Your Team Real Estate

Realty Executives Integrity

If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing.

While home prices are still appreciating in most areas, they’re climbing at a slower pace because higher mortgage rates are putting a squeeze on buyer demand. At the same time, the supply of homes for sale is growing. That means buyers have more options and your house may not stand out as much, if it’s not priced right.

Those two factors combined are why the asking price you set for your house is more important today than it has been in recent years.

And some sellers are finding that out the hard way. That’s leading to more price reductions. Mike Simonsen, Founder and President of ALTOS Research, explains:

“Looking at the price reductions data set . . . It all fits in the same pattern of increasing supply and homebuyer demand that is just exhausted by high mortgage rates. . . As home sellers are faced with less demand than they expected, more of them have to reduce their prices.”

That’s because they haven’t adjusted their expectations to today’s market. Maybe they’re not working with an agent, so they don’t know what’s happening around them. Or they’re not using an agent who prioritizes being a local market expert. Either way, they aren’t basing their pricing decision on the latest data available – and that’s a miss.

If you want to avoid making a pricing mistake that could turn away buyers and delay your sale, you need to work with an agent who really knows your local market. If you lean on the right agent, they’ll help you avoid making mistakes like:

In the end, accurate pricing depends on current market conditions – and only an agent has all the data and information necessary to find the right price for your house. The right agent will use that expertise to develop a pricing strategy that’s based on current market conditions and designed to get your house sold. That way you don’t miss the mark.

The right asking price is even more important today than it’s been over the last few years. To avoid making a costly mistake, let’s work together.

Chances are you’re hearing a lot about mortgage rates right now. You may even see some headlines talking about last week’s Federal Reserve (the Fed) meeting and what it means for rates. But the Fed doesn’t determine mortgage rates, even if the headlines make it sound like they do.

The truth is, mortgage rates are impacted by a lot of factors: geo-political uncertainty, inflation and the economy, and more. And trying to pin down when all those factors will line up enough for rates to come down is tricky.

That’s why it’s generally not worth it to try to time the market. There’s too much at play that you can’t control. The best thing you can do is control the controllables.

And when it comes to rates, here’s what you can influence to make your moving plans a reality.

Credit scores can play a big role in your mortgage rate. As an article from CNET explains:

“You can’t control the economic factors influencing interest rates. But you can get the best rate for your situation, and improving your credit score is the right place to start.Lenders look at your credit score to decide whether to approve you for a loan and at what interest rate. A higher credit score can help you secure a lower interest rate, maybe even better than the average.”

That’s why it’s even more important to maintain a good credit score right now. With rates where they are, you want to do what you can to get the best rate possible. If you want to focus on improving your score, your trusted loan officer can give you expert advice to help.

There are many types of loans, each offering different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose.”

When working with your team of real estate professionals, make sure you find out what’s available for your situation and which types of loans you may qualify for.

Another factor to consider is the term of your loan. Just like with loan types, you have options. Freddie Mac says:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Depending on your situation, the length of your loan can also change your mortgage rate.

Remember, you can’t control what happens in the broader economy. But you can control the controllables.

Work with a trusted lender to go over the things you can do that’ll make a difference. By being strategic with these factors, you may be able to combat today’s higher rates and lock in the lowest one you can.

Summer is a beautiful season to enjoy long days, warm weather, and outdoor activities. However, it is also an ideal time to tackle some essential home maintenance tasks. Proper summer home maintenance enhances your home’s appearance and ensures everything runs smoothly and efficiently. Here are seven summer home maintenance tips to keep your home in shape.

Nothing beats the relief of a cool home on a hot summer day. Schedule a professional HVAC inspection to ensure the air conditioning system in your home is prepared to handle the heat. Regular maintenance can prevent unexpected breakdowns and improve energy efficiency. Clean or replace air filters, check for refrigerant leaks, and ensure the thermostat works correctly.

Summer storms can bring heavy rain, wreaking havoc on your gutters. Clean out any debris, leaves, or twigs that may have accumulated during the spring. Inspect for any signs of sagging or damage and make the necessary repairs. Well-functioning gutters prevent water damage to your roof, siding, and foundation.

Windows and doors are vital areas where energy loss can occur. Check for any drafts and apply weather-stripping or caulk to seal gaps. Clean the windows inside and out to allow enough natural light and improve your home’s overall appearance. If any screens are damaged, replace them to keep bugs out while enjoying the summer breeze.

