Realty Executives Midwest

Planning to sell this spring? While you may be tempted to hold off until the first blooms or the spring showers hit, that’s actually waiting too long to get started by today’s standards.

Buyers have more options than they did a few years ago. So, it’s worth it to tackle repairs now and make sure your house is set up to stand out. Because you don’t want to be caught scrambling right before the spring rush. Or, running out of time to do the work your house really needs.

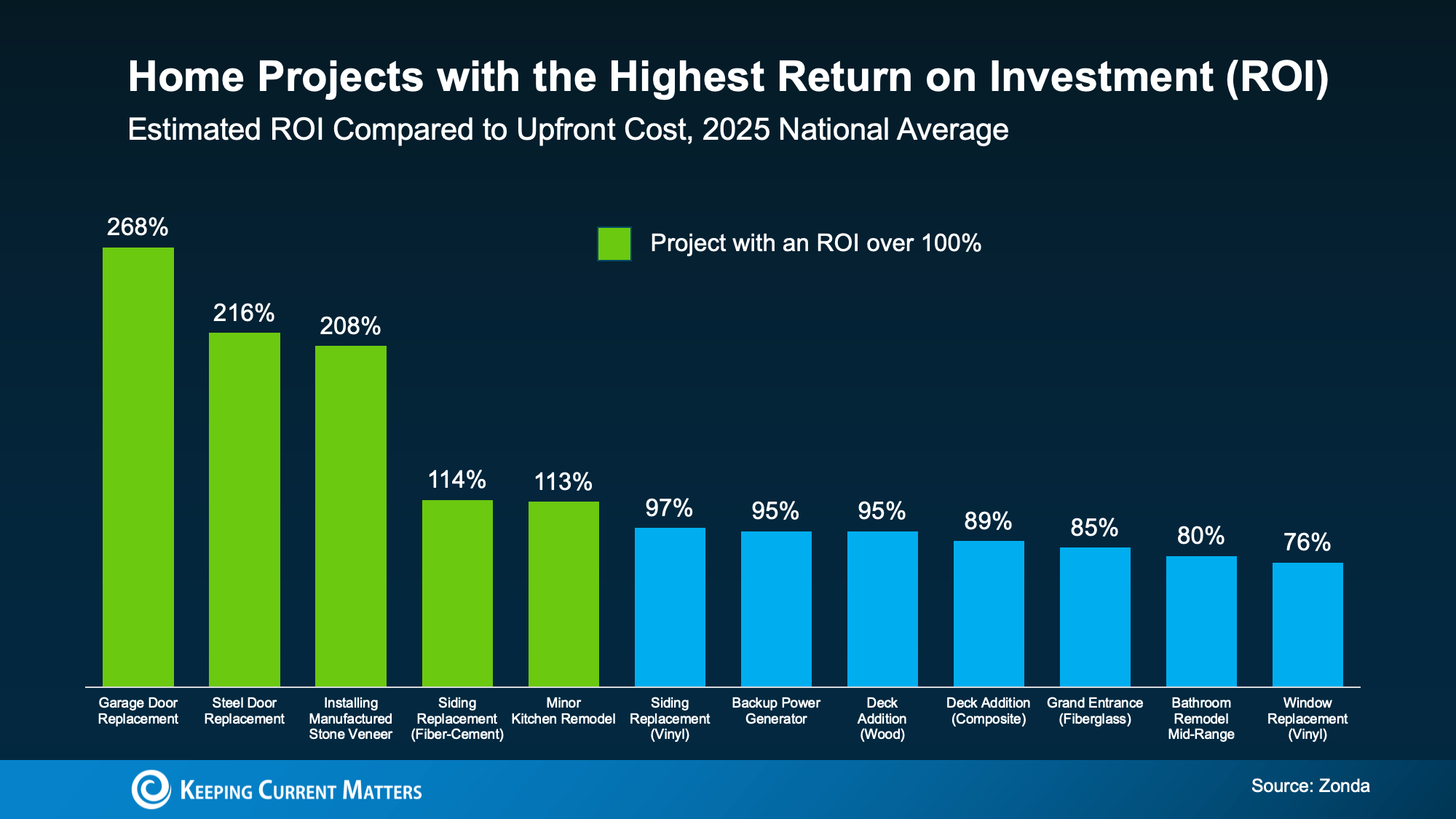

The key is focusing on updates that actually matter. And that’s exactly where return-on-investment (ROI) data comes in handy.

