(Published on - 8/17/2025 10:04:11 PM)

Discover Ocean Hills at Pacifica San Juan: A Coastal Sanctuary in San Juan Capistrano

Nestled in the picturesque city of San Juan Capistrano, Ocean Hills at Pacifica San Juan is a stunning gated community offering a luxurious coastal lifestyle. Developed by Toll Brothers, renowned for their craftsmanship and quality, this community features beautifully designed single-family homes that cater to a variety of tastes and needs.

A Brief Timeline of Development

Construction of Ocean Hills began in the early 2010s, with the community largely completing by 2020. The initial model homes drew widespread attention for their elegant designs and prime location, and subsequent phases continue to enhance the community’s appeal with new homes and features.

Community Sections and Their Unique Charms

Ocean Hills is thoughtfully divided into several distinct sections, each offering its own unique lifestyle and architectural appeal:

Ocean Hills – The Classic Retreat:The community's original phase, featuring spacious homes with traditional coastal design, open floor plans, and private outdoor spaces. It's perfect for families and those seeking a relaxed, friendly neighborhood.

The Preserve: An enclave emphasizing privacy and luxury, with larger lots and premium finishes. Surrounded by natural preservation areas, residents enjoy a peaceful connection to nature.

The Vista Collection: Known for panoramic city and ocean views, these homes boast multi-story layouts, expansive decks, and high-end finishes—ideal for entertaining and enjoying breathtaking scenery.

The Ocean Hill Terrace: Designed for a low-maintenance lifestyle, this section offers modern, detached homes suited for busy professionals, seniors, or anyone seeking comfort without extensive yard work.

The Hillside Estates: Offering luxury and exclusivity, these homes feature expansive footprints, custom options, and scenic hillside vistas, representing the pinnacle of elegance within Ocean Hills.

Features and Amenities

Residents of Ocean Hills enjoy a wealth of amenities designed to promote leisure, fitness, and social interaction:

Club Pacifica: The community’s premier clubhouse is a luxurious retreat with an elegant interior for gatherings, meetings, and events. Outdoors, residents can unwind in the resort-style pool and spa, or stay active in the state-of-the-art fitness center. The clubhouse also includes scenic outdoor areas, walking trails, and recreational facilities like BBQ areas, creating a vibrant social hub.

Other Amenities: Scenic walking trails, landscaped gardens, and outdoor seating areas foster a sense of community and outdoor living.

Living in San Juan Capistrano

Situated moments from Dana Point Harbor, pristine beaches, and the lively entertainment districts of San Juan Capistrano, Ocean Hills provides not just a beautiful home but access to an exceptional coastal lifestyle. Whether you’re interested in boating, beach activities, dining, or exploring historical sites, everything you desire is within easy reach.

Community Fees and Living Comfort

The homeowners association fee is $395 per month, covering maintenance of common areas, amenities, and security, ensuring a worry-free lifestyle for residents.

Take the Next Step

If you’re looking for a community that combines luxury, comfort, and a vibrant coastal lifestyle, Ocean Hills at Pacifica San Juan could be your perfect destination. With beautifully crafted homes, exclusive amenities, and a prime location, it offers an unparalleled living experience in Southern California.

