Ron Kurtz

Executive

Realty Executives Premiere

Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and leading some buyers to consider waiving those contingencies to stand out in the crowded market.

But is that the best move? Buying a home is one of the most important transactions in your lifetime, and it’s critical to keep your best interests in mind. Here’s a breakdown of what to expect from the appraisal and the inspection, and why each one can potentially save you a lot of time, money, and headaches down the road.

The home appraisal is a critical step for securing a mortgage on your home. As Home Light explains:

“. . . lenders typically require an appraisal to ensure that your loan-to-value ratio falls within their underwriting guidelines. Mortgages are secured loans where the lender uses your home as collateral in case you default on the agreed-upon payments.”

Put simply: when you apply for a mortgage, an unbiased appraisal – typically required by your lender – is the best way to verify the value of the home. That appraisal ensures the lender doesn’t loan you more than what the home is worth.

When buyers are competing like they are today, bidding wars and market conditions can push prices up. A buyer’s contract price may end up higher than the value of the home – this is known as an appraisal gap. In today’s market, it’s common for the seller to ask the buyer to make up the difference when an appraisal gap occurs. That means, as a buyer, you may need to be prepared to bring extra money to the table if you really want the home.

Like the appraisal, the inspection is important because it gives an impartial evaluation of the home. While the appraisal determines the current value of the home, the inspection determines the current condition of the home. As the American Society of Home Inspectors puts it:

“Home inspections are the opportunity to discover major defects that were not apparent at a buyer’s showing. . . . Your home inspection is to help you make an informed decision about the house, including its condition.”

If there are any concerns during the inspection – an aging roof, a malfunctioning HVAC system, or any other questionable items – you have the option to discuss and negotiate any potential issues with the seller. Your real estate advisor can help you navigate this process and negotiate what, if any, repairs need to be made before the sale is finalized.

Keep in mind – home inspections are critical because they can shed light on challenges you may face as the new homeowner. Without an inspection, serious, sometimes costly issues could come as a surprise later on.

Both the appraisal and the inspection are important steps in the homebuying process. They protect your best interests as a buyer by providing unbiased information about the home’s value and condition. Let’s connect so you have an expert guiding you throughout the entire process.

A recent survey from LendingTree.com found there are multiple reasons why Americans would choose to purchase a home instead of renting. Some of the most popular non-financial reasons given include:

In the same survey, 41% of respondents say they’d rather own a home than rent because of the unique way homeownership builds wealth over time.

And experts agree – the home you own is an important tool for building your net worth. Here’s what many of those experts have to say about building long-term financial stability through homeownership.

According to the National Association of Realtors (NAR):

“Homeowners who purchased a typical single-family existing-home 30 years ago at the median sales price of $103,333 with a 10% down payment loan and who sold the property at the median sales price of $357,700 in 2021 Q2 accumulated housing wealth of $349,258, . . .”

Mark Fleming, Chief Economist at First American, points out that a home is truly a one-of-a-kind asset. It’s the only asset that’s both an investment and a place for you to call your own.

“The major financial advantage of homeownership is the accumulation of equity in the form of house price appreciation. . . . We won’t always have 17% house price appreciation, but we have to take into account the fact that the shelter that you're owning is an equity-generating or wealth-generating asset.”

Homeowners can leverage the wealth they generate in several ways throughout their life. Tapping into accumulated equity has long been used to pay for the cost of an education, to start a business, or to fund various other expenses. The Joint Center of Housing Studies at Harvard points out:

“. . . by paying down mortgage principal each month and participating in the long-term appreciation of home values, a family can build wealth that can be used for retirement or other needs, including helping the next generation.”

With home prices expected to continue to appreciate in coming years, homebuyers have an opportunity to start the long-term wealth-building process right now. Let’s connect today if you’re ready to begin your journey on the path to becoming a homeowner.

![Reasons Renters Buy [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/10/30142601/20211001-MEMa-1046x1991.png)

