Realty Executives Midwest

As of September 2023, the Darien real estate market is experiencing some fascinating shifts.

Firstly, we have a current inventory supply of only 0.47 months. Yes, you heard that right! This means that if no new homes were added to the market, it would only take 0.47 months to sell off all the existing inventory. This low supply is certainly something sellers should take note of.

Now, let's talk about the remarkable change we've witnessed in the past year. Over the last 12 months, the months supply of inventory has experienced a staggering decline of 71.17%. This shows a significant decrease in available homes, which ultimately favors sellers like you. With fewer options for buyers, your home becomes more desirable and stands a better chance of selling quickly.

Moving on to the next noteworthy statistic, the list to sold price percentage currently stands at an impressive 100.2%. This means that on average, homes in Darien are selling for 100.2% of their initial list price. As a seller, this indicates a strong market where buyers are willing to pay a premium for well-priced properties.

Now, let's talk about the crucial aspect of time. The median days on the market in Darien is just 12 days. That's right, only 12 days! This means that, on average, homes are selling within a mere two weeks of being listed. With such a quick turnaround time, sellers can expect a speedy and efficient selling process.

Lastly, let's discuss the median sold price in Darien, which currently stands at $387,500. This represents the middle point of all homes sold in the area, indicating a strong market with healthy price growth. It's essential to keep an eye on this figure as it can provide valuable insights into the overall market performance.

So, sellers, what do all these numbers mean for you? Well, it's evident that the Darien real estate market is favoring sellers right now. With a low supply of inventory, high list to sold price percentages, quick selling times, and a healthy median sold price, there couldn't be a better time to list your home.

If you're considering selling your home in Darien, we would be thrilled to help you navigate this exciting market. Feel free to reach out to us at Realty Executives Midwest, where we pride ourselves on providing exceptional service to our clients.

Mortgage rates have been back on the rise recently and that’s getting a lot of attention from the press. If you’ve been following the headlines, you may have even seen rates recently reached their highest level in over two decades (see graph below):

That can feel like a little bit of a gut punch if you’re thinking about making a move. If you’re wondering whether or not you should delay your plans, here’s what you really need to know.

There’s no denying mortgage rates are higher right now than they were in recent years. And, when rates are up, that affects overall home affordability. It works like this. The higher the rate, the more expensive it is to borrow money when you buy a home. That’s because, as rates trend up, your monthly mortgage payment for your future home loan also increases.

Urban Institute explains how this is impacting buyers and sellers right now:

“When mortgage rates go up, monthly housing payments on new purchases also increase. For potential buyers, increased monthly payments can reduce the share of available affordable homes . . . Additionally, higher interest rates mean fewer homes on the market, as existing homeowners have an incentive to hold on to their home to keep their low interest rate.”

Basically, some people are deciding to put their plans on hold because of where mortgage rates are right now. But what you want to know is: is that a good strategy?

If you’re eager for mortgage rates to drop, you’re not alone. A lot of people are waiting for that to happen. But here’s the thing. No one knows when it will. Even the experts can’t say with certainty what’s going to happen next.

Forecasts project rates will fall in the months ahead, but what the latest data says is that rates have been climbing lately. This disconnect shows just how tricky mortgage rates are to project.

The best advice for your move is this: don’t try to control what you can’t control. This includes trying to time the market or guess what the future holds for mortgage rates. As CBS News states:

“If you’re in the market for a new home, experts typically recommend focusing your search on the right home purchase — not the interest rate environment.”

Instead, work on building a team of skilled professionals, including a trusted lender and real estate agent, who can explain what’s happening in the market and what it means for you. If you need to move because you’re changing jobs, want to be closer to family, or are in the middle of another big life change, the right team can help you achieve your goal, even now.

The best advice for your move is: don’t try to control what you can’t control – especially mortgage rates. Even the experts can’t say for certain where they’ll go from here. Instead, focus on building a team of trusted professionals who can keep you informed. When you’re ready to get the process started, connect with a local real estate agent.

Are you considering buying your first home? If so, it can be helpful to know what led other people to make that decision. According to a recent survey of first-time homebuyers by PulteGroup:

“When asked why they purchased their first home recently, the answer was simple: because they wanted to. Either the desire to stop renting or recognition that homeownership is a smart financial investment was the main motivator for 72% of respondents.”