Every year, Zonda looks at which home improvements deliver the most bang for the buck when you go to sell the home. And the results can be a little surprising.

The green in the chart below shows the updates where sellers have the biggest potential to add value based on that research:

While there’s a wide range of projects represented in this data, the cool part is, some of the top winners aren’t big to-do’s. They’re just swapping out doors.

While there’s a wide range of projects represented in this data, the cool part is, some of the top winners aren’t big to-do’s. They’re just swapping out doors.

This goes to show little projects can have a big impact. So, you don’t have to spend a fortune. And you don’t need to tackle everything on this list. But in today’s market, doing nothing can work against you.

Now that buyers have more homes to choose from, a lot of them are going to opt for what’s move-in ready.

The best advice? Focus on what your house needs, whether it’s listed here or not – like the repairs you’ve been putting off. A front door or shutters in need of a little TLC. Piles of leaves in the yard. Scuffed up paint where your kids play inside. Those details matter too.

Mallory Slesser, Interior designer and Home Stager, explains it to the National Association of Realtors (NAR) this way:

“If you’re looking for affordable updates that pack a punch, dollar for dollar, I would say painting; changing out light fixtures; changing out hardware; maybe new draperies or window treatments. Those are all cost-effective ways to make a big statement. It really changes the space.”

These seemingly small things help buyers focus on the home itself – not the work they think they’ll have to do after moving in. And that’s paying off for other sellers. Buyers are often willing to spend more on homes that feel well cared for, updated, and move-in ready.

Here’s the important thing to remember. National data like this is a guideline. Buyer preferences are going to vary by location, price point, and even neighborhood. That means a project that boosts value in one area might be unnecessary (or even overkill) in yours.

That’s why the first step should always be to talk with a local real estate professional before you start.

An experienced agent can help you answer questions like:

That guidance helps you avoid over-improving and under-preparing.

If you’re looking to sell this spring, you still have time to make updates that help your home stand out – without taking on a full renovation.

If you’re not sure where to start, talk to a local about what makes sense for your house. A quick conversation can help you prioritize the updates that’ll pack the biggest punch.

What’s one upgrade you’ve been thinking about – and wondering if it’s worth it?

Owning a home comes with endless opportunities to enhance comfort, efficiency, and value. One of the simplest ways to achieve these goals is by investing in appliance upgrades. Modern home appliances aren’t just about convenience, they can save energy, streamline daily routines, and even increase your home’s long-term value.

Whether you’re preparing your home for family life, maximizing energy efficiency, or planning for resale, these five appliance upgrades are worth considering. Each offers practical benefits, and the right choices can make a tangible difference in your day-to-day living.

The refrigerator is often the most used appliance in a household, yet many homeowners delay upgrading it for years. Today’s models offer features far beyond simple cooling: smart temperature controls, energy-efficient designs, flexible shelving, and even connectivity with apps that monitor food inventory.

Why upgrade:

Older refrigerators can be energy hogs, sometimes using 30–50% more energy than modern ENERGY STAR-rated models. Upgrading not only reduces utility bills but also preserves your food better, minimizing waste.

Considerations:

Look for a model with adjustable shelving, humidity-controlled drawers, and separate temperature zones. Smart technology can also alert you if the door is left open or if maintenance is required. For families, this convenience alone can save time and reduce stress.

Your oven or range is another kitchen staple that benefits from modern technology. Upgrading to a newer model can improve efficiency, provide faster cooking, and even enhance safety features.

Why upgrade:

Many older ranges lack consistent heat distribution or precise temperature controls. Modern electric and gas ranges provide even cooking, self-cleaning options, and induction cooktops that heat faster while consuming less energy.

Considerations:

If you cook frequently, consider a range with double ovens, convection baking, or smart connectivity that allows remote preheating or recipe guidance. Induction cooktops are particularly efficient and safer for households with children.

A high-performing dishwasher does more than clean dishes—it streamlines a major household task while conserving water and energy. Many older dishwashers were designed before today’s energy and water standards, meaning they can be surprisingly inefficient.