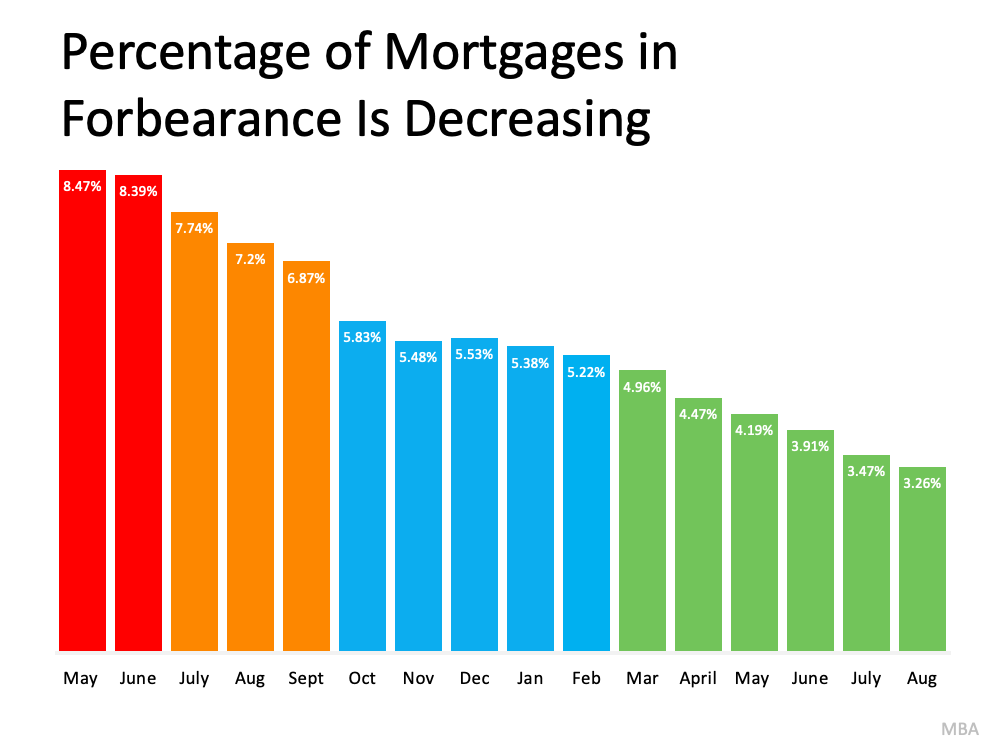

Even though experts agree there’s no chance of a large-scale foreclosure crisis, there are a number of homeowners who may be coming face-to-face with foreclosure as a possibility. And while the overall percentage of homeowners at risk is decreasing with time (see graph below), that’s little comfort to those individuals who are facing challenges today. If you haven’t taken advantage of the forbearance period, it may be time to research and understand your options. It starts with knowing what foreclosure is. Investopedia defines it like this:

If you haven’t taken advantage of the forbearance period, it may be time to research and understand your options. It starts with knowing what foreclosure is. Investopedia defines it like this:

“Foreclosure is the legal process by which a lender attempts to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property. Typically, default is triggered when a borrower misses a specific number of monthly payments . . .”

The good news is, there are alternatives available to help you avoid having to go through the foreclosure process, including:

But before you go down any of those paths, it’s worth seeing if you have enough equity in your home to sell it and protect your investment.

Equity is the difference between what you owe on the home and its market value based on factors like price appreciation.

In today’s real estate market, many homeowners have far more equity in their homes than they realize. Over the last year, buyer demand has been high, but housing supply has been low. That’s led to a substantial increase in home values. When prices rise, so does the amount of equity you have in your house.

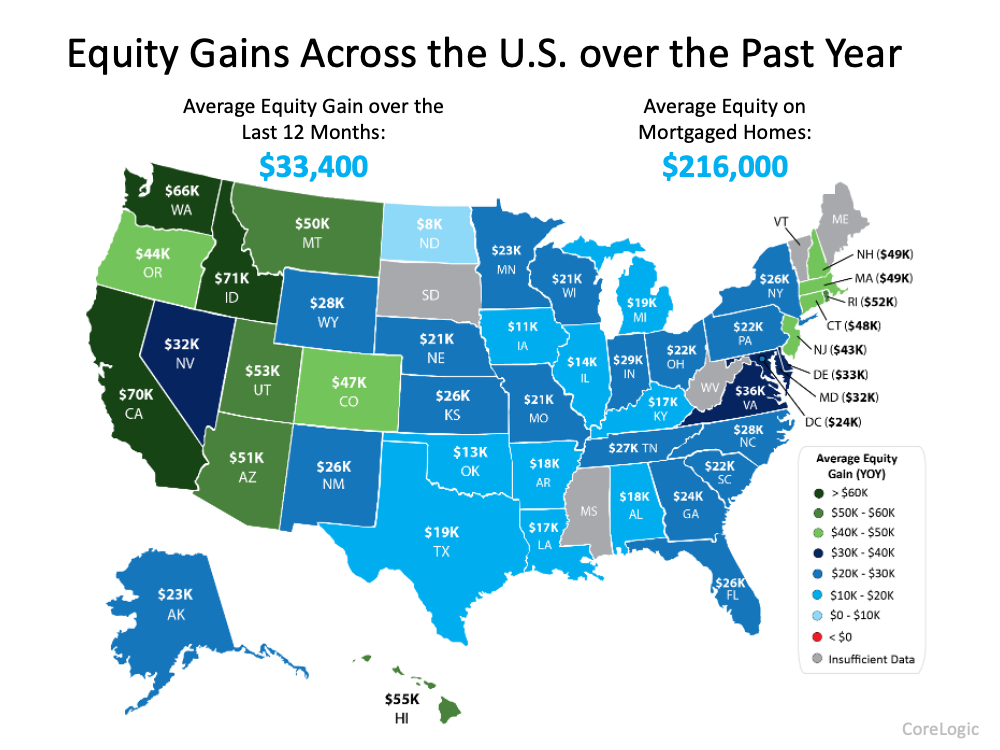

According to CoreLogic, on average, homeowners gained $33,400 in equity over the last 12 months, and the average equity on mortgaged homes is now $216,000 (see map below): So, what does that mean for you? Over the past year, chances are your home’s value and therefore your equity has risen dramatically. If you’ve been in your home for a while, the mortgage payments you’ve made over time chipped away at the balance of your loan. If your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage.