While that survey looked specifically at first-time homebuyers buying newly built homes, the same sentiment is true for just about anyone buying their first home. Here’s a bit more information to help you think about those two benefits of homeownership to see if they’re a key factor for you too.

You might want to stop renting because rents keep going up. If you’re a renter, that means there’s a chance your payment will increase each time you sign a new rental agreement or renew your current one.

On the other hand, when you buy your home with a fixed-rate mortgage, your monthly housing payment is predictable over the length of that loan. This stability can give you a peace of mind that renting just can’t provide. Jeff Ostrowski, real estate journalist, breaks it down:

“With a fixed-rate mortgage, your monthly principal and interest payment is set for as long as you keep the loan. Sign a rental lease, however, and you could see your rent rise the following year, the year after that and so on.”

Beyond that, owning a home can also be a great long-term investment. While renting may be the more affordable option right now, it doesn’t provide an avenue for you to grow your wealth over time. Mark Fleming, Chief Economist at First American, explains that’s an important distinction to consider:

“Given current dynamics, more young households may choose to rent in the near term as the cost to own, excluding house price appreciation, has unequivocally increased. Yet, accounting for house price appreciation in that cost of homeownership, whether to rent or buy will depend on where, and if, a home is likely to cost more or less in the near future.”

Basically, renting doesn’t allow you to build equity. In contrast, homeownership can help you grow your net worth as your home’s value appreciates. That’s a significant perk you can’t get if you keep renting.

When you take that into account, it may make better financial sense to buy. Most experts project home prices will continue to appreciate over the next few years at a pace that’s more normal for the market. That means when you buy a home, not only are you investing in a place to live, but you’re also investing in your financial future.

If you're ready, it can be a smart move to buy your first home instead of renting. Connect with a real estate professional so you can stabilize your housing payment and start building wealth for your future.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

Just like when you meet someone for the first time, a good first impression can go a long way. The same can be said when it comes to your home. Your home’s curb appeal — otherwise known as its overall exterior attractiveness — can make a big difference in how it is perceived.

According to the 2022 Home Buyers and Sellers Generational Trends Report, 55% of home buyers will visit a property after viewing it online, primarily based on its curb appeal. If you are selling your home, you want to pay attention to how your home’s curb appeal might impact its selling value.

And even if you are not ready to sell your home, boosting your curb appeal can help ensure your home gives a great first impression to any visitors or passersby.

Adding charm to your home’s exterior does not have to mean burning a hole in your pocket and spending a lot of money! There are countless ways to boost your home’s curb appeal, making it more enjoyable for you or any potential buyers without breaking the bank.

Ready to get started improving your home’s curb appeal? Here are a few of our favorite (and simple!) ways to make your home look its best.

The most noticeable aspect of your property is usually your yard. Since it is the first thing most visitors see, there are small ways you can improve your landscaping to boost your curb appeal – even with no previous landscaping experience!

If you are looking for some easy beginner projects, start with keeping the edges of your walkways trimmed, plants properly pruned and a green, weed-free lawn. You can incorporate seasonal plants to help add color to your space. Do not forget to add mulch to add contrast and freshness! You can even consider using a budget-friendly mulching alternative, like leaf mulch, made from fallen leaves.

Do a bit of research into what kind of plant varieties do best in your area, and make sure to consider things like how much shade you have in your yard and the amount of rainfall.

As the main entryway to your home, the front door can really set the tone for the rest of your home’s curb appeal. It is amazing what a fresh coat of paint in a vibrant color can do to improve and upgrade your home’s overall look and feel. You can affordably improve your home’s curb appeal with just a gallon of paint and some paint brushes.

Looking to take it to the next level? Try adding a kick plate or installing a new, modern door handle for an upgraded look. These small differences are also relatively affordable and simple to do with tools you likely already have lying around!

A well-lit pathway and front porch can dramatically change your home’s appearance. One way to improve the appearance of walkways and shaded areas without increasing your electricity bill or cash out of pocket is by installing solar-powered lights. You can place these lights strategically along your walkways and underneath large trees to add a touch of brightness and safety to your outdoor space.

