Need a Professional?

HomeKeepr is the only platform where homeowners can discover home service pros powered entirely by real referrals from real people – not reviews.

Realty Executives Oceanside

By HomeKeepr

In uncertain times, it can be easy to sit back and worry your time away hoping things will work out eventually. Although worrying will absolutely give you something to do, it won’t get you anywhere. So if you’ve been wanting to buy a home or refinance this year, don’t discount the possibility just because your income may have dropped. It’s true that qualifying for a mortgage is getting trickier for many potential borrowers, but you still have plenty of options and opportunities for a home loan.

Many industries are facing uncertain futures and what are likely to be unstable paths of recovery. Because of this, lenders have become increasingly concerned about borrowers’ abilities to repay loans. That’s not to say that there’s no hope in sight for workers or business owners, just that from a lender’s perspective, the pandemic has introduced an additional level of risk that has never been factored into home lending equations before now.

So it’s not that you’ve done anything wrong, or that home buyers in general have done anything wrong, but lenders like to see that incomes are stable and will continue to be stable for the foreseeable future. And in the current economic climate, this is pretty much impossible to forecast. Given this, lenders are getting more choosy about who they’ll lend to. Minimum credit scores are going up and, in some cases, so are down payments. The good news is that lenders are still issuing loans for home purchases and refinances, even to buyers who have lost income during the pandemic.

Revenues in many industries have taken a huge blow, and many workers are being asked to take a salary cut in order to maintain the integrity of the workforce. This doesn’t necessarily mean that you would be denied a loan, although you may need to provide additional documentation so your lender has a better picture of your overall financial picture. But a lower income can still affect your loan in one or more ways:

The good news is that just because one bank may have new requirements that reduce your loan amount or make you ineligible for a loan right now, others may not. Offers vary from bank to bank and from program to program, so it’s worthwhile to shop around for mortgages. If you’re not sure where to start, contact us today! We can help point you in the right direction with local experts we know in the community!

For more information, please reach out to us!

386-506-8008 | Oceanside@RealtyExecutives.com | |

|

![]() @REOceanside

@REOceanside

By Realty Executives International

What is an investment? For most people, it’s buying stocks and shares. However, it’s quite intimidating, given the turbulent nature of current circumstances. So if you are looking to invest, real estate is always a smart choice. It’s a physical asset, a great passive income generator – overall, a reliable revenue source. You might not have known that there are several types of real estate investments, and you should think long and hard before you decide which is the best for you.

Passive real estate investments

As the word implies, this is the type of investment where you take a more passive role. There is no driving around in search of a suitable property. Instead, there are real estate investment platforms where you can browse through the options. These platforms often function as crowdfunding websites. You will find a specific project you want to invest in. The amount of money you will put in will depend on the project and the platform of your choice. Then, your money will be put together with other investors’ money, and you will receive dividends from the projects you have invested in. Dividends will, of course, be proportionate to the amount of money you have put in.

Moreover, passive investment means that you will not be responsible for the maintenance, repairs, rent collection or other property manager duties. You are just an investor.

Active real estate investments

If you would rather take a more proactive road, active real estate investment is your option. Beware, however, that it can be much harder than it seems. You will have to spend more time searching for the right rental property to invest in. This type of investment implies purchasing the property of choice and being responsible for all managerial duties like finding tenants. It will mean that you are the landlord, and you will be collecting rent in exchange for housing and maintenance.

If this sounds like a suitable option for you, it’s worth considering the following points:

Something in-between

If being a landlord is too much for you, but you do want some direct control over the management of a property, there are semi-passive options for you. One such option is hiring a property manager who will do all the heavy lifting for a fee. Another one is finding an alternative real estate investment, such as a parking lot or a garage. And finally, if you have space in your home you don’t use, you can rent it via Airbnb or Homestay websites.

Flipping homes

Buy, renovate, sell for more – sounds pretty straightforward. However, this is the most costly, time-consuming, and energy-draining of all real estate investments. The way to make it work is to have a network of trustworthy and reliable contractors. Also, it’s vital to keep in mind that this is a risky business – the real estate market, economy, and location play an important role. So, there are no guarantees that the house will sell for more.

Nevertheless, it still has a lot of potentials. In 2020, many families who live in apartments dreamed of a house with a garden during lockdowns due to Covid-19. If you’re into making dreams come true, flipping houses is the right choice for you. All these people will have to do is hire the guys from a moving company, such as Zippy Shell Columbus or similar places, to help them relocate safely and efficiently.

Real estate investments are always a good idea, whichever way you choose. However, you do need to do your homework before investing, for you can easily lose your shirt if you don’t play your cards carefully. But if you do, not only will you make your money back, but you will make some, and more.

For more information, please reach out to us!

