Economist for NAR, says:

“There are simply not enough homes for sale. The market can easily absorb a doubling of inventory.”

Sellers, these conditions give you a real edge. Right now, there are buyers who are ready, willing, and able to purchase a home. And, because there’s a shortage of homes up for sale, the ones that do hit the market are like magnets for those buyers.

If you work with a local real estate agent to list your house right now, in good condition, and at the right price, it could get a lot of attention. You might even end up with multiple offers.

Today’s seller’s market sets you up with a big advantage when you sell your house. Because supply is so low, your house will be in the spotlight for motivated buyers who are craving more options. Connect with a local real estate agent so you understand what’s happening in your area as you get ready to enter the market.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

Are you putting off selling your house because you’re worried no one’s buying because of where mortgage rates are? If so, know this: the latest data shows plenty of buyers are still out there, and they’re purchasing homes today. Here’s the data to prove it.

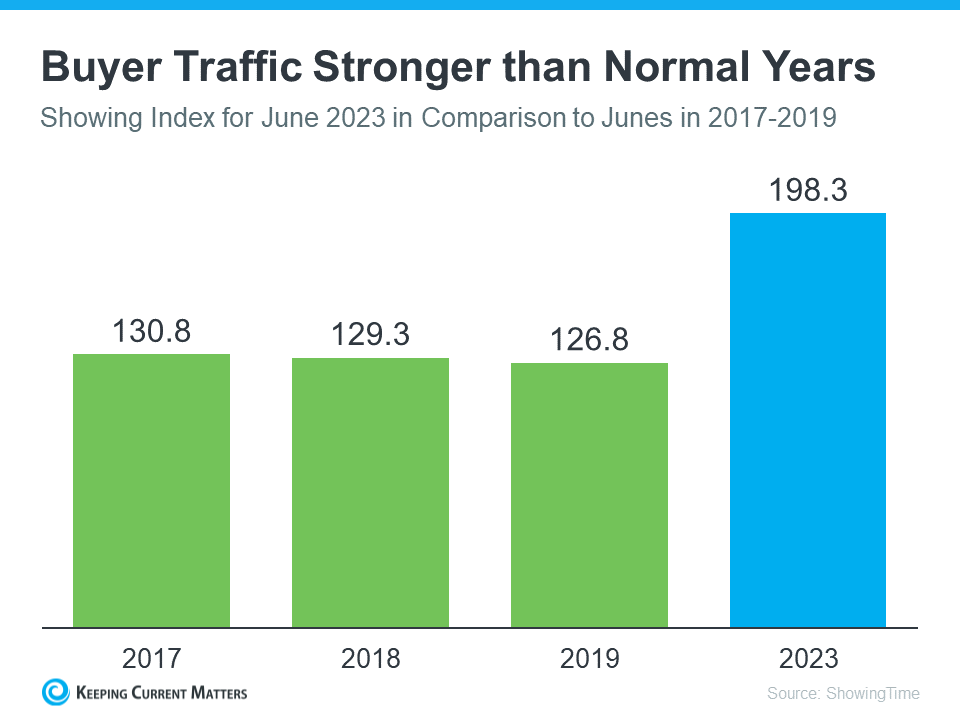

The ShowingTime Showing Index is a measure of buyers touring homes. The graph below uses the latest numbers available and compares them to the same month in the last normal years to show just how active today’s buyers still are:

As you can see, when June 2023 numbers are stacked alongside what’s typical for the housing market at this time of year, it’s clear buyers are still active. And, they’re actually a lot more active than the norm.

As you can see, when June 2023 numbers are stacked alongside what’s typical for the housing market at this time of year, it’s clear buyers are still active. And, they’re actually a lot more active than the norm.

If you’re wondering how this could possibly be true, it’s because buyers are getting used to higher mortgage rates and accepting them as the new reality. As Danielle Hale, Chief Economist, Realtor.com, explains:

“Interest rate hikes continue to further cut into buyers’ purchasing power, although they appear to have adapted to the higher mortgage rate environment . . .”

It’s simple. Buyers will always need to buy, and those who can afford to move at today’s rates are going to do so.

While it’s true things have slowed down from the frenzy of the last couple of years, it doesn’t mean today’s market is at a standstill. The reality is: buyer traffic is still strong today. Even with today’s mortgage rates, plenty of buyers are still making their moves. So why delay your own move when there’s clearly a market for your house?