Why upgrade:

Modern dishwashers are quieter, faster, and gentler on both dishes and the environment. Features like soil sensors, multiple cycle options, and adjustable racks make them versatile and convenient.

Considerations:

Look for ENERGY STAR-certified models and consider size relative to your household’s needs. Some premium models even allow you to customize cycles for specific items, such as wine glasses, pots, or delicate plates.

Laundry is one of the most frequent household chores, and upgrading your washer and dryer can transform the experience. New appliances offer improved cleaning, energy efficiency, and water savings—all while being gentler on clothing.

Why upgrade:

Older models can use more water and electricity than necessary and may take longer to complete cycles. Upgrading reduces both utility costs and the wear and tear on your wardrobe.

Considerations:

Front-loading washers often use less water and energy than top-loading models, while high-efficiency dryers reduce drying time. Smart washers and dryers can alert you when cycles are complete and provide remote monitoring, making laundry a little easier to manage.

While not a traditional “appliance,” a smart thermostat is one of the most impactful upgrades for any home. Heating and cooling typically account for the largest portion of household energy use, and a modern thermostat allows you to control these systems with precision.

Why upgrade:

Smart thermostats learn your schedule, adjust temperatures automatically, and can be controlled remotely via apps. This reduces energy waste, lowers bills, and keeps your home at a consistent, comfortable temperature year-round.

Considerations:

Choose a thermostat compatible with your existing HVAC system. Many offer integration with voice assistants or smart home platforms, adding convenience and even the ability to monitor indoor air quality.

While these five upgrades offer immediate benefits, a few overarching considerations can make your choices even more impactful:

Upgrading home appliances isn’t about keeping up with trends, it’s about improving the way you live every day. From refrigerators that maintain freshness, to ovens that cook efficiently, to smart thermostats that optimize comfort, modern appliances bring convenience, energy savings, and long-term value to your home.

For homeowners, making thoughtful appliance upgrades also reflects a broader approach to maintaining and enhancing your property. By combining practical investments with modern technology, you create a home that’s comfortable, functional, and appealing—both for your family and, potentially, for future buyers.

Even slight changes can make a significant difference. Start with the appliances that impact your household most, and let each upgrade build toward a more efficient, enjoyable, and valuable home in the years to come.

Source: Realty Executives

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

If you’re thinking about selling your house this year, you may be torn between two options:

In 2026, that decision matters more than it used to. Here’s what you need to know.

Over the past year, the number of homes for sale has been climbing. And this year, a Realtor.com forecast says it could go up another 8.9%. That matters. As buyers gain more options, they also re-gain the ability to be selective. So, the details are starting to count again.

That’s one reason most sellers choose to make some updates before listing.

According to a recent study from the National Association of Realtors (NAR), two-thirds of sellers (65%) completed minor repairs or improvements before selling (the blue and the green in the chart below). And only one-third (35%) sold as-is:

