The Emperor is Naked

Do you remember when the little boy yelled, “The Emperor has on no clothes!”? Well, if you listen to current media coverage of the housing market, you’ll hear detailed descriptions of the finest gold silk you have ever seen. But even the slightest scrutiny will reveal that the man is naked and the headlines are hype.

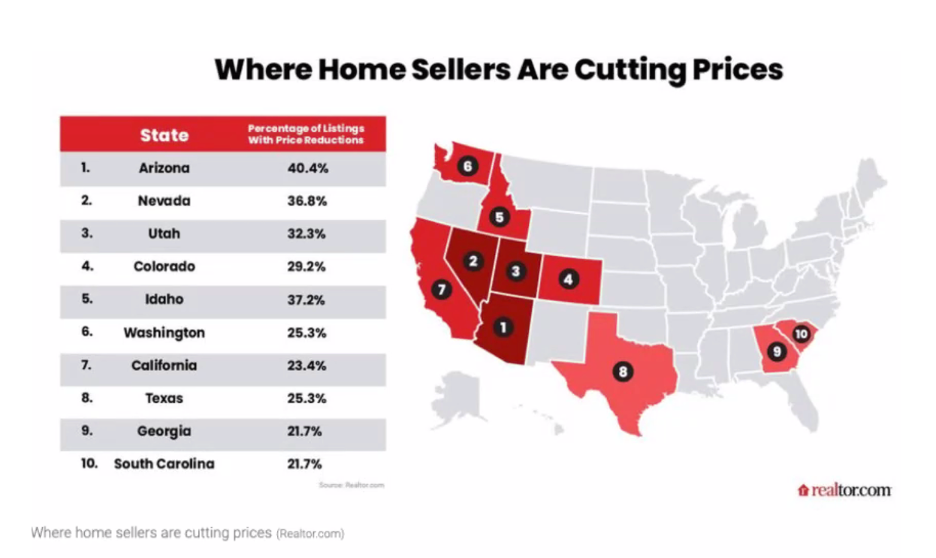

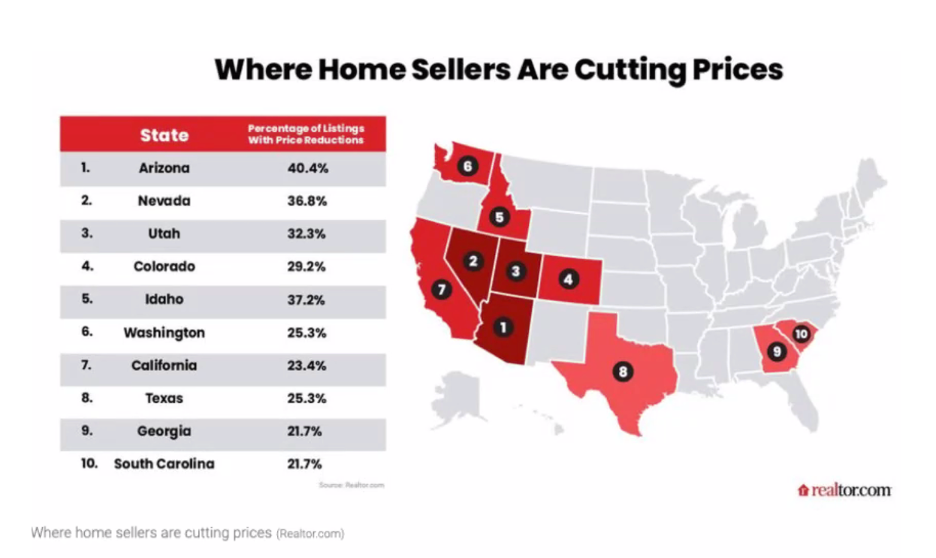

Phoenix Tops the Nation in List Price Reductions

The top story making my phone ring this week is Phoenix leads the nation in list price reductions. Keep in mind this refers to the number of homes that have reduced their price, not the amount of reduction. In most cases the number was artificial to start with. But let’s be real, the number is based on a prior number of ZERO, since there were zero price reductions for the last two years, so of course any reductions would look like a huge jump.

Prices hit their Peak this Summer

Over the last two years, buyers faced fierce competition. A shortage of inventory and historically low interest rates provided Sellers with offers above asking price immediately. This phenomenon obviously encouraged other Sellers to ask more than what they typically would have been happy with in a normal market, selling for normal reasons like downsizing or moving or illness of a family member. It also encouraged Sellers who really didn’t care if they sold, to join the party, willing to sell if they got a high enough price. Once they started to get excited about a move, many decided to get realistic in order to make it happen, others took their homes off the market and turned their attention to the holidays.

