It can be tempting, especially with how hot the housing market has been over the past two years, to consider selling your home on your own. But today’s market is at a turning point, making it more essential than ever to work with a real estate professional.

Not only will a trusted real estate advisor keep you updated and help you make the best decisions based on current market trends, but they’re also experts in managing the many aspects of selling your house.

Here are five key reasons why working with a real estate professional makes sense today.

1. A Professional Follows the Latest Market Trends

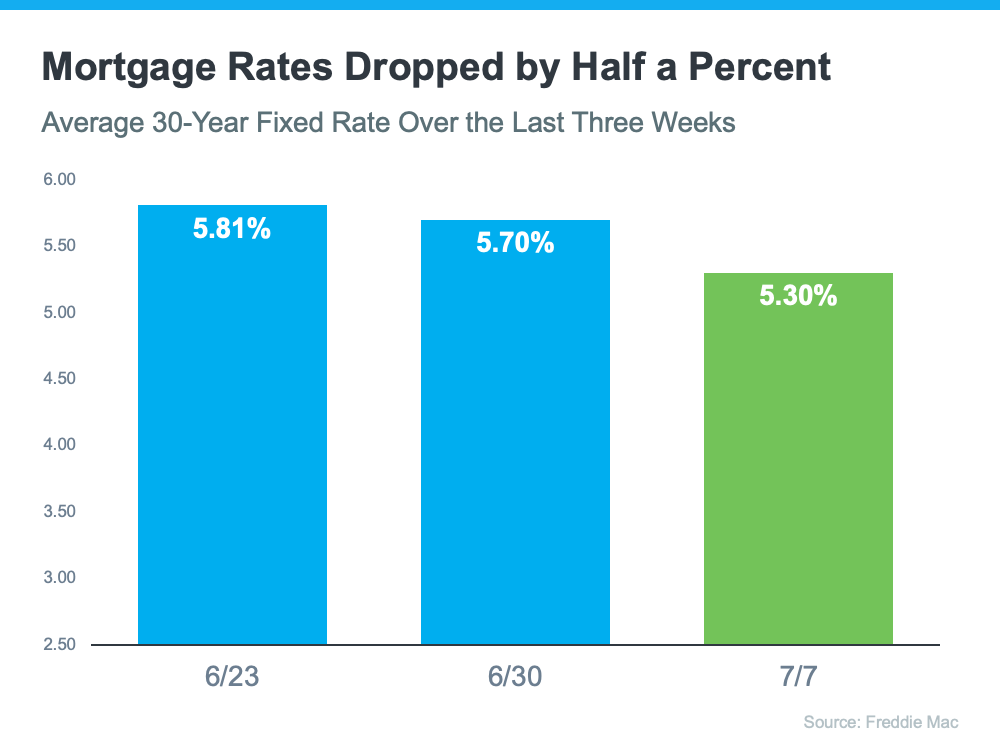

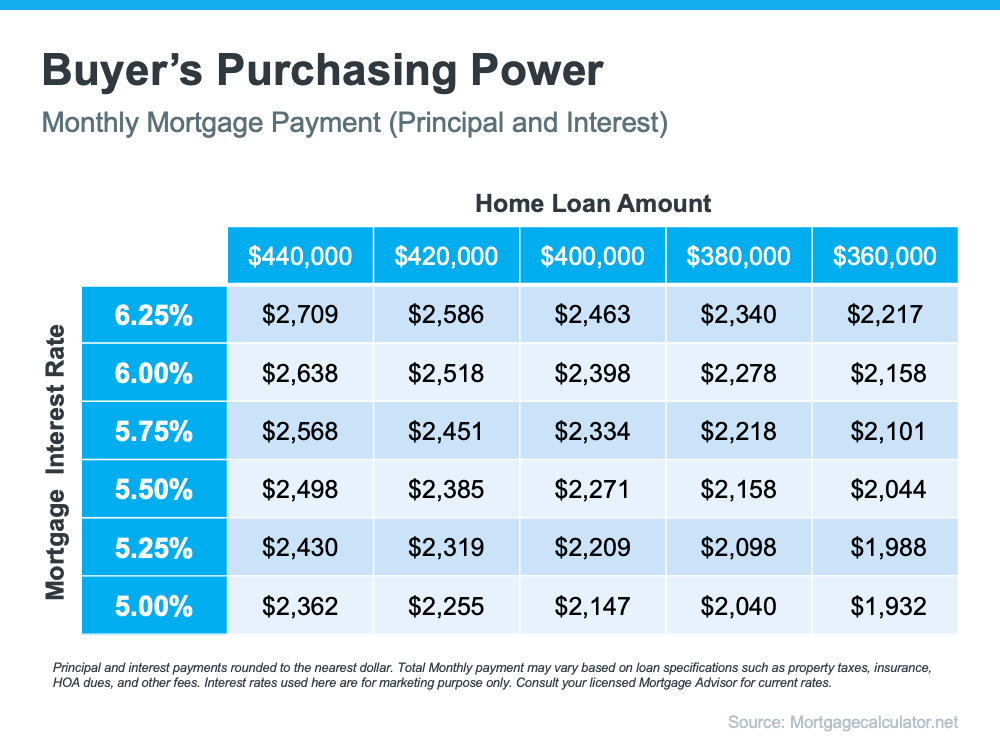

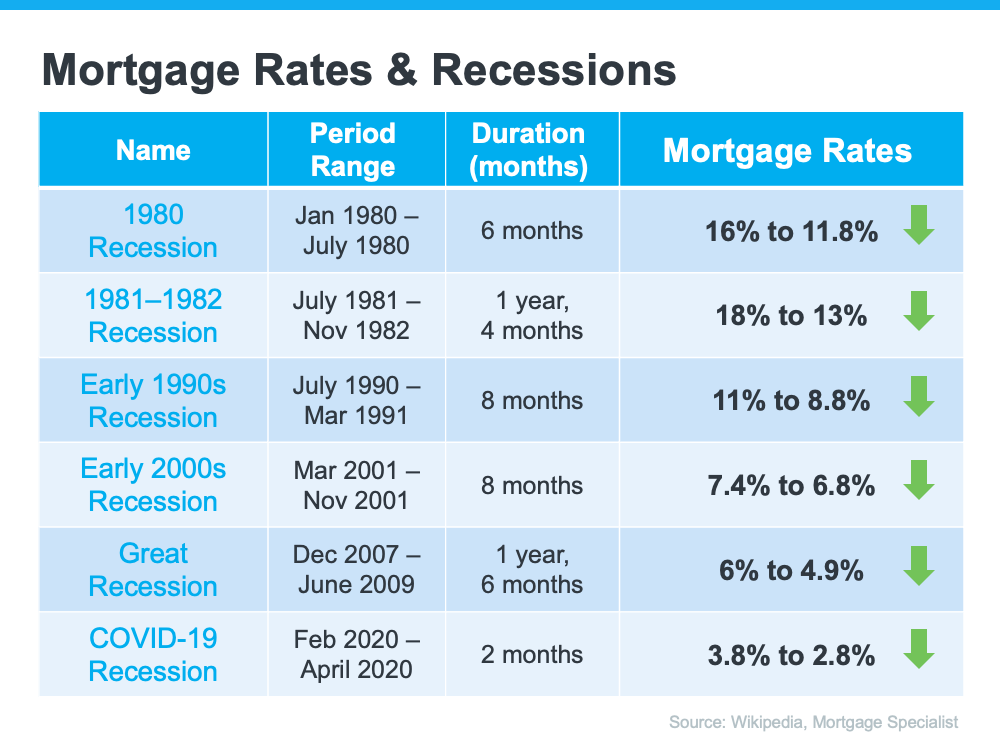

With higher mortgage rates, rising home prices, and a growing number of homes for sale, today’s housing market is showing signs of a shift back toward more pre-pandemic levels. When conditions change, following the trends and staying on top of new information is crucial when you sell.

That makes working with an expert real estate advisor critical today. They know your local area and follow national trends too. More importantly, they’ll know what this data means for you, and as the market shifts, they’ll be able to help you navigate it and make your best decision.

2. A Professional Helps Maximize Your Pool of Buyers

Your agent’s role in bringing in buyers is important. Real estate professionals have a large variety of tools at their disposal, such as social media followers, agency resources, and the Multiple Listing Service (MLS) to ensure your house is viewed by the most buyers. Investopedia explains why it’s risky to sell on your own without the network an agent provides:

“You don’t have relationships with clients, other agents, or a real estate agency to bring the largest pool of potential buyers to your home. A smaller pool of potential buyers means less demand for your property, which can translate into waiting longer to sell your home and possibly not getting as much money as your house is worth.”