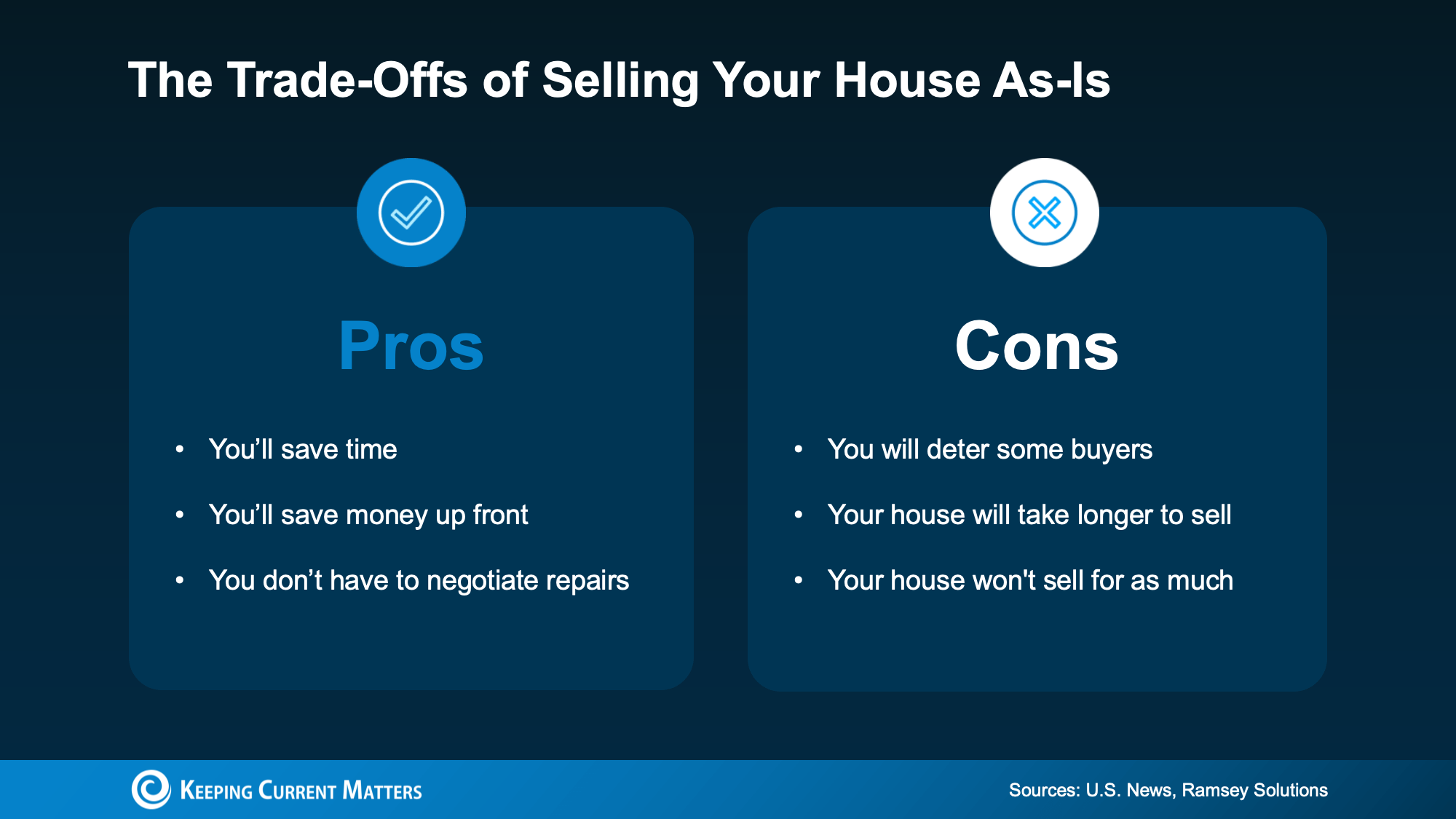

Selling as-is means you’re signaling upfront that you won’t handle repairs before listing or negotiate fixes after inspection. That can definitely simplify things on your end, but it also narrows your buyer pool.

Homes that are move-in ready typically attract more buyers and stronger offers. On the flip side, when a home needs work, fewer buyers are willing to take it on. That can mean fewer showings, fewer offers, more time on the market, and often a lower final price.

It doesn’t mean your house won’t sell – it just means it may not sell for as much as it could have.

How an Agent Can Help

How an Agent Can HelpSo, what should you do? The answer isn’t one-size-fits-all. It’s going to depend a lot on your house and your local market.

And that’s why working with an agent is a must. The right agent will help you weigh your options and anticipate what your house may sell for either way – and that can be a key factor in your final decision.

The good news is, there’s still time to get repairs done. Typically speaking, the spring is the peak homebuying season, so there are still several months left before buyer demand will be at its seasonal high. That means you have time to make some repairs, without rushing or stressing, and still hit the listing sweet spot.

The choice is yours. No matter what you end up picking, your agent will market your house to draw in as many buyers as possible. And in today’s market, that expertise is going to be worth it.

While selling as-is can still make sense in certain situations, in some markets today, it may cost you. So, no, you don’t have to make repairs before you list. But you may want to.

To make sure you’re considering all your options and making the best choice possible, connect with an agent to have a quick conversation about your house.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

After several years of high mortgage rates and hesitation from buyers, momentum is quietly building beneath the surface of the housing market. Sellers are reappearing. Buyers are re-engaging. And for the first time in what feels like forever, there’s movement happening again.