You can also purchase smart outdoor lighting that works on a timer to save you the hassle on turning it on every evening — and save a little money on your electric bills, too!

Looking to upgrade the appearance of your mailbox? There are plenty of budget-friendly options to give it a fresh look. Consider applying a new coat of paint, adding some beautiful greenery and plants around it, or even replacing it entirely. You can find a mailbox that compliments your home’s style and color to add to your home’s overall exterior appearance.

With these simple modifications, your mailbox will be transformed, elevating the overall curb appeal of your home. Give it a try and see the difference it makes!

You would be amazed how even the smallest cleaning and tidying up of your home can make a difference in improving curb appeal. Even something like cleaning your windows or keeping your lawn mowed can make your home sparkle and look its best.

If you are looking to take on a slightly bigger project, try installing shutters or window boxes with flowers to bring a well-rounded and unique style to your home. You can find shutters with unique colors or select window boxes to decorate seasonally with flowers and greenery.

Do not forget that maintaining and improving your curb appeal is an ongoing process. Each season will bring new opportunities to improve or follow the latest exterior home improvement trends. Make sure to keep regularly checking in on your landscaping, front door, and mailbox to keep your house looking its best year-round.

Regular touch-ups like pruning, power washing the exterior, cleaning the gutters, and maintaining the walkway will also ensure your home continues to be a great addition to the block and neighborhood.

You can also always have fun with seasonal decorations like pumpkins in the fall or a wreath during the holiday season. Do not forget your home is yours to make unique and reflect your personal style!

The real estate saying, “curb appeal sells homes,” is a popular saying for a reason!

Your home’s exterior is often the first impression people have, and you want to make it a good one — whether you are selling your home or just enjoying it. By applying these tips to spruce up your landscape, front door, outdoor lighting, mailbox, and windows, you can dramatically improve your home’s curb appeal without busting your budget.

An important factor shaping today’s market is the number of homes for sale. And, if you’re considering whether or not to list your house, that’s one of the biggest advantages you have right now. When housing inventory is this low, your house will stand out, especially if it’s priced right.

But there are some early signs that more listings are coming. According to the latest data, new listings (homeowners who just put their house up for sale) are trending up. Here’s a look at why this is noteworthy and what it may mean for you.

It’s well known that the busiest time in the housing market each year is the spring buying season. That’s why there’s a predictable increase in the volume of newly listed homes throughout the first half of the year. Sellers are anticipating this and ramping up for the months when buyers are most active. But, as the school year kicks off and as the holidays approach, the market cools. It’s what’s expected.

