(Published on - 7/29/2025 6:29:11 PM)

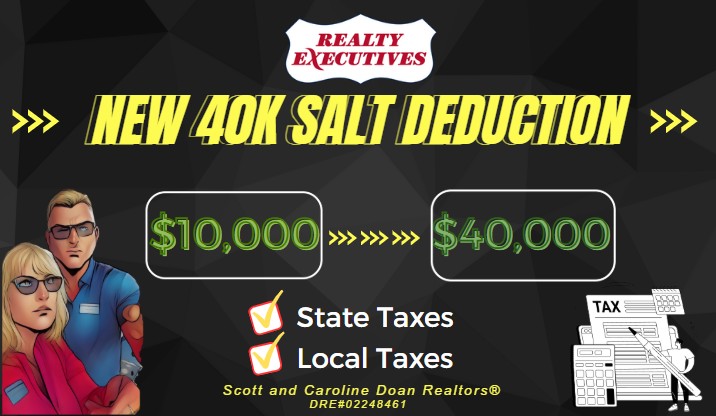

Buying a home is one of life's biggest milestones — a moment filled with excitement and new possibilities. But for many, the biggest hurdle isn’t the dream itself—it’s coming up with the down payment. If that feels overwhelming, you're not alone. That’s why, during National Homeownership Month, Realtors® Scott and Caroline Doan want to spotlight a resource that could make your homeownership journey more achievable: **down payment assistance**.

What Is Down Payment Assistance?

Since 2008, Down Payment Resource (DPR) has been dedicated to helping prospective buyers discover financial aid they might not even know exists. DPR tracks over 2,500 assistance programs nationwide, providing tools that connect you to support, reduce your upfront costs, and make owning a home more affordable.

So, what exactly is DPA?

Down payment assistance programs are designed to help cover upfront costs — usually the down payment, but often they go beyond:

- Closing costs

- Prepaid expenses

- Interest rate buy-downs

- Even your buyer’s agent commission (yes, some programs cover this!)

Many programs also help reduce your monthly mortgage payments and decrease the total amount you’ll repay over time, making homeownership more manageable.

Debunking Myths: You Might Qualify More Than You Think

A common misconception is that DPA is only for low-income or first-time buyers. The reality is quite different:

- Income limits are often based on your local area, and many are higher than you expect.

- Your credit score doesn’t need to be perfect—if you’re close to lender requirements, you could qualify.

- Repeat buyers are welcome — nearly 40% of programs are open to those who have owned before.

- Buying unconventional homes? Almost 1,000 programs support manufactured homes, and over 800 cover multifamily properties like duplexes or fourplexes. You can even live in one unit and rent out the others to offset costs.

What Does Help Look Like?

DPA programs aren’t one-size-fits-all, but here are some examples of what you might find:

- Loans: 57% offer second mortgage loans—often at low or no interest.

- Deferred payments: 80% of these loans are deferred until you sell or refinance.

- Forgiveness: 53% of programs forgive portions of the loan over time, rewarding stability.

- Grants: 177 programs provide free money that you never have to pay back.

On average, these programs can reduce your loan-to-value (LTV) ratio by about 6%, easing your path to qualifying for a mortgage and lowering your monthly payments.

Finding Assistance Has Never Been Easier

Since partnering in 2021, over five million home shoppers have used DPR tools via Zillow, and 93% of users found at least one assistance program they may qualify for. That means help is out there, and you might be surprised at how close to your goal you already are.

Your Journey to Homeownership Starts Here

If saving that huge down payment has kept you on the sidelines, let DPR and your local real estate professionals help you turn that dream into reality. Scott and Caroline Doan are here to:

- Help you discover programs you’re eligible for

- Show how assistance can fit into your overall homebuying plan

- Connect you with knowledgeable agents and lenders familiar with DPA

Let’s Make Homeownership Happen

This National Homeownership Month, it’s time to rewrite the story of what it takes to buy a home. Down payment assistance isn’t just a “long shot”—it’s a practical, powerful resource that’s helping countless people across the country take that first step toward homeownership.

Your dream home might be closer than you think.

Ready to get started? Find down payment programs in your area today and see if you qualify. Scott and Caroline Doan are here to guide you every step of the way! Here is the link to our website to get started.

Looking to purchase? Reach out today and let’s explore your options together!

Thank you,

Scott and Caroline Doan Realtors®

(951) 541-3498

Realty Executives

28581 Old Town Front St. #100

Temecula, Ca. 92591

DRE#02248461