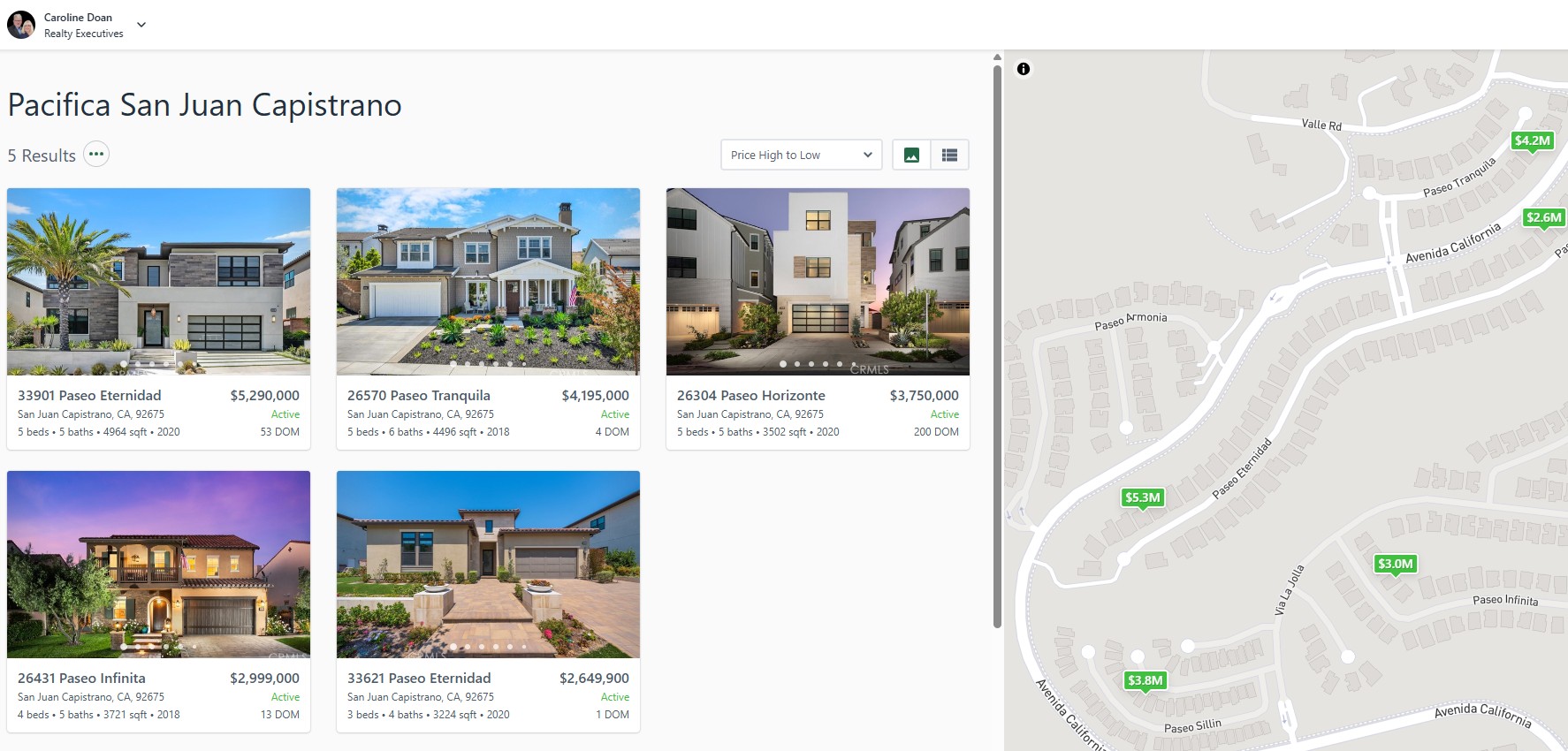

Start your search here

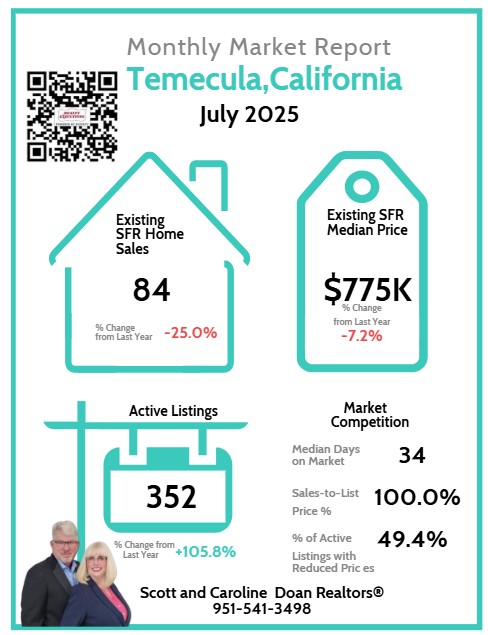

Let’s start the conversatioN. If you're interested in buying or selling real estate in or around Temecula California connect with us easily through our digital business card! Stay updated and get in touch anytime — CLICK HERE to access our contact information and professional profile.

Thank you,

Scott and Caroline Doan Realtors®

(951) 541-3498

Realty Executives

28581 Old Town Front St. #100

Temecula, Ca. 92591

DRE#02248461