The exterior of your home faces a lot of wear and tear from the weather changes. Inspect your home’s exterior paint for any peeling or chipping. Freshly painted siding is protected from moisture and sun damage while boosting curb appeal. Select a good-quality paint that can withstand the summer heat and humidity.

Your roof is your home’s first line of defense against the elements. Summer is a great time to inspect it for possible signs of damage, such as leaks, missing shingles, or cracks. Attending to these issues early can prevent eventual costly repairs. If necessary, hire a professional roofer to inspect thoroughly and repair.

Outdoor spaces like decks and patios are perfect for summer gatherings. To keep them looking their best, clean and seal your deck to protect it from the sun and rain. Remove any dirt, mold, or mildew, and check for loose boards or nails. Power wash the surface of patios and inspect for any cracks or damage. Consider applying a sealant to protect against future wear and tear.

A well-maintained garden and landscape can enhance the beauty of your home and provide a relaxing outdoor environment. Trim overgrown bushes, trees, and shrubs to prevent them from encroaching on your home.

Mow the lawn regularly, water plants early in the morning or late evening to minimize evaporation, and add mulch to retain moisture and suppress weeds. Also, consider installing a drip irrigation system to conserve water and ensure your plants get the hydration they need.

Summer can bring extreme weather conditions, including storms and hurricanes in some areas. Ensure your home is prepared with an emergency kit including essentials like water, non-perishable food, flashlights, batteries, and a first-aid kit. Create a family emergency plan and make sure everyone knows the steps to take in case of a disaster.

Taking the time to perform these summer maintenance tasks can save you money, prevent costly repairs, and enhance the comfort and safety of your home. Enjoy a worry-free summer by keeping your home in top condition and ready to handle whatever the season brings.

June is a busy month in the housing market because a lot of people buy and sell this time of year. So, if you’ve got a move on your mind and you’re looking to make it happen this month, here’s a snapshot of what you need to know to make sure you’re ready.

A lot of homebuyers with children like to move after one school year ends and before the next one begins. That’s one reason why late spring into summer is a popular time for homes to change hands. And whether that’s a motivator for you or not, it’s important to realize more buyers are going to be looking right now – and that means you’ll want to be ready for a bit more competition. But there is a silver lining to a move this time of year. This is also when more sellers will list – so you should find you have more options. As an article from Bankrate says:

“Late spring and early summer are the busiest and most competitive time of year for the real estate market. There’s usually more inventory listed for sale than other times of year . . . This is a double-edged sword for a buyer, as you will be met with more opportunities but [also] much more competition.”

During this busy season, it’s extra important to work with a trusted real estate agent. Your agent will help you stay on top of the latest listings, share expertise on how to make a strong offer in a competitive market, and give you insight into things like what the home is actually worth so you can make an informed decision when you buy. As Forbes says:

“Approaching the market confidently, armed with good information and grounded expectations will take you far. Don't let the hustle of the market convince you to buy something that’s not in your budget, or not right for your lifestyle.”

Because there are more buyers this time of year, you’re in a great spot as a seller. Many of those buyers are highly motivated to make their move happen before the next school year kicks off – so they’ll likely put in strong offers to try to make that possible. That means, if your house shows well and is listed at market value, you could see your house sell faster or for a higher price. According to the National Association of Realtors (NAR):

“Warmer weather and the end of the school year encourage more people to buy and sell, respectively. Buyers are looking to move and settle before the new school year begins, contributing to increased competition and, consequently, higher prices.”

You want to be sure you’ve got a great agent on your side to help you with the contingencies on those offers and any negotiations that take place so you can pick the best offer. Make sure you go over closing dates with your agent. Buyers trying to time their move with the school year may need to delay a bit or move faster. This can depend on the school calendar where you live. As U.S. News Real Estate explains:

“ . . if your house goes under contract in early summer, the buyer may ask for a delay in closing or move-in until the school year finishes or their current home has sold. Alternatively, a buyer later in summer may be looking to close quickly and move in under a month. Remain flexible to keep the deal running smoothly, and your buyer may be willing to throw in concessions, like covering some of your closing costs or overlooking the old roof.”

If you’re looking to make a move this June, let’s chat so you know what to expect. We’ll come up with a plan that factors in current market conditions, but still works for you.

There’s no denying mortgage rates are having a big impact on today’s housing market. And that may leave you with some questions about whether it still makes sense to sell your house and make a move.

Here are three of the top questions you may be asking – and the data that helps answer them.

If you’re thinking about waiting to sell until after mortgage rates come down, here’s what you need to know. So are a ton of other people.