Don’t put off your plans because you’re worried no one will buy your home. The opposite is true, and more buyers are more active than the norm. Connect with a real estate agent to get your house ready to sell, so it makes the best first impression possible on those eager buyers.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

New backsplash? You've done it. Upgrading a faucet? No problem. You're a DIY master. But what about that electrical issue? Or fixing a leaky roof? Even though you (and your BFF, YouTube) have pulled off many DIY projects, you know there are projects you've no business trying on your own. But what about those projects that fall somewhere in between "I got this" and "I'm calling the pros"? How can you know if a project is really DIYable for you?

For Lucas Hall, finding that answer has been trial and error. As a "DIY landlord" for more than two years and founder of Landlordology, an online resource for landlords, he's gutted three homes and renovated countless others.

"I'm just handy enough to be dangerous," Hall says.

He's suffered more than his fair share of DIY disasters. With each, he's learned a valuable lesson about his own limits, as well as how he can do better next time.

When Hall updated a tiny kitchen in one of his rentals, he installed a brand-new, expensive fridge — and then built a peninsula countertop extension.

"We thought it was the greatest idea," he says. But adding the peninsula narrowed the space in front of the refrigerator, making it impossible to remove without lifting it entirely up and over the extension. (Ever tried to lift a fridge?)

"I'm just praying the fridge doesn't die on me, because I'm going to have to hire four or five burly guys to get it out," Hall says. "Or just Sawzall the thing in half."

DIY lesson: Measure once, measure twice, measure again, and think through every possible scenario before changing a room's layout.

Speaking of kitchen appliances: Hall was looking for an island range hood, which can be extra-expensive because it needs to be attractive from all angles. Dismayed by the prices he found elsewhere online, he went to Amazon, where he found an $800 hood on sale for about $250.

"Of course, it was from a brand we hadn't really heard of," Hall says.

Less than a year after installation, the hood was on the fritz. Removing the appliance was a challenge. The electrical wiring needed to be redone, and the wall needed to be drywalled, requiring a professional contractor.

"It probably cost me three-fold to fix my mistake," says Hall. "For any appliance that's more complicated than plugging it in and rolling it into place, upgrade and buy something that's not going to break on you within a year."

DIY lesson: For any DIY project, the cheapest option, from materials to appliances, should raise a red flag.

Hall is no electrician, but since he'd done some minor electrical work before, he figured the job of adding a dimmer switch would be no big deal.

"We hung a chandelier in the dining room and figured you might want to dim this giant chandelier for a relaxing candlelit dinner," says Hall. Because the space had switches at both entrances, he added a dimmer to both -- the more the merrier, right?

Wrong.

"After four hours spent blowing circuits and lightbulbs and struggling to get this chandelier to dim correctly, we called the manufacturer," Hall says. Spoiler alert: You just can't have two dimmer switches for one circuit.

A dimmer works by modulating the amount of electricity flowing through the circuit; adding another one causes chaos. A little research would've indicated the second dimmer switch was a no-no.

"It just flips out," says Hall. "It doesn't know how much dimming should be happening. The lights were flickering like a poltergeist."

DIY lesson: No one blames you for not being a specialist, but any time you're taking on a specialty project make sure to do your research first or consult a pro.

Holidays might be a great time to tackle minor DIY projects, but if you're working on anything that could require a professional if things go south, consider waiting for a normal business day.

"I was trying to get a property ready to rent," says Hall. "Time is money. It was the Fourth of July, and I was adding a new cabinet [in the bathroom]."

It sounds easy enough, but the unit was in a condo building with a centralized water system; there wasn't a water shut-off valve for just that bathroom. Not wanting to shut down the water for the entire building on July Fourth, he decided to risk it.

And oh, what a risk it turned out to be. When trying to loosen a pipe, the whole thing broke off. It was rusted out. Water sprayed out so hard, it hit him in the chest. After rushing to the basement, he flipped every knob he found until the water shut-off.

"Luckily my property was on the first floor and the basement was a laundry room, because water was leaking through the floor, destroying drywall," Hall says.

Being a holiday, the rest of the day was no less of a disaster. The condo association's emergency line sent him a plumber who was angry to be missing his holiday events and drinking as he tried to fix the problem. Sloppy work resulted in a fire -- in a building with no water.

