Realty Executives Midwest

As we move into the second half of the year, one thing is clear: the current real estate market is one for the record books. The exact mix of conditions we have today creates opportunities for both buyers and sellers. Here’s a look at four key components that are shaping this unprecedented market.

Earlier this year, the number of homes available for sale fell to an all-time low. In recent months, however, inventory levels are starting to trend up. The latest Monthly Housing Market Trends Report from realtor.com says:

“In June, newly listed homes grew by 5.5% on a year-over-year basis, and by 10.9% on a month-over-month basis. Typically, fewer newly listed homes appear on the market in the month of June compared to May. This year, growth in new listings is continuing later into the summer season, a welcome sign for a tight housing market.”

This is good news for buyers who crave more options. But even though we’re experiencing small gains in the number of available homes for sale, inventory remains a challenge in most states. That’s why it’s still a sellers’ market, giving homeowners immense leverage when they decide to make a move.

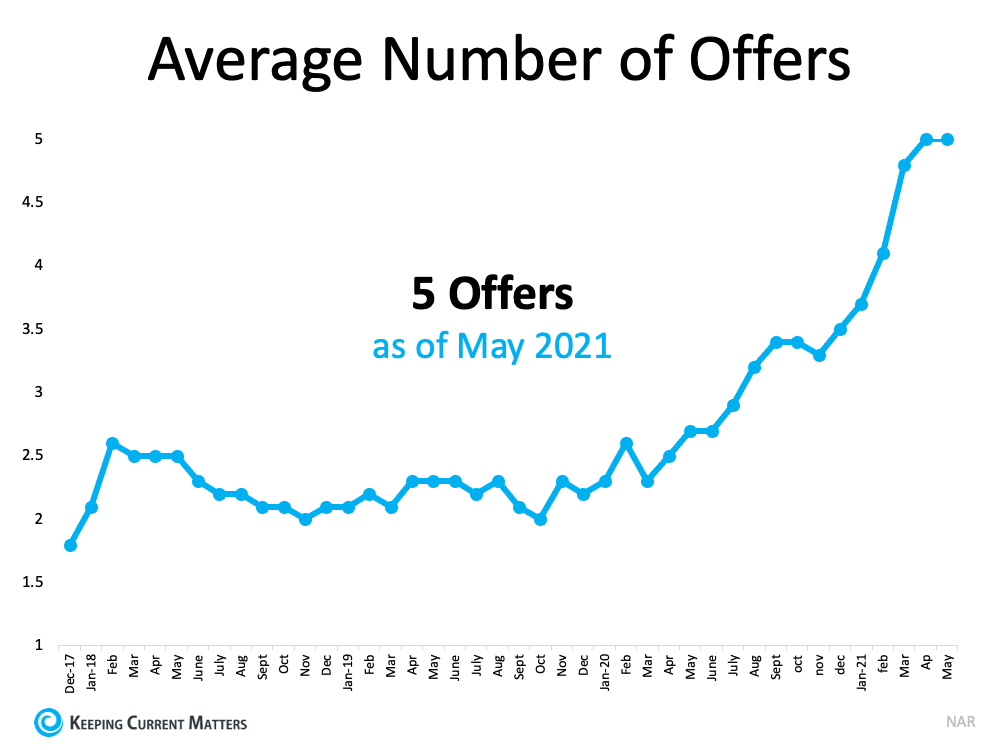

Today’s ongoing low supply, coupled with high demand, creates a market characterized by high buyer competition and bidding wars. Buyers are going above and beyond to make sure their offer stands out from the crowd by offering over the asking price, all cash, or waiving some contingencies. The number of offers on the average house for sale broke records this year – and that’s great news for sellers.

The latest Confidence Index from the National Association of Realtors (NAR) says the average home for sale receives five offers (see graph below):

For buyers, the best way to put a compelling offer together is by working with a local real estate professional. That agent can act as your trusted advisor on what terms are best for you and what’s most appealing to the seller.

The competition among buyers is driving prices up. Over the past year, we’ve seen home price appreciation rise across the country. According to the most recent Home Price Index (HPI) from CoreLogic, national home prices increased 15.4% year-over-year in May:

“The May 2021 HPI gain was up from the May 2020 gain of 4.2% and was the highest year-over-year gain since November 2005. Low mortgage rates and low for-sale inventory drove the increase in home prices.”

Rising home values are a big part of why real estate remains one of the top sought-after investments for Americans. For potential sellers, it also means it’s a great time to list your house to maximize the return on your investment.

The equity in a home doesn’t just grow when a homeowner pays their mortgage – it also grows as the home’s value appreciates. Thanks to the jump in price appreciation, homeowners across the country are seeing record-breaking gains in home equity. CoreLogic recently reported:

“…homeowners with mortgages (which account for roughly 62% of all properties) have seen their equity increase by 19.6% year over year, representing a collective equity gain of over $1.9 trillion, and an average gain of $33,400 per borrower, since the first quarter of 2020.”