And while mortgage rates are still forecasted to come down later this year, if you wait for that to happen, you may be dealing with a lot more competition as other buyers and sellers jump back in too. As Bright MLS says:

“Even a modest drop in rates will bring both more buyers and more sellers into the market.”

That means if you wait it out, you’ll have to deal with things like prices rising faster and more multiple-offer scenarios when you buy your next home.

But that doesn’t mean no one is moving right now. While some people are holding off, there are still plenty of buyers active today. And here’s the data to prove it.

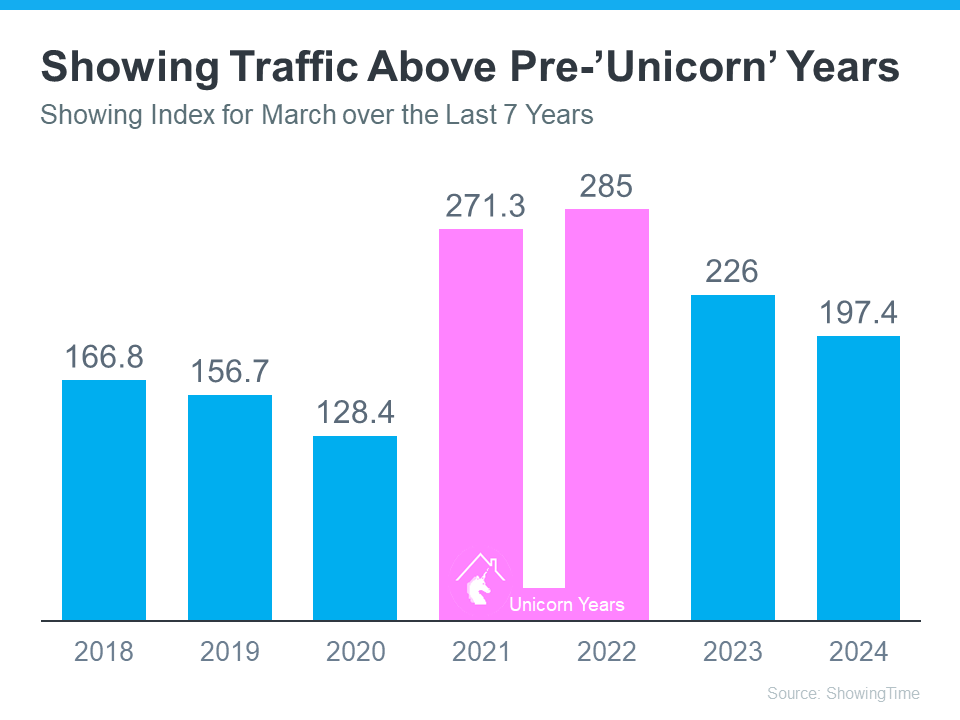

The ShowingTime Showing Index is a measure of how frequently buyers are touring homes. The graph below uses that index to show buyer activity for March (the latest data available) over the past seven years:

You can see demand has dipped some since the ‘unicorn’ years (shown in pink). That’s in response to a lot of market factors, like higher mortgage rates, rising prices, and limited inventory. But, to really understand today’s demand, you have to compare where we are now with the last normal years in the market (2018-2019) – not the abnormal ‘unicorn’ years.

When you focus on just the blue bars, you can get an idea of how 2024 stacks up. And that gives you a whole new perspective.

Nationally, demand is still high compared to the last normal years in the housing market (2018-2019). And that means there’s still a market for your house to sell.

And if you’re worried about how you’ll afford your next move with today’s rates and prices, consider this: you probably have more equity in your current home than you realize.

Homeowners have gained record amounts of equity over the past few years. And that equity can make a big difference when you buy your next home. You may even have enough to be an all-cash buyer and avoid taking out a mortgage altogether. As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“ . . . those who have earned housing equity through home price appreciation are the current winners in today's housing market. One-third of recent home buyers did not finance their home purchase last month—the highest share in a decade. For these buyers, interest rates may be less influential in their purchase decisions.”

If you’ve had these three questions on your mind and they’ve been holding you back from selling, hopefully, it helps to have this information now. A recent survey from Realtor.comshows more than 85% of potential sellers have been considering selling for over a year. That means there are a number of sellers like you who are on the fence.

But that same survey also talked to sellers who recently decided to take the plunge and list. And 79% of those recent sellers wish they’d sold sooner.

If you want to talk more about any of these questions or need more information, let’s connect.