When you’re selling any item, you usually want to sell it for the greatest profit possible. That happens when there’s a strong demand and a limited supply for that item. In the real estate market, that time is right now. If you’re thinking of selling your house this year, here are two reasons why now’s the time to list.

1. Demand Is Very Strong This Winter

A recent article in Inman News explains:

“Spring, the hottest time of year for homebuyers and sellers, has started early, according to economists. . . . ‘Home shopping season appears to already be in full swing!’”

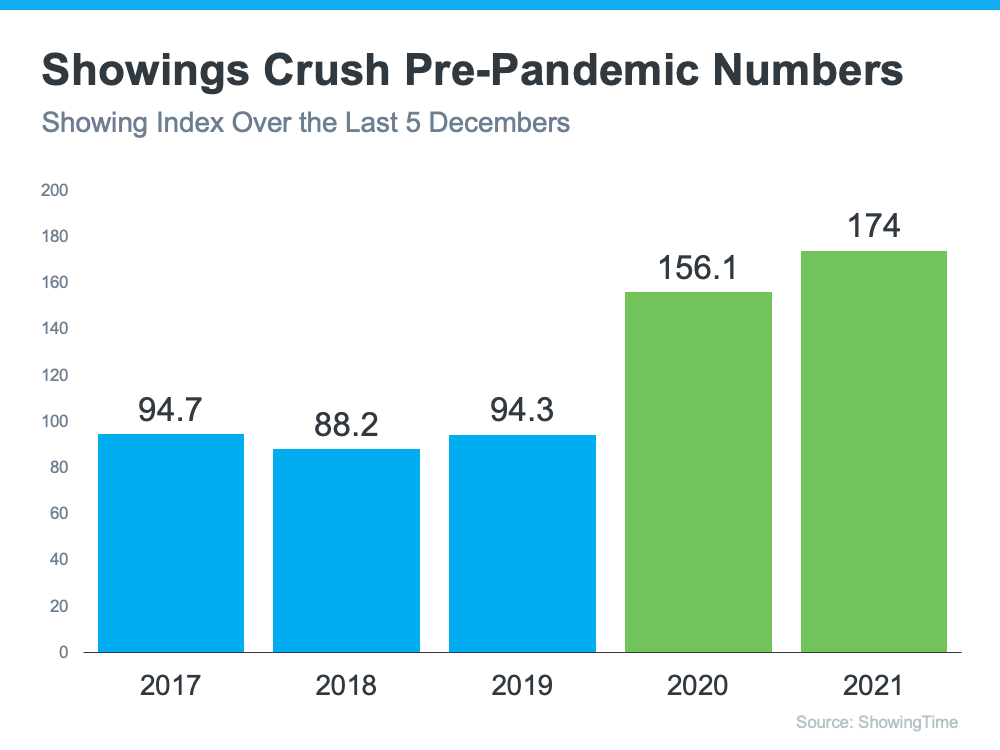

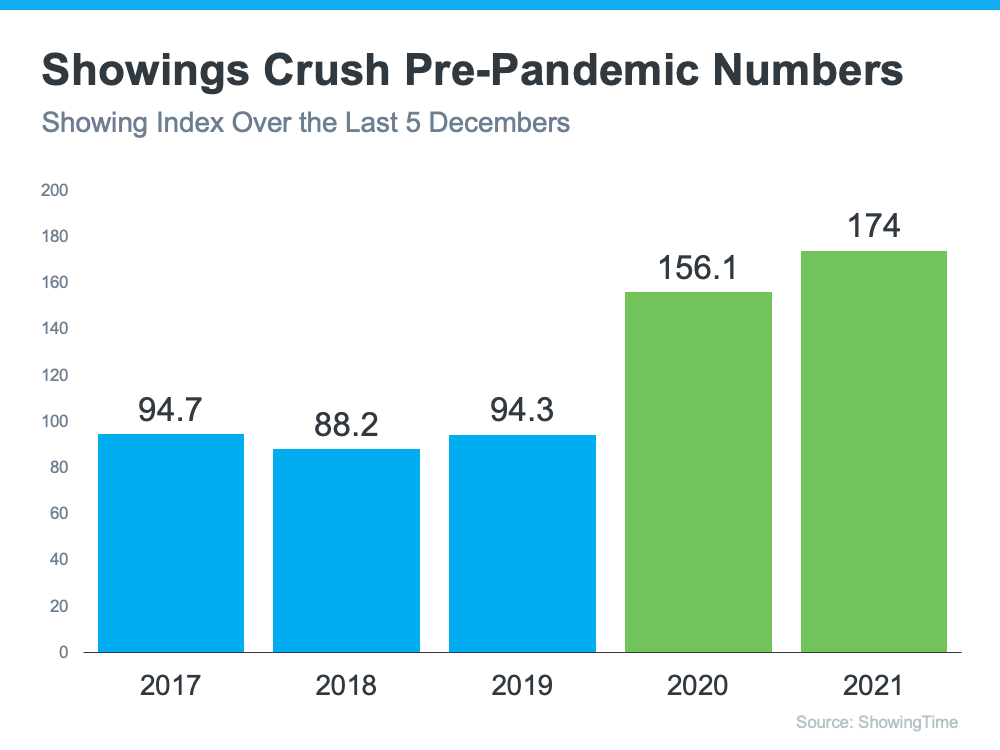

And they aren’t the only ones saying buyers are already out in full force. That claim is backed up with data released last week by ShowingTime. The ShowingTime Showing Index tracks the average number of monthly buyer showings on active residential properties, which is a highly reliable leading indicator of current and future trends for buyer demand. The latest index reveals this December was the most active December in five years (see graph below):

As the data indicates, buyers are very active this winter. Last December saw even more showings than December of 2020, which was already a stronger-than-usual winter. And remember – you want to sell something when there’s a strong demand for that item. That time is now.