No, it’s not a surge. But it is a shift – and it’s one that could set the stage for a stronger year in 2026.

So, what’s driving the comeback? Here are three big trends that are slowly breathing life back into the housing market right now.

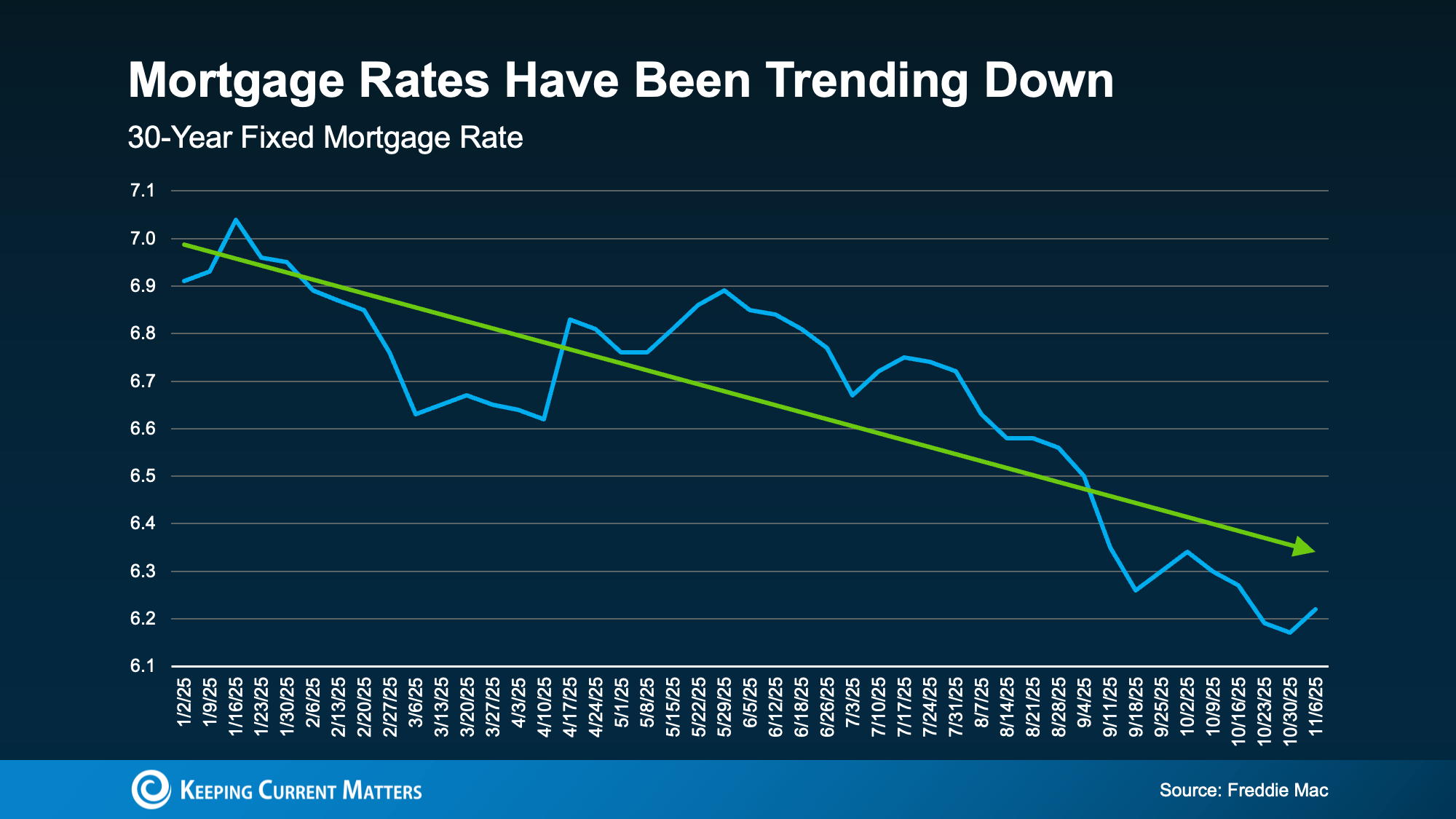

Mortgage rates are always going to have their ups and downs – that’s just how rates work. Especially with the general economic uncertainty right now, some volatility is to be expected. But, if you zoom out, it’s the larger trend that really matters most.