386-506-8008 | Oceanside@RealtyExecutives.com | |

|

![]() @REOceanside

@REOceanside

Our local community is hopping with events this coming weekend! We wish we could attend them all! With cooler weather coming, these fun events are perfect for the whole family or maybe a date night.

Feeling Fall-ish? Check out the Long & Scott Farm's Corn Maze and Night Maze! Mazes run from October 3rd to December 13th. They are hosting 3 night mazes this season: October 24th, October 31st and November 7th. For more information and to buy tickets, visit here!

Start off Saturday by attending the Creative Bazaar Arts and Crafts Market Presented by Palm Coast Arts Foundation! The Bazaar happens the 1st Saturday of each month through December. Check out more information here!

The European Village Farmer's Market is BACK! Recurring every Sunday from 12 - 4pm, take stroll through the scenic European Village while you shop local! Admission is always FREE!

On Saturday, November 7th, Hammock Wine and Cheese will be hosting a Veteran's Foodie Fair where they will be serving their best food and drinks! 100% of the proceeds will go toward GratitudeAmerica, which is a 501(c)(3) non-profit organization whose primary goal is to provide critical support for our past and present military service members and their families during their return to civilian life. For more information, click here!

Want to get away with the kids? Kids Free November 2020 hosts city attactions in Jacksonville where five children under 12 get in FREE! For participating attractions and free things to do, visit here!

For more information, please reach out to us!

386-506-8008 | Oceanside@RealtyExecutives.com | |

|

![]() @REOceanside

@REOceanside

By HomeKeepr

When rates are low, it can seem like the ideal time to refinance your mortgage. After all, who doesn’t like a lower interest rate? There are lots of good reasons to refinance your mortgage, such as adding on or trying to streamline your expenses, but what’s really involved in the process?

Perhaps the best news any homeowner can get when it comes to a refi is that it’s not likely to be nearly as difficult as getting the original loan was. Breathe a big sigh of relief if you need to; this is the time for it.

For many homeowners, refinancing happens for a few specific reasons: reducing mortgage interest, dropping mortgage insurance, or cashing out for a remodeling expense. When rates are low and values are high, a refinance can provide a double whammy financially. Dropping any mortgage insurance you’re currently on the hook for can make a big dent in your house payment, especially if waiting for it to fall off naturally would take several more years. And, of course, a lower interest rate also means you’re paying less money towards interest over time.

Combine the two and it can mean big savings on a home you plan to hold over the longer term. Remodeling is a valid and effective way of adding value, as well, which has a whole lot of other benefits that come with it. In short, there are tons of ways a refi can be helpful to your financial welfare.

Much like when you got your initial loan, your mortgage banker or broker will examine your financial history and your longer term prospects, which includes your work history, to ensure you’re financially stable. Your debt to income ratio will be reexamined as well. Although these are closely scrutinized, many banks will grant a bit more wiggle room than they did for initial mortgages, especially for homeowners who have a lot of equity already established.

Once approved for your loan, you’ll choose when to lock in your rate. Because interest rates can vary from day to day, it’s important to pay close attention to both the current rate being offered and your lender’s advice in the matter. If they have noticed rates are going up, locking right away makes a lot of sense, but if you’re the gambling sort and rates are trending down, you may want to float your rate a few days to see if you can do any better. Remember, though, this is a bet that you’re taking that the rate will drop, and it won’t always pay off.

HomeKeepr is the only platform where homeowners can discover home service pros powered entirely by real referrals from real people – not reviews.

Just like with the initial mortgage, you’ll need to prove you are who you say you are and that you have the income you claim, among other things. Your banker will almost certainly ask for the following types of paperwork:

Once your lender has reviewed your paperwork and determined they’re willing to refinance your loan, they’ll order an appraisal of your home. Typically, an inspection won’t be needed, unlike with a purchase. In many cases, a drive-by appraisal will be adequate, especially if it’s very clear at a glance that you’ve maintained the property.

With all your paperwork in hand and your appraisal completed, your lender will be ready to send you and your loan to closing. Since there’s not a seller involved, you will be going to closing at a time that’s convenient for you, and it’ll be a very quick process. Make sure to double-check the terms of the loan to ensure you’re agreeing to the mortgage you believed you were signing up for. If you have any questions, your lender will be more than happy to clarify, but ask them before you sign the dotted line.

Following your closing day, you have a special period to change your mind and revoke the loan entirely. Thanks to your right of rescission, you can cancel the loan with no penalties and no modification to your previous mortgage within three days of closing. So, if you wake up the next day with cold feet, it’s not too late to turn back time!

For more information, please reach out to us!

386-506-8008 | Oceanside@RealtyExecutives.com | |

|

![]() @REOceanside

@REOceanside

This weekend should be filled with trick-or-treating, costume wearing, and overall fun times with family and friends! Maybe you'll carve pumpkins or make candy apples! But what if you'd like to do something different or don't like the Halloween vibes - check out our list below!

