So it's time to move out and you need to figure out how much rent you can afford to rent an apartment.

The best answer for this question is as little as possible. Why? Well, if you are renting, the money you spend on rent is basically gone! Poof! But renting has its advantages as well. For example, if you are not sure how long you will be living in a certain area, renting gives you flexibility to move easier, as long as you don't have too long of a lease. Also, if you rent, you don't have to worry about expensive home repairs, taxes, etc.

When deciding how much you can afford for rent, there is quick calculation you can use called the 30% rule.

The 30% rule is a commonly recommended guideline for determining how much of your income you should allocate towards housing expenses, specifically rent. According to this rule, your monthly rent payment should not exceed 30% of your gross monthly income.

The 30% rule is based on the idea that allocating a reasonable portion of your income towards housing allows you to have enough funds for other essential expenses, savings, and discretionary spending. By adhering to this guideline, you aim to maintain a balanced budget and prevent housing costs from overwhelming your overall financial situation.

However, in some situations, such as in areas with high housing costs or if you have other financial considerations, you may need to adjust the percentage. In such cases, the 40% rule is sometimes used as an alternative guideline. Under the 40% rule, your monthly rent payment would not exceed 40% of your gross monthly income.

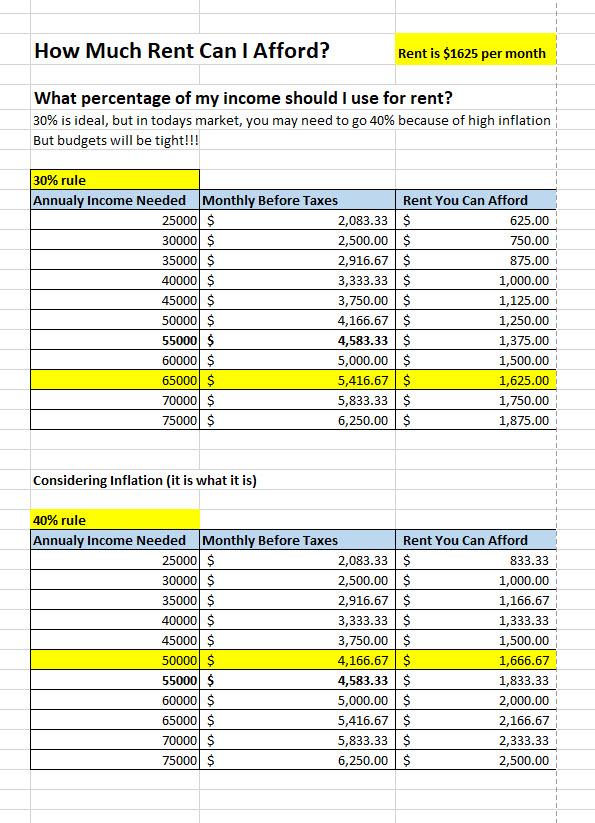

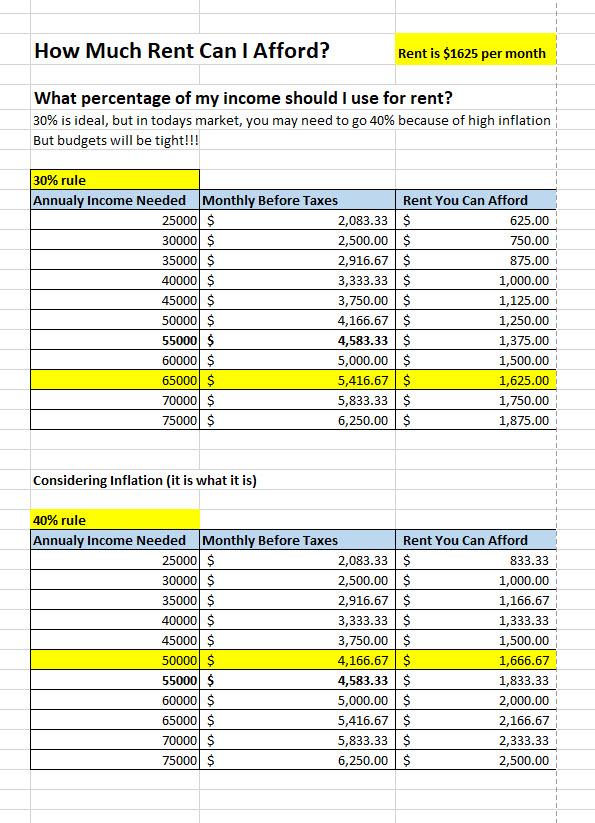

Here is a spreadsheet demonstrating what you might be able to afford based on rent of $1625 per month using both the 30% rule, and I added a so called 40% rule for people who want nicer living space and less money to live!

It's important to note that these rules are not absolute, and individual circumstances and financial goals should be taken into account. Some factors to consider when deciding on your rent affordability include:

- Other Financial Obligations: If you have significant debt payments, such as student loans or credit card debt, or if you have high monthly expenses in other areas, you may need to allocate a smaller portion of your income to rent.

- Savings and Financial Goals: If you have specific savings goals, such as building an emergency fund, saving for a down payment on a home, or investing for the future, you may want to allocate more of your income towards savings and reduce your rent percentage accordingly.

- Consider your spending habits and lifestyle choices. If you have higher discretionary expenses or prefer to spend more on experiences and leisure activities, you might need to adjust your rent percentage to accommodate those preferences.

- Lifestyle and Discretionary Spending: Consider your spending habits and lifestyle choices. If you have higher discretionary expenses or prefer to spend more on experiences and leisure activities, you might need to adjust your rent percentage to accommodate those preferences.

Remember, these guidelines are intended to provide a starting point for assessing rent affordability, but individual circumstances vary. It's crucial to evaluate your unique financial situation, consider your short-term and long-term goals, and ensure that you can comfortably cover all your expenses while maintaining financial stability.