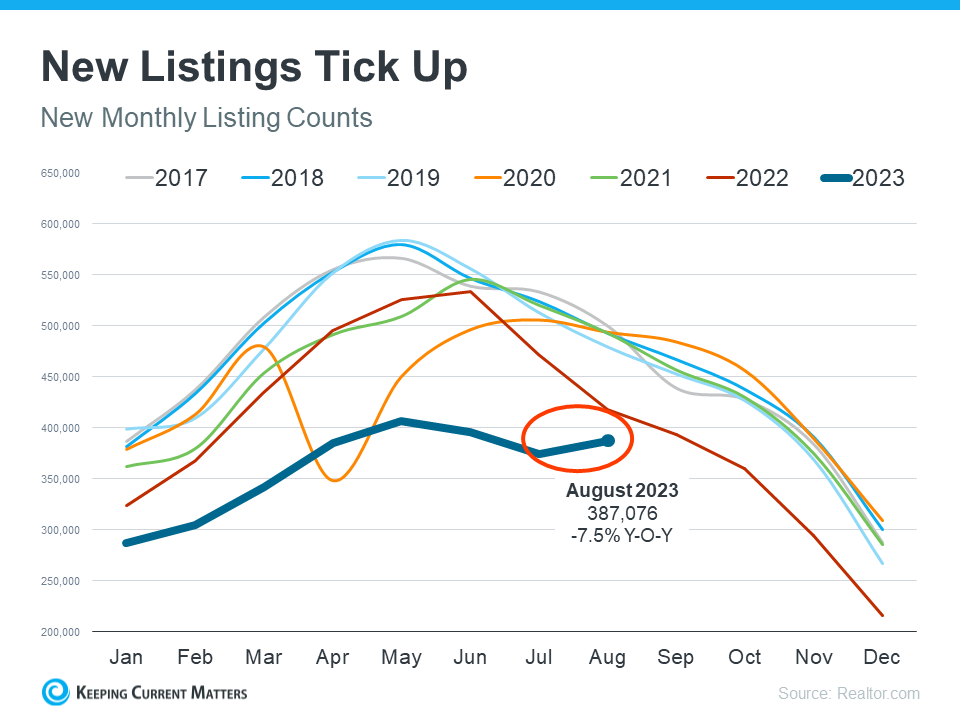

But here’s what’s surprising. Based on the latest data from Realtor.com, there’s an increase in the number of sellers listing their houses later this year than usual. A peak this late in the year isn’t typical. You can see both the normal seasonal trend and the unusual August in the graph below: As Realtor.com explains:

As Realtor.com explains:

“While inventory continues to be in short supply, August witnessed an unusual uptick in newly listed homes compared to July, hopefully signaling a return in seller activity heading toward the fall season . . .”

While this is only one month of data, it’s unusual enough to note. It’s still too early to say for sure if this trend will continue, but it’s something you’ll want to stay ahead of if it does.

If you’ve been putting off selling your house, now may be the sweet spot to make your move. That’s because, if this trend continues, you’ll have more competition the longer you wait. And if your neighbor puts their house up for sale too, it means you may have to share buyers’ attention with that other homeowner. If you sell now, you can beat your neighbors to the punch.

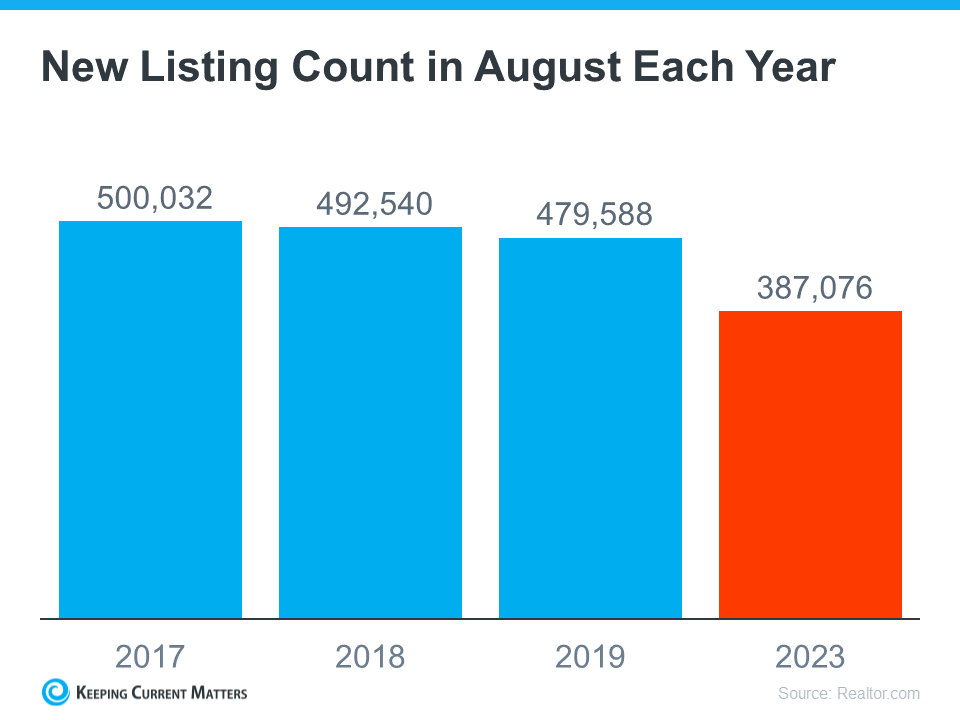

But, even with more homes coming onto the market, the market is still well below normal supply levels. And, that inventory deficit isn’t going to be reversed overnight. The graph below helps put this into context, so you can see the opportunity you still have now:

Even though inventory is still low, you don’t want to wait for more competition to pop up in your neighborhood. You still have an incredible opportunity if you sell your house today. Connect with a real estate agent to explore the benefits of selling now before more homes come to the market.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com