?? Fall 2025 Real Estate Market Update: Downers Grove & Surrounding Suburbs

The Fall 2025 real estate market across Downers Grove, Westmont, Lisle, Bolingbrook, Darien, Burr Ridge, Lemont, and Woodridge is showing balance and opportunity. While home prices are holding steady, homes are spending more time on the market — creating a great season for both buyers and sellers.

?? Home Prices Stay Strong in the Western Suburbs

Prices continue to reflect solid buyer demand:

-

Downers Grove: Average price around $535,000, up 4.5% year-over-year.

-

Westmont & Lisle: Mid-$400K range with steady growth.

-

Bolingbrook & Woodridge: Affordable options attracting steady buyer traffic.

-

Darien, Burr Ridge & Lemont: Higher-end homes remain stable thanks to limited listings.

Across these communities, prices remain 3–5% higher than last fall, supported by strong local demand and low supply.

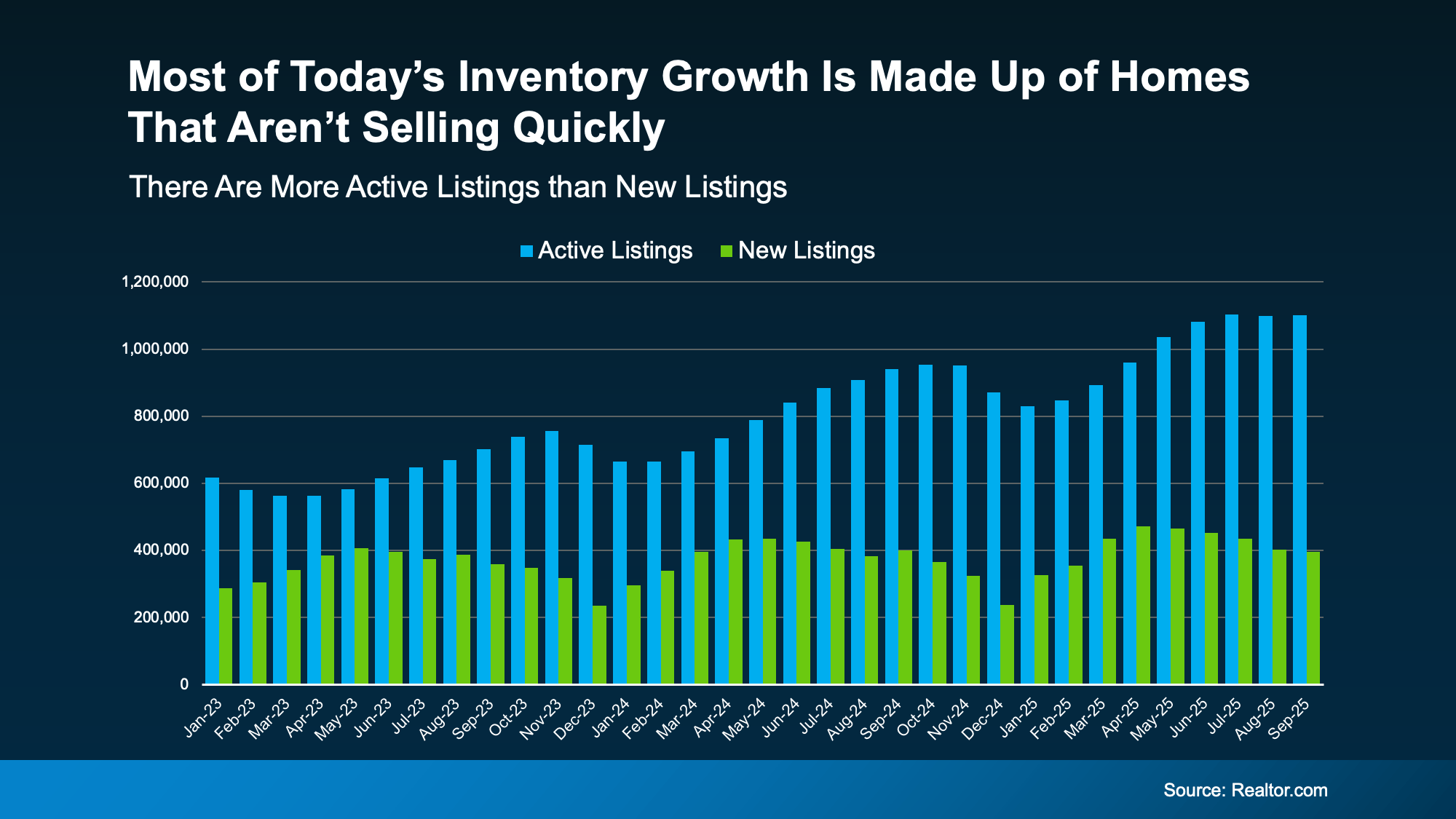

?? Market Pace: More Time, More Strategy

The average days on market is now around 50–60 days, up from last year. Buyers are taking more time, while sellers who price right are still seeing solid results.