That’s a major perk for households to leverage. Homeowners can use that equity to accomplish major life goals or move into their dream homes.

If you’re thinking about buying or selling, there’s no time like the present. Reach out to a local real estate professional to talk about how you can take advantage of the conditions we’re seeing today to meet your homeownership goals.

Article Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

It is a part of homeownership: unexpected home repairs. Some of them are simple and inexpensive fixes, like repairing a broken drawer handle or replacing a doorknob. However, some of them, such as replacing the roof or removing mold, are laborious tasks that require the services of a professional and can cause financial strain if you are unprepared.

For this reason, it is important to plan for major home repairs. Even though you do not know when to expect such repairs, you can be prepared for when they happen! Read on for some insight into common home fixes that homeowners may encounter.

The roof is essential in protecting your home from the elements. If there is a leak or other issue with your roof, it can lead to a host of other serious, expensive problems. Regularly check your roof for any leaks or missing/broken shingles or tiles. It is also a good idea to have a professional inspection done every few years. Expect to pay anywhere from $100 to $1,000 for a roof repair.

If you have an abundance of large trees around your home, it is important to be mindful of how they could affect your home or property, particularly if a severe storm were to occur. In some cases, it could be better to remove a tree rather than cut it back. Tree removal costs can vary depending on the size of the tree and its location, and you can expect to pay anywhere from $50 to as much as $1,500. Be sure to ask about additional costs, such as stump grinding, to confirm if it is included in the price.

It is common for furnaces to stop working properly, and it is important to be prepared if it happens to you. Bob Vila recommends that homeowners consider the age of the furnace and whether it is working well. If it is older or not functioning at full capacity, you may be able to get by with a minor repair. However, it is also possible you will need a new furnace.

In most cases, a new furnace can run about $1,000 to $6,000, but the cost will vary depending on what kind of furnace you get. For instance, an electric model can cost $400 to $1,200 while a gas model can range from $850 to $1,800. Labor is another expense to consider, which can add an extra $1,500 to $3,000 to the bill.

It is easy to see the potential problems with a water heater that goes out—cold showers perhaps being the most obvious one. However, a defective water heater can also cause some very costly issues, such as flooding. Keep an eye on your water heater, have it checked periodically, and set aside $767 to $1,446 for when you need a new one installed.

There are many ways for water damage to occur (e.g., leaks, flooding, storms, etc.), and it can be expensive to fix. Typically, the cost to repair water damage will depend on the type of damage that has occurred. Here are the three main categories of water damage and the average cost of remediation:

According to Allstate Insurance Company, these prices include only the remediation of water damage. You will also need to factor in the cost of repairs to any items or areas of the home (e.g., furniture, drywall, floors, etc.) that need to be restored.

While some people opt to do their own electrical work, it is not the best idea if you do not have any valuable experience. In short, there is just too much that can go wrong, and the consequences of a simple mistake could result in electrocution, fire, or any other number of problems. If you need electrical work done, especially if it is rewiring, call a professional. Most electricians charge $75 per hour.

You may not be able to predict every major home repair that comes your way, but you can start preparing for the costs now. The repairs on this list are only a few of many that should be considered. Be sure to keep researching so that you can prepare as well as possible for future home repairs that call for the services of a professional!

Article Source: Realty Executives International

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off a robust housing market in the first half of 2021, but what does the forecast tell us about what’s on the horizon?

Many experts are projecting a rise in interest rates. The latest Quarterly Forecast from Freddie Mac states:“We forecast that mortgage rates will continue to rise through the end of next year. We estimate the 30-year fixed mortgage rate will average 3.4% in the fourth quarter of 2021, rising to 3.8% in the fourth quarter of 2022.”

However, even as mortgage rates rise, the anticipated increase is expected to be modest at most, and still well below historical averages. Rates remaining low is good news for homebuyers who are looking to maximize their purchasing power. The same report from Freddie Mac goes on to say:“While higher mortgage rates will help slow the pace of home sales and moderate house price growth, we expect overall housing market activity will remain robust. Our forecast has total home sales, the sum of new and existing home sales, at 7.1 million in 2021….”

Joe Seydl, Senior Markets Economist at J.P. Morgan, projects home prices to continue rising as well, indicating buyers interested in purchasing a home should do so sooner rather than later. Waiting for rates or home prices to fall may not be wise:“Homebuyers—interest rates are still historically low, though they are inching up. Housing prices have spiked during the last six-to-nine months, but we don’t expect them to fall soon, and we believe they are more likely to keep rising. If you are looking to purchase a new home, conditions now may be better than 12 months hence.”