2. Housing Supply Is Extremely Low

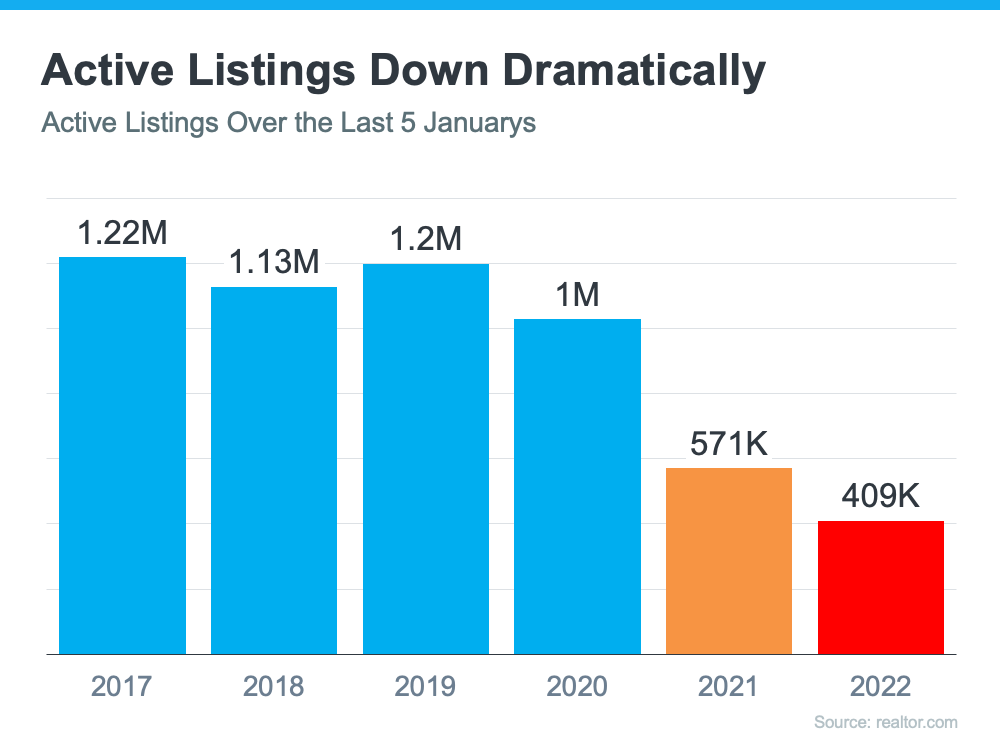

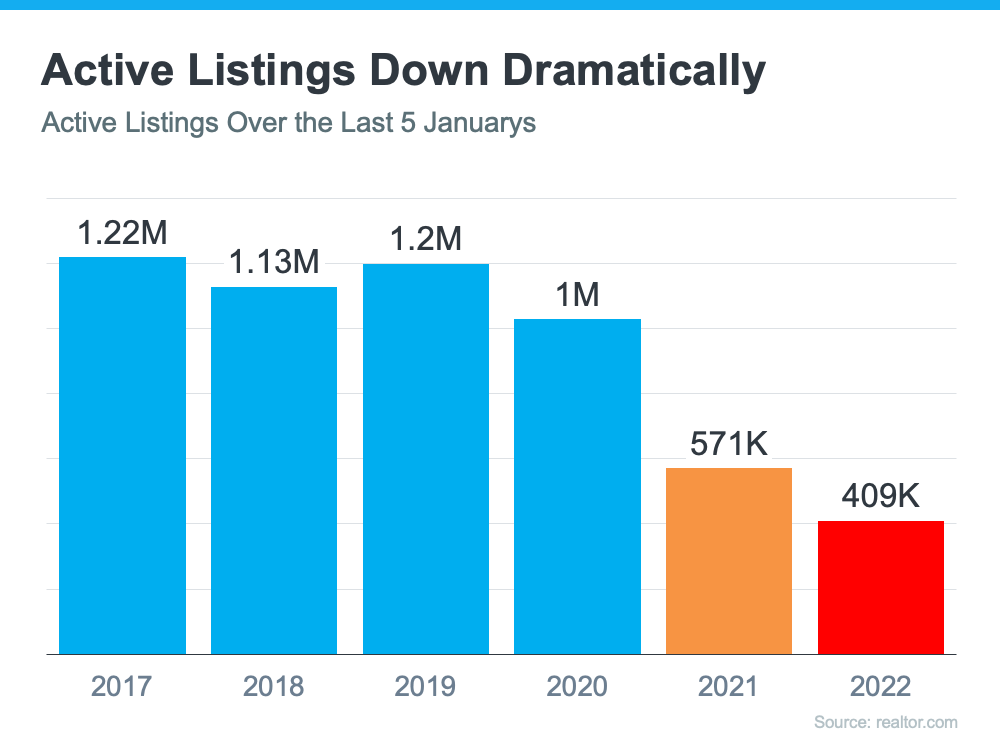

Each month, realtor.com releases data on the number of active residential real estate listings (listings currently for sale). Their most recent report reveals the latest monthly number is the lowest we’ve seen in any January since 2017 (see graph below):

And don’t forget, the best time to sell an item is when there’s a limited supply of it available. This graph clearly shows how extremely low housing supply is today.

Even Though Supply Is at a Historic Low, Home Sales Are at a 15-Year High

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), existing-home sales totaled 6.12 million in 2021 – the highest annual level since 2006. This means the market is hot and homeowners are in a great place to sell now while sales are so strong.

