When you sell a house, the last thing you want is for the deal to fall apart right before closing. But according to the latest data from Redfin, that’s happening a bit more often lately. The good news is, it’s completely avoidable if you lean on an agent for insight into why that is and how to avoid it happening to you.

This June, 15% of pending home sales fell through. That means those buyers backed out of their contracts. That’s not too much higher than the norm of roughly 12% from 2017-2019, but it’s still an increase. And it’s one you don’t want to have to deal with.

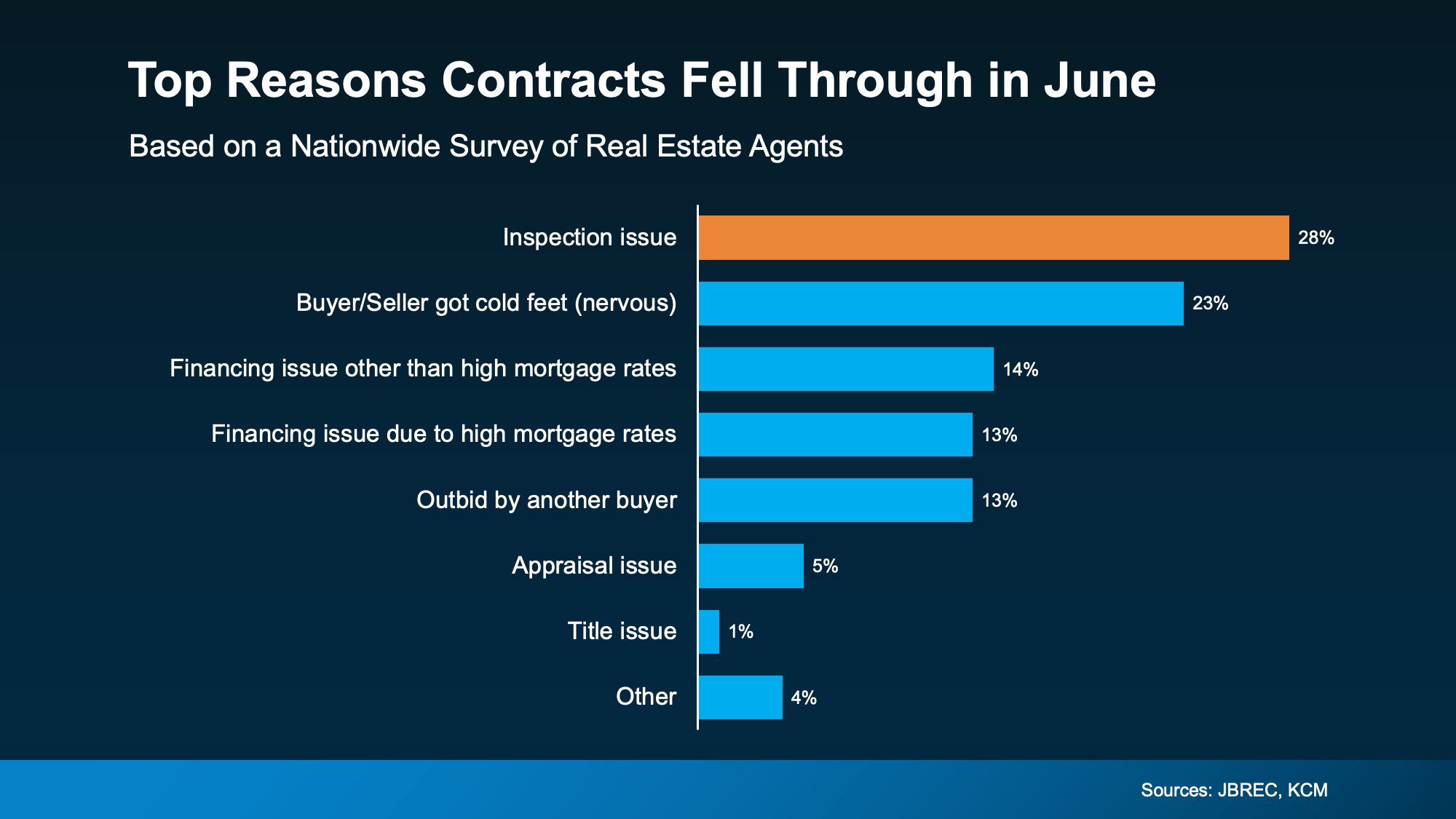

The key to avoiding this headache is knowing what’s causing the issues that lead to a buyer walking away. A recent survey from John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM) finds that agents reported the #1 reason deals are falling apart today is stemming from the home inspection (see graph below):

Here’s why. With high prices and mortgage rates stretching buyers’ budgets, they don’t have a lot of room (or appetite) for unexpected repairs.