?? Interest Rates & Buyer Trends

Interest rates remain steady but elevated, making buyers more selective. Still, motivated buyers are acting fast when they find the right property. Price reductions and negotiation flexibility are helping close more deals this fall.

?? For Sellers: Why Now Is Still a Great Time

Even with longer sale times, low inventory keeps the market strong for sellers. Listing before the spring rush lets your home stand out and capture the attention of serious fall buyers.

?? For Buyers: Negotiation Power

This season gives buyers more leverage than in previous years. With fewer bidding wars and more options, it’s an ideal time to make an offer and negotiate terms that work for you.

?? The Bottom Line

The Downers Grove area real estate market remains healthy and full of opportunity. Sellers can still enjoy high equity returns, and buyers have more space to negotiate fair deals.

?? Get Your Free Home Valuation and Fall Home Seller’s Guide

Thinking of selling or just curious about your home’s worth?

Contact Mark Sotir – Realtor® at 630-815-8098 for your free home valuation and seller’s guide to make the most of Fall 2025’s market

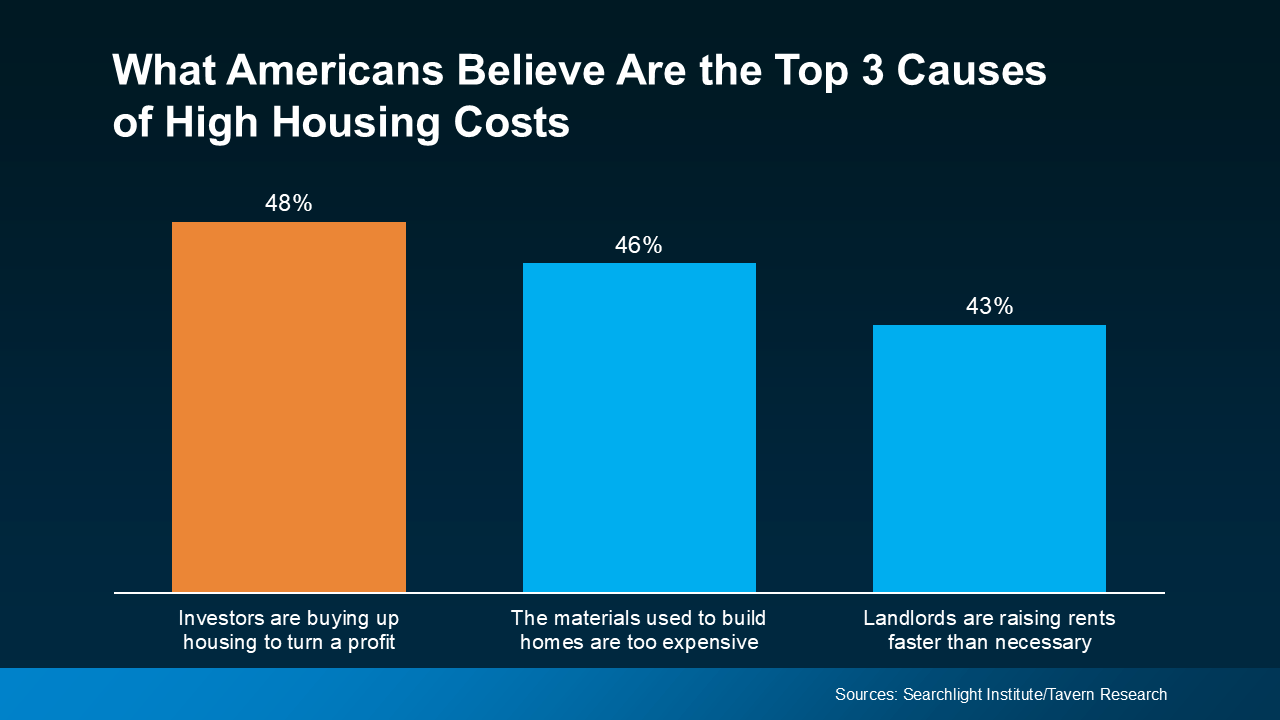

But that theory doesn’t actually hold up once you look at the data.

But that theory doesn’t actually hold up once you look at the data.