Home prices are rising, but they should moderate as more housing inventory comes to market. George Ratiu, Senior Economist at realtor.com, notes there are signs that we may see the current inventory challenges lessen, slowing the fast-paced home price appreciation and creating more choices for buyers:“We have seen more new listings this year compared with 2020 in 11 of the last 13 weeks. The influx of new sellers over the last couple of months has been especially helpful in slowing price gains.”

New home starts are also showing signs of improvement, which further bolsters hopes of more options coming to market. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), writes:“As an indicator of the economic impact of housing, there are now 652,000 single-family homes under construction. This is 28% higher than a year ago.”

Finally, while it may not fundamentally change the market conditions we’re currently experiencing, another reason to be optimistic more homes might come to market: our improving economy. Mark Fleming, Chief Economist at First American, notes:“A growing economy in the summer months has multiple implications for the housing market. Growing consumer confidence, a stronger labor market, and higher wages bode well for housing demand. While a growing economy and improving public health conditions may also spur hesitant existing owners to list their homes for sale, it’s unlikely to significantly ease the super sellers’ market conditions.”

As we look at the forecast for prices, interest rates, inventory, and home sales, experts remain optimistic about what’s on the horizon for the second half of 2021. Contact your trusted real estate advisor to discuss how to navigate the market together in the coming months.

Article Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

You may have been told that it’s important to get pre-approved at the beginning of the homebuying process, but what does that really mean, and why is it so important? Especially in today’s market, with rising home prices and high buyer competition, it’s crucial to have a clear understanding of your budget so you stand out to sellers as a serious homebuyer.

Being intentional and competitive are musts when buying a home right now. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Just as important, being able to present a pre-approval letter shows sellers you’re a qualified buyer, something that can really help you land your dream home in an ultra-competitive market.

With limited housing inventory, there are many more buyers active in the market than there are sellers, and that’s creating some serious competition. According to the National Association of Realtors (NAR), homes are receiving an average of 5.1 offers for sellers to consider. As a result, bidding wars are more and more common. Pre-approval gives you an advantage if you get into a multiple-offer scenario, and these days, it’s likely you will. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war.

Freddie Mac explains:

“By having a pre-approval letter from your lender, you’re telling the seller that you’re a serious buyer, and you’ve been pre-approved for a mortgage by your lender for a specific dollar amount. In a true bidding war, your offer will likely get dropped if you don’t already have one.”

Every step you can take to gain an advantage as a buyer is crucial when today’s market is constantly changing. Interest rates are low, prices are going up, and lending institutions are regularly updating their standards. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals such as a loan officer and a trusted real estate agent making sure you take the right steps and can show your qualifications as a buyer when you find a home to purchase.

In a competitive market with low inventory, a pre-approval letter is a game-changing piece of the homebuying process. Not only does being pre-approved bring clarity to your homebuying budget, but it shows sellers how serious you are about purchasing a home.

Article Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

In today’s booming housing market, sellers have their pick of home offers. According to a study by Realtor.com, the median home listing price is up 15.6% compared to last year.

Now, more than ever, sellers have a chance to get more money for their homes. And while this is great for sellers, it leaves buyers asking: “How can I stand out in such a competitive market?”

One way buyers can stand out is with their offer. This isn’t the market for low offers, which is why buyers may think the only option is putting in a high offer. This often means going above the listing price. But what happens when the seller accepts that high offer and the home appraisal comes in far lower?

Before purchasing a house, a buyer’s lender will hire an appraiser to appraise a home. The goal of an appraisal is to ensure the price of the home matches or exceeds the home’s listing price. If it does, everything is fine. But if it doesn’t, things can get complicated.

If the appraisal is lower than the home’s price, a lender won’t approve the loan for that amount. For example, if the listing price is $300,000 but it appraisers for $250,000, the buyer now has to come up with the difference.

There are several reasons why a home with a high price tag might not appraise for as much. For one, bidding wars (like the ones we’re currently seeing) can cause listing prices to skyrocket, even if the home isn’t necessarily worth the price.

With that said, if the appraisal comes in too low, you have a few options:

How to avoid paying more?

Buyers should consider adding an appraisal gap coverage clause in their offer. To put it simply, appraisal gap coverage is when a buyer agrees to cover a certain amount of the difference between the offer price and the appraisal value – if, in fact, there’s an appraisal gap.

For example, let’s say you offer $200,000 on a home. In your appraisal gap coverage clause, you could say you’re willing to pay $10,000 over the appraised value. If the appraised value ends up being equivalent to the listing price, you don’t have to pay any extra money. But if the appraised value is under, be prepared to come to the table with more money.

The benefit of having an appraisal gap coverage clause is it shows the seller you’re serious about purchasing the home, without you having to offer an obscene amount of money. It also provides you with the option to cancel the contract, if there’s an appraisal gap.

Article Source: HousingWire

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com