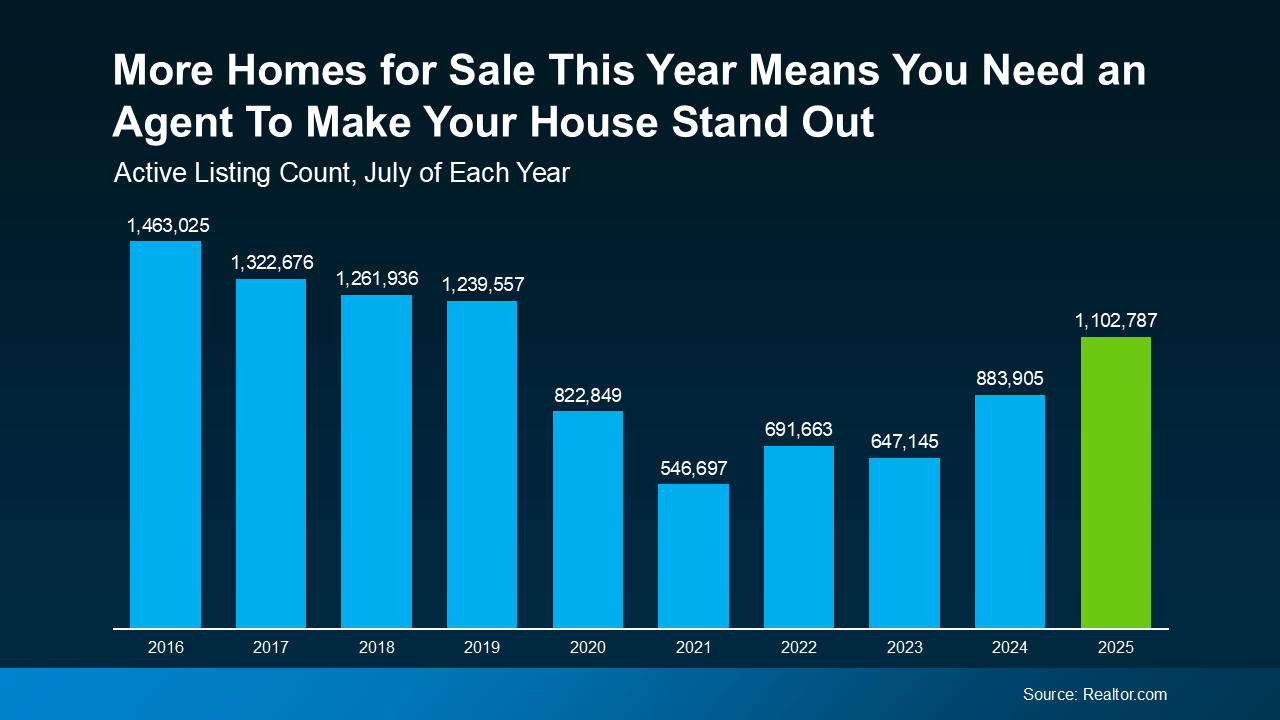

Not to mention, buyers have more options to choose from now that there are more homes on the market. So, if the inspection turns up a major issue, they may opt to walk away. Afterall, there are plenty of other homes they could buy instead.

Or, if the seller isn’t willing to tackle repairs, a buyer may back out because they don’t want the expense (and the hassle) of dealing with those issues themselves.

The good news is, there’s a way you can get ahead of any unpleasant surprises as a seller, and that’s getting a pre-listing inspection. It’s not required, but the National Association of Realtors (NAR) explains why it’s helpful right now:

“To keep deals from unraveling . . . it allows a seller the opportunity to address any repairs before the For Sale sign even goes up. It also can help avoid surprises like a costly plumbing problem, a failing roof or an outdated electrical panel that could cause financially stretched buyers to bolt before closing.”

What’s a Pre-Listing Inspection?

It's exactly what it sounds like: a professional home inspection you schedule before your home hits the market. Here’s what it can do for you:

- Give you time to fix what matters. You’ll know what issues could come up in the buyer’s inspection. So, you’ll have time to take care of them before anyone even walks through the door.

- Avoid last-minute renegotiations. When buyers uncover unexpected issues after you’re under contract, it opens the door for concessions you may have to make like price drops or repairs, or worse, a canceled deal. A pre-listing inspection helps you stay ahead of those things before they become deal breakers.

- Show buyers you’re serious. When your home is clean, well-maintained, and already vetted, buyers see that. It builds trust and can help you sell faster with fewer back-and-forth negotiations.

The bottom line? A few hundred dollars upfront can save you thousands later.

Should Every Seller Do This?

Not necessarily. Your real estate agent can help you decide what makes the most sense for your situation, your house, and your market. If you decide to move forward with a pre-listing inspection, your agent will guide you every step of the way. They’ll:

- Advise on whether to fix or disclose each issue

- Help you prioritize repairs based on what buyers in your area care about

- Make sure you understand your local disclosure laws