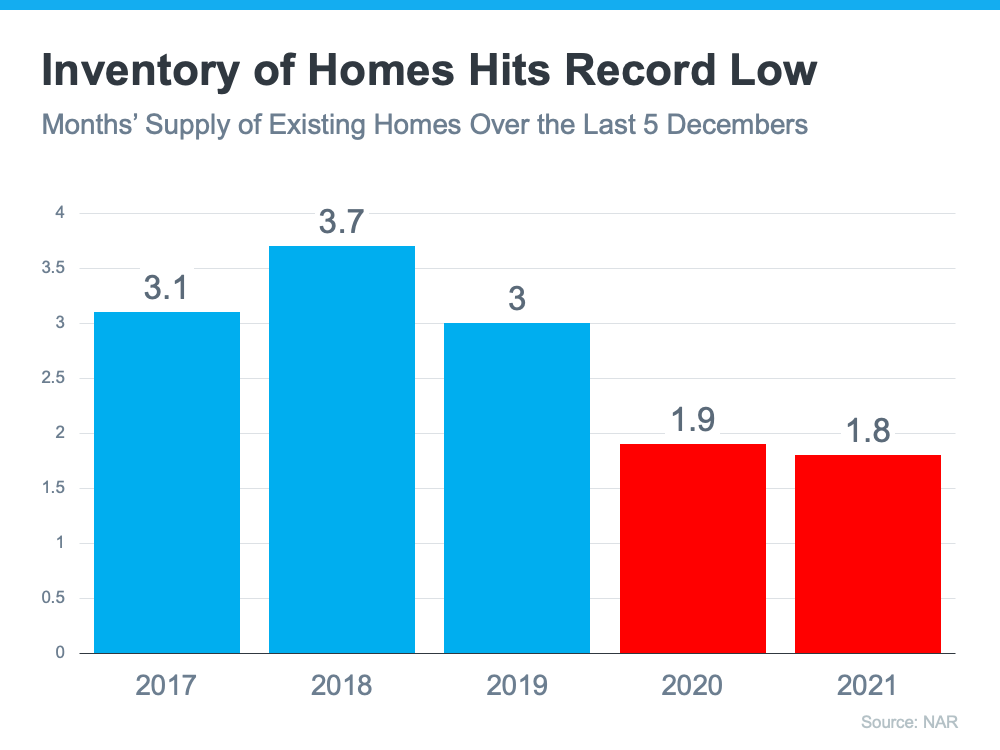

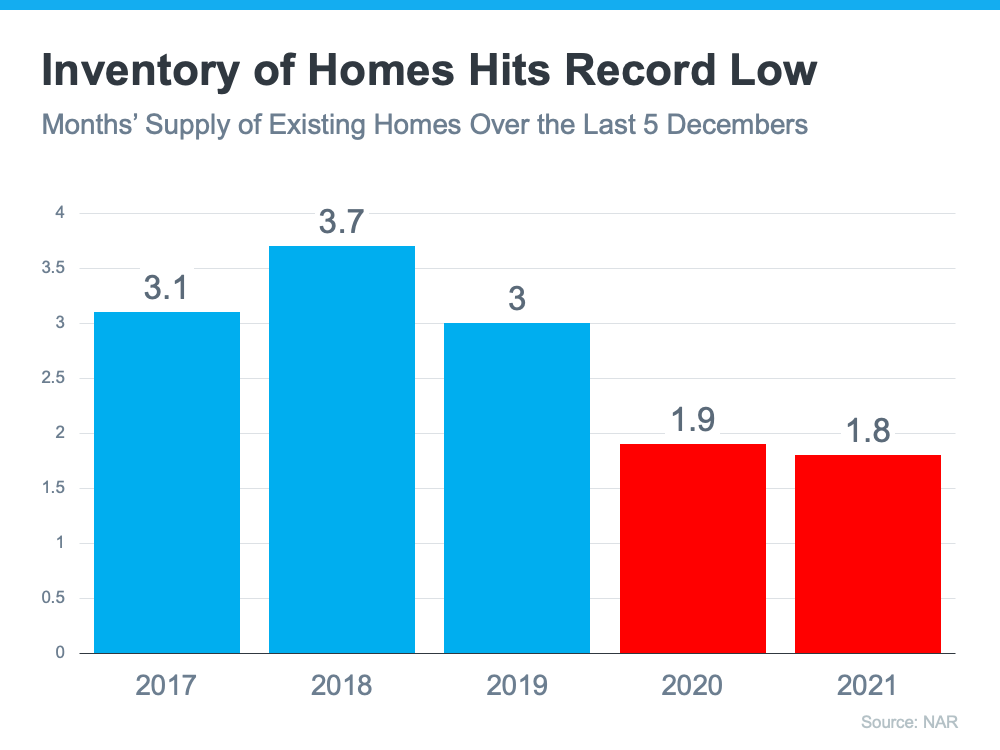

NAR also reports available listings by calculating the current months’ supply of inventory. They explain:

“Months’ supply refers to the number of months it would take for the current inventory of homes on the market to sell given the current sales pace.”

The current 1.8-months’ supply is the lowest ever reported. Here are the December numbers over the last five years (see graph below):

The ratio of buyers to sellers favors homeowners right now to a greater degree than at any other time in history. Buyer demand is high, and supply is low. That gives sellers like you an incredible opportunity.

Bottom Line

If you agree the best time to sell anything is when demand is high and supply is low, let’s connect to begin discussing the process of listing your house today.

![How To Win as a Buyer in a Sellers’ Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/02/10091346/20220211-MEM-1046x2408.png)