"He runs to my fridge and starts grabbing anything liquid -- milk, a bottle of Sprite, cans of beer," Hall recalls. "He's dumping water into the middle of the wall, punching holes in it, trying to find the fire."

DIY lesson: Always do tricky DIY projects when you know a pro -- a pro you trust -- can help out in a hurry.

Source: Houselogic

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

Wondering if it still makes sense to sell your house right now? The short answer is, yes. Especially if you consider how few homes there are for sale today.

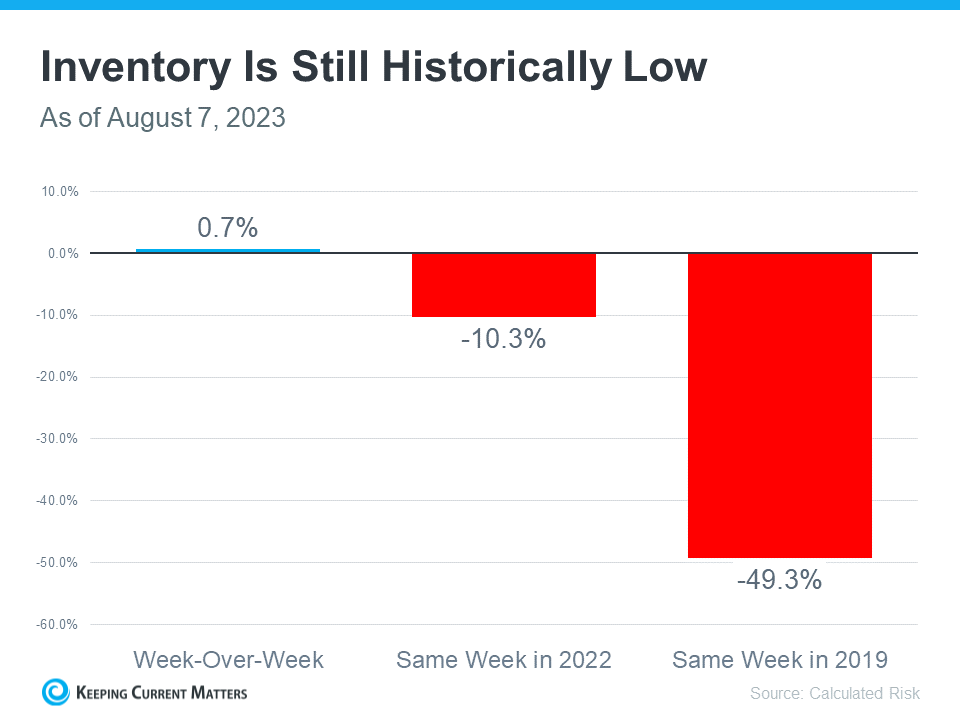

You may have heard inventory is low right now, but you may not fully realize just how low or why that’s a perk when you go to sell your house. This graph from Calculated Risk can help put that into perspective:

As the graph shows, while housing inventory did grow slightly week-over-week (shown in the blue bar), overall supply is still low (shown in the red bars). Compared to the same week last year, supply is down roughly 10% – and it was already considered low at that time. But, if you look further back, you’ll see inventory is down even more significantly.

As the graph shows, while housing inventory did grow slightly week-over-week (shown in the blue bar), overall supply is still low (shown in the red bars). Compared to the same week last year, supply is down roughly 10% – and it was already considered low at that time. But, if you look further back, you’ll see inventory is down even more significantly.

To gauge just how far off from normal today’s inventory is, let’s compare right now to 2019 (the last normal year in the market). When you compare the same week this year with the matching week in 2019, supply is about 50% lower. That means there are half the homes for sale now than there’d usually be.

The key takeaway? We’re still nowhere near what’s considered a balanced market. There’s plenty of demand for your house because there just aren’t enough homes to go around. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“There are simply not enough homes for sale. The market can easily absorb a doubling of inventory.”

So, if you want to list your house, know that there’s only about half the inventory there’d usually be in a more normal year. That means your house will be in the spotlight if you sell now and you may see multiple offers and a fast home sale.

With the number of homes for sale roughly half of what there’d usually be in a more normal year, you can rest assured there’s demand for your house. If you want to sell, connect with a local real estate agent now so your house can shine above the rest while inventory is so low.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com