And overall, rates have been trending down for most of this year (see graph below):

And in just the last few months, we’ve seen the best rates of 2025. According to Sam Khater, Chief Economist at Freddie Mac:

And in just the last few months, we’ve seen the best rates of 2025. According to Sam Khater, Chief Economist at Freddie Mac:

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

Here’s why that matters for you. This shift changes what you can actually afford. It means lower borrowing costs and more buying power. Take this as an example.

Data from Redfin shows a buyer with a $3,000 monthly budget can now afford roughly $25,000 more home than they could one year ago. That’s a big deal. And it’s just one of the reasons why activity is picking up.

For a while, many homeowners stayed put because they didn’t want to give up their low mortgage rate. That “lock-in effect” kept inventory tight. And while plenty of homeowners are still staying where they are today, the number of rate-locked homeowners is starting to ease as rates come down. Life changes are becoming a bigger part of what’s driving more people to move, and that’s opening up more inventory.

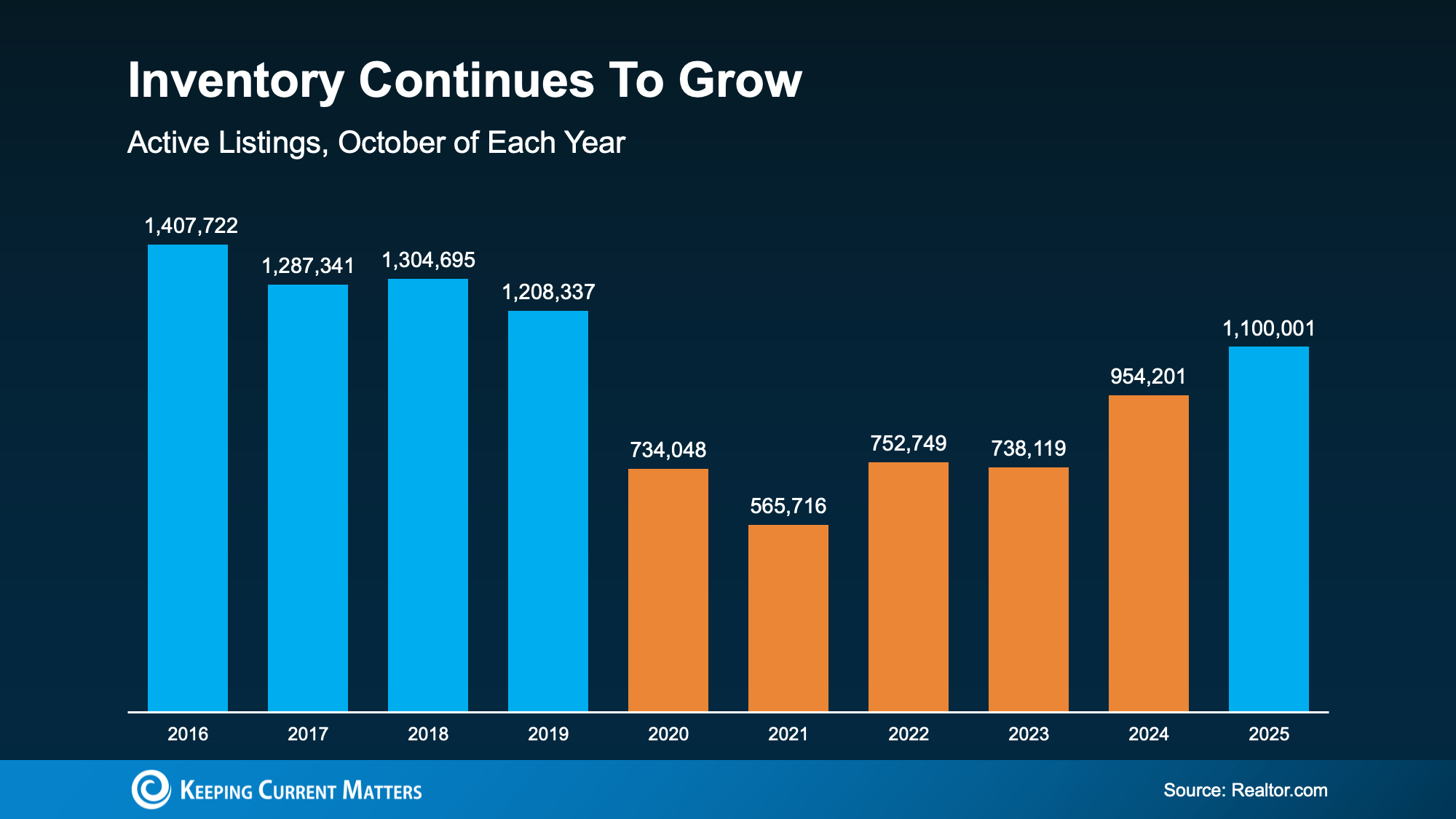

Data from Realtor.com shows just how much the number of homes for sale has grown. And the really interesting part is that the market is approaching levels that haven’t been seen for the past six years (see the blue on the graph below):

That return to more normal inventory levels is a really good thing. It gives buyers more options than they’ve had in years. And it’s helping to bring the market closer to balance.

That return to more normal inventory levels is a really good thing. It gives buyers more options than they’ve had in years. And it’s helping to bring the market closer to balance.