3. A Professional Understands the Fine Print

Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. The National Association of Realtors (NAR) explains it best, saying:

“Selling a home typically requires a variety of forms, reports, disclosures, and other legal and financial documents. . . . Also, there’s a lot of jargon involved in a real estate transaction; you want to work with a professional who can speak the language.”

A real estate professional knows exactly what needs to happen, what all the paperwork means, and how to work through it efficiently. They’ll help you review the documents and avoid any costly missteps that could occur if you try to handle them on your own.

4. A Professional Is a Trained Negotiator

If you sell without a professional, you’ll also be solely responsible for all the negotiations. That means you’ll have to coordinate with:

- The buyer, who wants the best deal possible

- The buyer’s agent, who will use their expertise to advocate for the buyer

- The inspection company, which works for the buyer and will almost always find concerns with the house

- The appraiser, who assesses the property’s value to protect the lender

Instead of going toe-to-toe with all these parties alone, lean on an expert. They’ll know what levers to pull, how to address everyone’s concerns, and when you may want to get a second opinion.

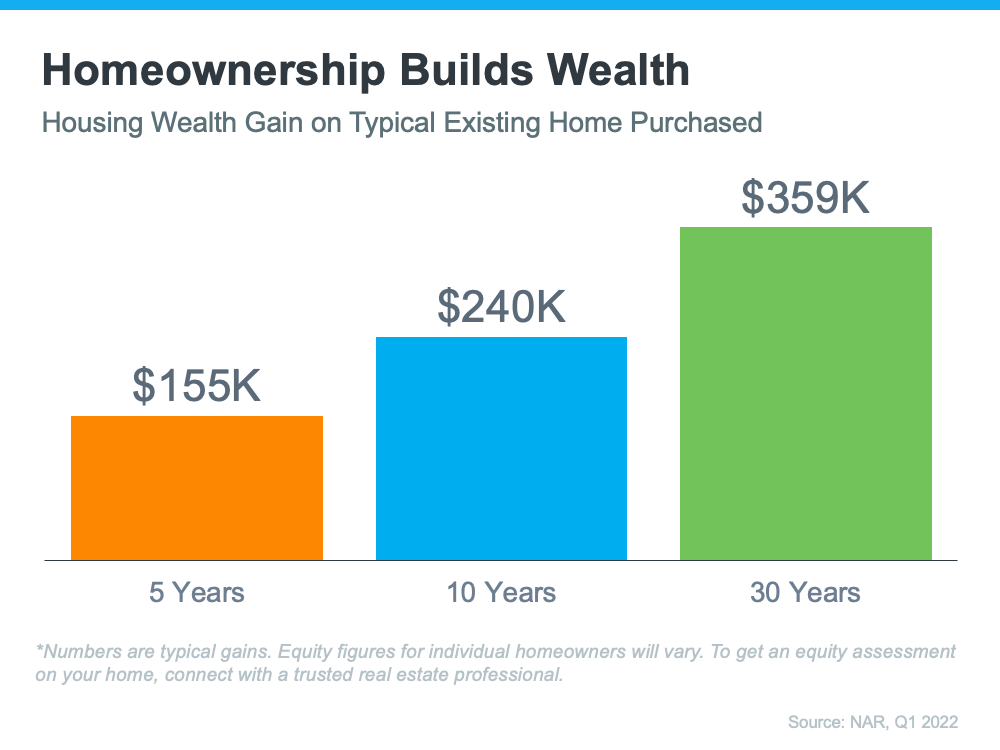

5. A Professional Knows How To Set the Right Price for Your House

If you sell your house on your own, you may over or undershoot your asking price. That could mean you’ll leave money on the table because you priced it too low or your house will sit on the market because you priced it too high. Pricing a house requires expertise. NAR explains it like this:

“A great real estate agent will look at your home with an unbiased eye, providing you with the information you need to enhance marketability and maximize price.”

Real estate professionals know the ins and outs of how to price your house accurately and competitively. To do so, they compare your house to recently sold homes in your area and factor in the current condition of your home. These steps are key to making sure it’s set to move quickly while still getting you the highest possible final sale price.

Bottom Line

Whether it’s following local and national trends and guiding you through a shifting market or pricing your house right, a real estate agent has essential insights you'll want to rely on throughout the transaction. Don’t go at it alone. If you plan to sell, let’s connect so you have an expert on your side.