Dear Homeowners and future Homebuyers,

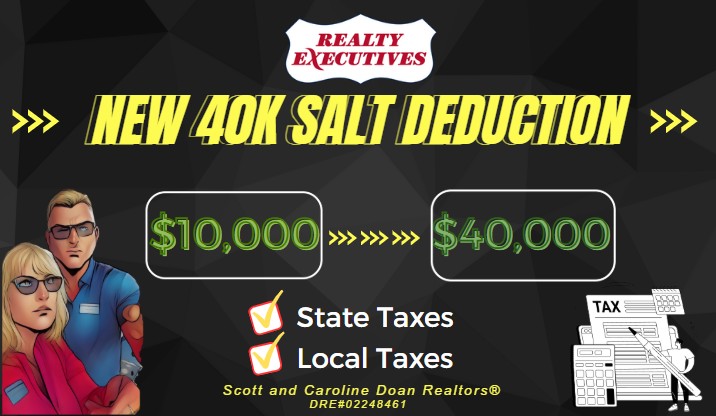

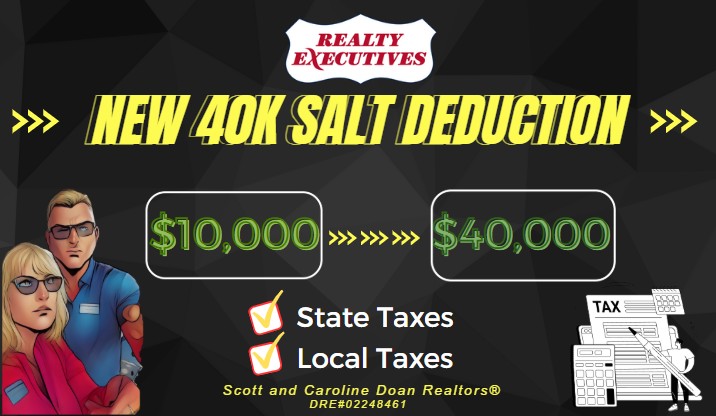

We're pleased to share some important news that could significantly impact your tax strategy and savings in the coming years. A recent change in federal tax law has temporarily increased the SALT (State and Local Tax) deduction cap from $10,000 to $40,000 beginning in 2025. This change offers noteworthy advantages, especially for homeowners in high-tax states.

What Does the New SALT Deduction Mean?

Starting with the 2025 tax year, taxpayers can now claim up to $40,000 in SALT deductions. This is quadruple the previous limit of $10,000, which was in effect from 2018 through 2024. The deduction amount is set to increase slightly each year through 2029, after which it reverts to $10,000 unless Congress acts to extend or preserve the increase. Additionally, there is a phasedown for taxpayers with a modified adjusted gross income over $500,000.

The new law also preserves the mortgage interest deduction at the levels established by the 2017 Tax Cuts and Jobs Act (TCJA), allowing homeowners to continue claiming mortgage interest deductions, which are a significant benefit of homeownership.

Why Is Deductibility of Mortgage Interest and SALT Important?

The ability to deduct mortgage interest and state and local taxes from your federal return has been a cornerstone benefit of homeownership for over a century. Prior to the 2017 law, many homeowners relied heavily on itemized deductions. However, the TCJA limited the SALT deduction to $10,000 while nearly doubling the standard deduction, which led to a sharp decline—from 31% of taxpayers in 2017 to just 9% in 2020—of those itemizing their deductions, according to the Tax Policy Institute.

Higher-tax state homeowners, in particular, were disproportionately affected by the $10,000 cap. This advocacy-led change aims to make homeownership more affordable and attractive, fostering stronger communities and social benefits such as improved educational outcomes, civic engagement, and health.

How Do I Take Advantage of the New SALT Limit?

To benefit from these changes, you'll want to itemize deductions on IRS Form 1040 Schedule A. In addition to SALT, common deductible expenses include:

- Mortgage interest

- Contributions to qualified charitable organizations

- Medical and dental expenses exceeding a certain percentage of your adjusted gross income

The law also restores deductibility of private mortgage insurance (PMI), which is often required for borrowers with less than 20% equity in their homes.

Additional Tips:

- Maintain thorough records and receipts to substantiate your deductions.

Consult with a qualified tax professional to ensure you leverage all available deductions and understand how the phasedown may affect high-income taxpayers.

Final Thoughts

These changes could have a meaningful impact on your tax savings and homeownership affordability. As policies evolve, we do our best to say informed and share the information they may benefit you the most.

When it is time to buyer or sell a home please call us.

Thank you Scott and Caroline Doan Realtors®

(951) 541-3498

Disclaimer:

This newsletter provides general information about recent tax law changes. It is not intended as tax advice. Please seek personalized guidance from a qualified tax professional or financial advisor before making any tax-related decisions.