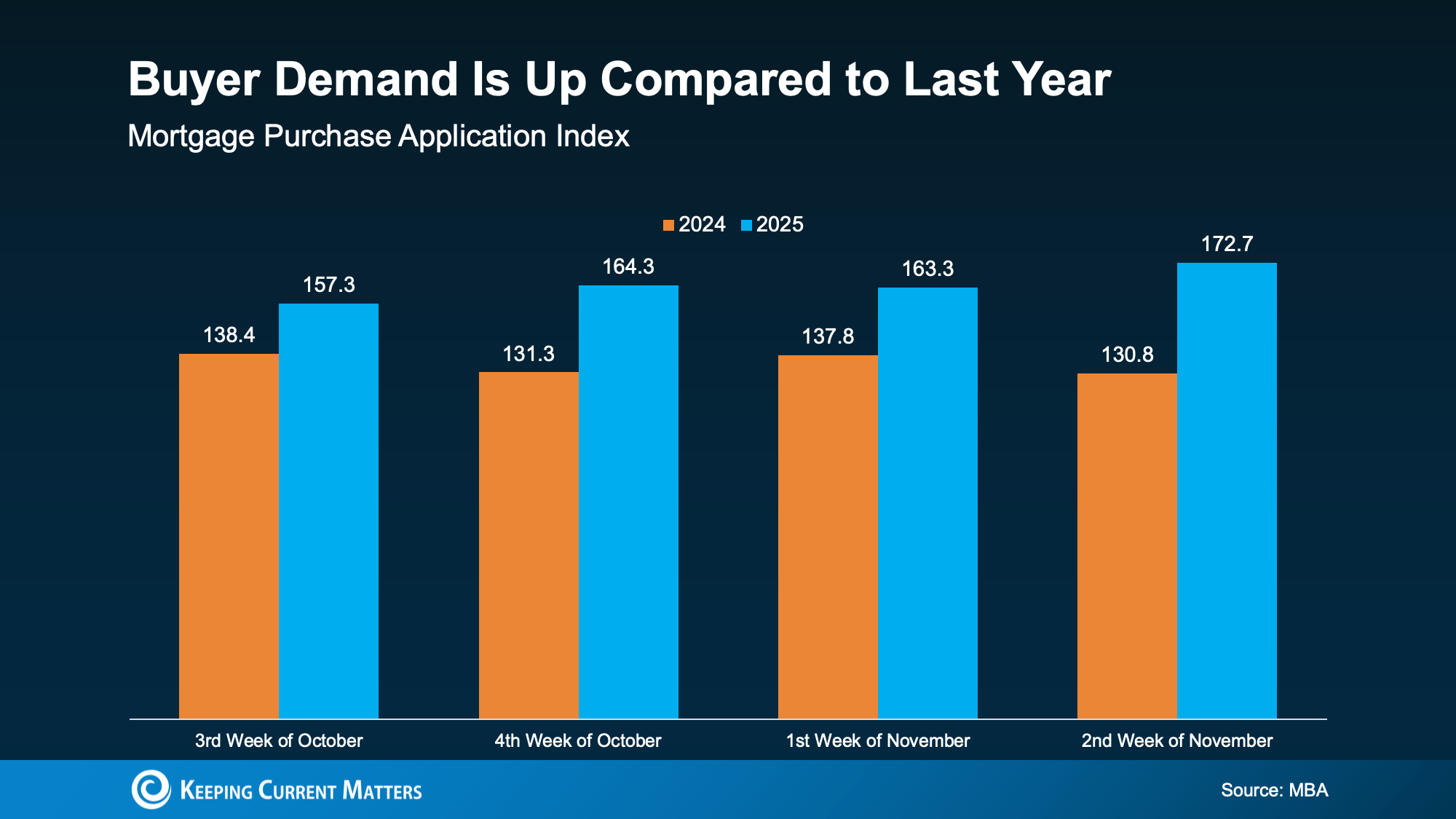

And it’s not just sellers making moves. With more options and slightly better affordability, buyers are getting back in the game, too. The Mortgage Bankers Association (MBA) reports purchase applications are up compared to last year, a clear signal that demand is building again (see graph below):

And experts think this momentum will continue. Economists from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) all forecast moderate sales growth going into 2026.

And experts think this momentum will continue. Economists from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) all forecast moderate sales growth going into 2026.

Now, this recovery won’t happen overnight. It’s not a flood of activity. But it is the start of steady improvement going into 2026. And that’s something a lot of people have been waiting for.

After several slower-than-normal years, the market is finally starting to turn a corner. Declining mortgage rates, more listings, and growing buyer activity all point to a market gaining real traction.

Connect with a local real estate agent about what’s changing and how you can make the most of it in 2026.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

If you’re trying to decide if you’re ready to become a homeowner in the next twelve months, there’s probably a lot on your mind. You’re thinking about your finances, today’s mortgage rates, home prices, the current state of the economy, and more. And, you’re juggling how all of those things will impact the choice you’ll make. It’s a lot.

But here’s what you need to remember. While housing market conditions are definitely a factor in your decision, your own personal situation and your finances matter too. As an article from NerdWallet says:

“Housing market trends give important context. But whether this is a good time to buy a house also depends on your financial situation, life goals and readiness to become a homeowner.”

So, instead of trying to time the market, focus on what you can control. Here are a few questions that can give you clarity on whether or not you’re ready to make your move.

Buying a home is a big commitment. You’re going to take out a home loan stating you’ll pay that loan back. Knowing you have a reliable job and a steady stream of income is important and will give you peace of mind for a purchase so large.