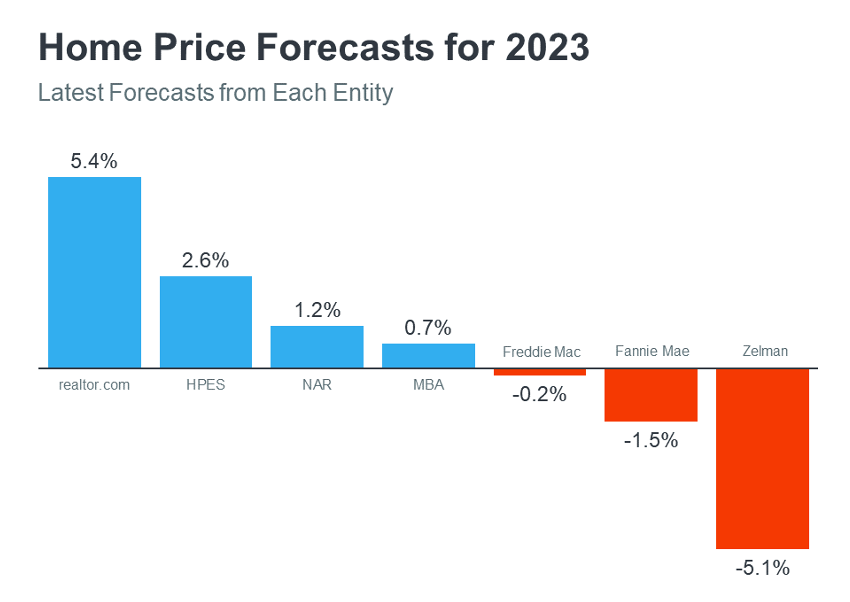

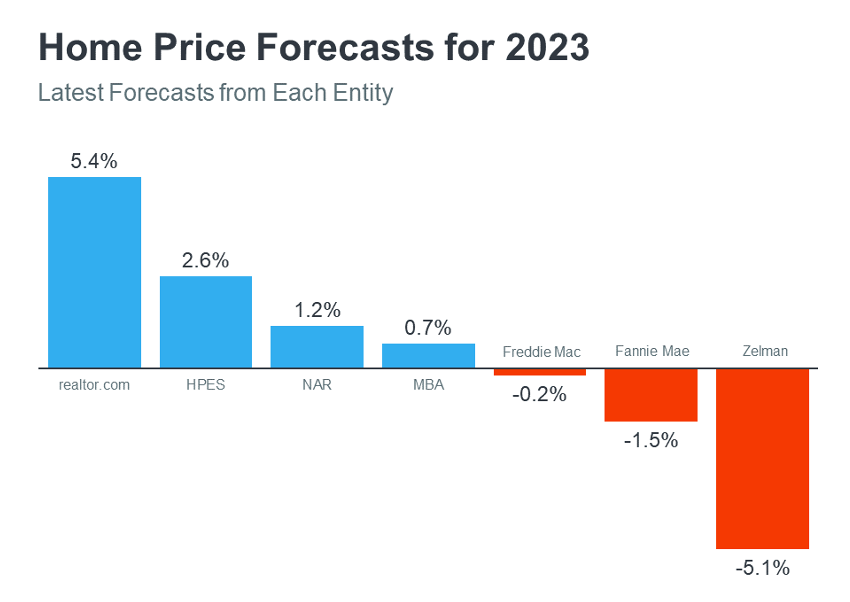

Home Prices are Not Expected to Crash

According to the National Association of Realtors, top experts don’t believe home prices will crash anything like they did in 2008. Keep in mind, anyone who has owned a home for two years most likely has a lot of equity, that was the opposite case in 2008. Experts believe that home prices will moderate at various levels depending on the local market and the supply and demand in that area. That’s why some experts are calling for slight appreciation. However, even the worst case of 5.1% hardly makes a dent in the 40-90% appreciation of the last two years.

Mortgage Rates will Come Back Down

Mortgage Rates will Come Back Down

While mortgage rates have risen dramatically this year, the rapid increases we’ve seen have moderated in recent weeks as early signs hint that inflation may be easing slightly. Where they’ll go from here largely depends on what happens next with inflation. If inflation does truly begin to cool, mortgage rates may come down as a result.

When that happens, expect more buyers to jump back into the market. For you, that means you’ll once again face more competition. Buying your house now before more buyers reenter the market could help you get one step ahead. As Lawrence Yun, Chief Economist for NAR, says: “The upcoming months should see a return of buyers, as mortgage rates appear to have already peaked and have been coming down since mid-November.” When mortgage rates come down, those waiting on the sidelines will jump back in. Your advantage is getting in before they do.

Listen to the Experts

So, before you repeat the news anchors, take a few minutes to learn from the experts. Here are a couple good reports and predictions for the 2023 Housing Market.

Have a great holiday! Warmly, Denise van den Bossche

Celebrating nearly 40 years in the Arizona Real Estate Market

Mortgage Rates will Come Back Down

Mortgage Rates will Come Back Down