On Tuesday, 10/27 at 3:00 - 7:00 pm, Hammock Beach Golf Resort & Spa will be hosting Taste of FUN Coast! Get ready for an evening of Flagler County’s finest restaurants; highlighting the area’s catering facilities, spirits, and cigar companies at the renowned Hammock Beach Resort. You can buy your tickets here!

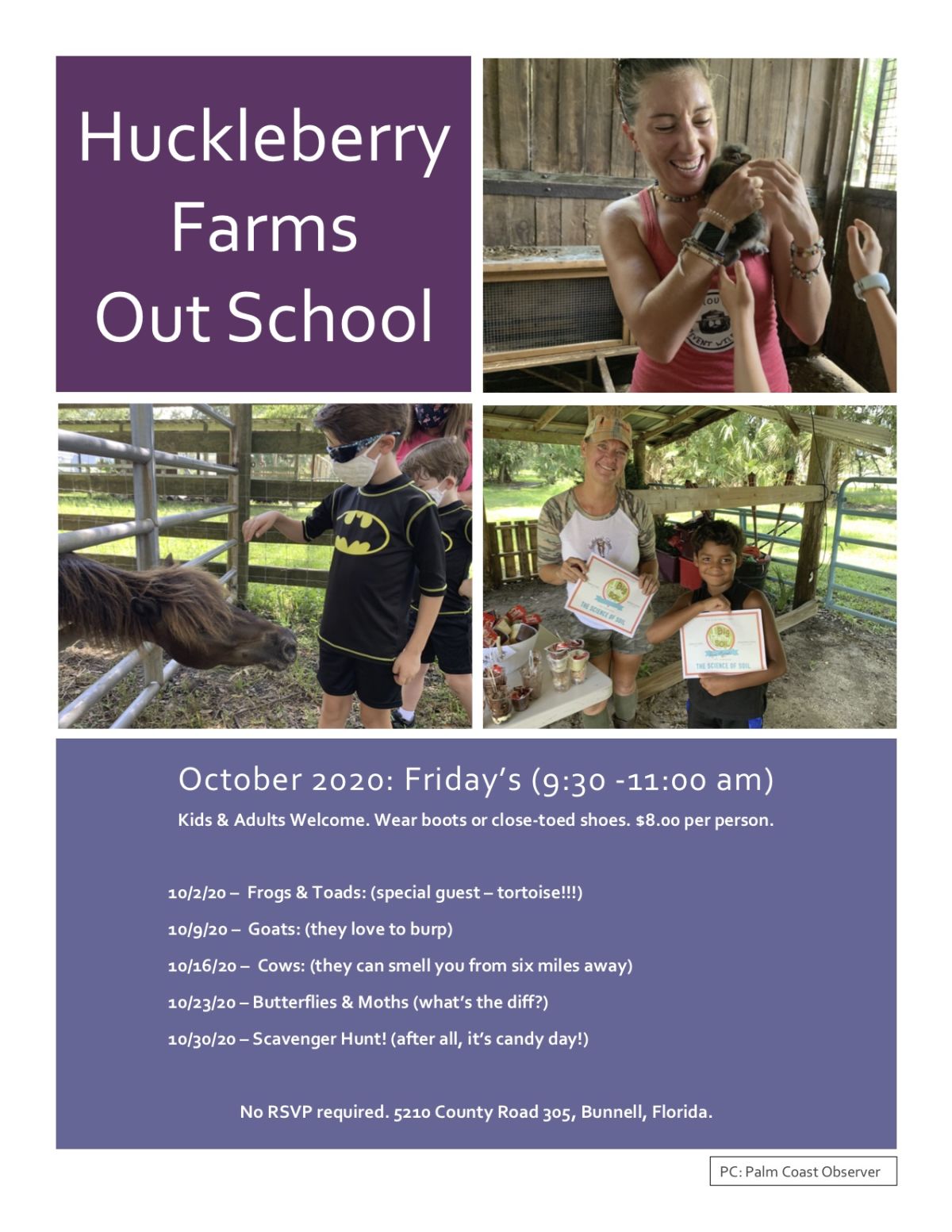

Huckleberry Farms is hosting a whole weekend chock full of fun! On Friday, 10/30 9:30 - 11:00 am, they are hosting a scavenger hunt. No RSVP is required and its only $8! On Sunday, Nov. 1st, they will be hosting Yoga on the Farm. Join them for animal fun, relaxing, and mimosas! Check out this website for more information on yoga and this one for the Scavenger Hunt!

For more information, please reach out to us!

386-506-8008 | Oceanside@RealtyExecutives.com | |

|

![]() @REOceanside

@REOceanside