If you have a reliable paycheck coming in, the next thing to figure out is what you can afford. This depends on your budget, spending habits, debts, and more.

At this point, it helps to talk with a trusted lender. They’ll be able to tell you about the pre-approval process and what you’re qualified to borrow, current mortgage rates and your approximate monthly payment, closing costs, and other expenses you’ll want to budget for. That way, you have a good idea of what to expect.

As you crunch your numbers, you’ll want to make sure you have enough cash left over in case of emergency. Think about it. You don’t want to overextend on the house, and then not be able to weather a storm if one comes along. It’s not a fun topic, but it’s an important one. As CNET says:

“You’ll want to have a financial cushion that can cover several months of living expenses, including mortgage payments, in case of unforeseen circumstances, such as job loss or medical emergencies.”

It was mentioned above, but buying a home comes with some upfront expenses. And while you’ll get that money back (and more) as you gain equity, that process takes some time. If you plan to move again soon, you may not recoup your full investment.

So, how long should you stay put in an ideal world? Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Five years is a good, comfortable mark. If the price of your home appreciates considerably, then even three years would be fine.”

So, think about your future. If you’re going to live there for a while, it may make sense to go for it. But, if you’re looking to sell and move within a year or two because you’re planning to transfer to a new city with that promotion you’ve been working so hard for, or you anticipate you’ll need to move to take care of family, those are things to factor in.

If you do, great. But if you don’t, finding a trusted local agent and a lender is a good first step. Having the right team can make figuring out everything else easier. The pros can talk you through your options and help you decide if you’re ready to make your move, or if you have a few more things to get in order first.

If you want to have a conversation about all the things you need to consider to determine if you’re ready to buy, connect with a local real estate professional.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com