So, what does that mean for you? Over the past year, chances are your home’s value and therefore your equity has risen dramatically. If you’ve been in your home for a while, the mortgage payments you’ve made over time chipped away at the balance of your loan. If your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage.

Frank Martell, President and CEO of CoreLogic, elaborates on how equity can help:

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic. These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market.”

To find out what your house is worth in today’s market, work with a local real estate professional. We’ll be able to give you an estimate of what your house could sell for based on recent sales of similar homes in your area. Since home prices are still appreciating, you may be able to sell your house to avoid foreclosure.

If you find out that you have to pursue other options, your agent can help with that too. We’ll be able to connect you with other professionals in the industry, like housing counselors who can look into your unique situation and offer advice on next steps if selling isn’t the best alternative.

If you’re a homeowner facing hardship, let’s connect to explore your options and see if you can sell your house to avoid foreclosure.

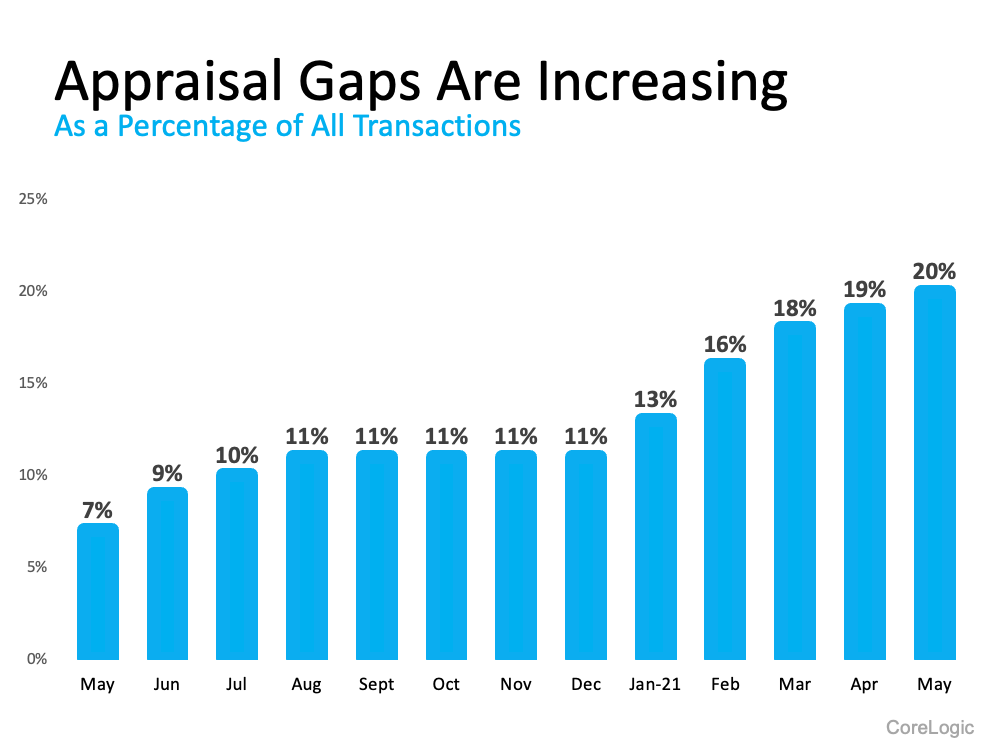

It’s economy 101 – when supply is low and demand is high, prices naturally rise. That’s what’s happening in today’s housing market. Home prices are appreciating at near-historic rates, and that’s creating some challenges when it comes to home appraisals.

In recent months, it’s become increasingly common for an appraisal to come in below the contract price on the house. Shawn Telford, Chief Appraiser for CoreLogic, explains it like this:

“Recently, we observed buyers paying prices above listing price and higher than the market data available to appraisers can support. This difference is known as ‘the appraisal gap . . . .’”

Basically, with the heightened buyer demand, purchasers are often willing to pay over asking to secure the home of their dreams. If you’ve ever toured a house you’ve fallen in love with, you understand. Once you start to picture yourself and your furniture in the rooms, you want to do everything you can to land the property, including putting in a high offer to try to beat out other would-be buyers.

When the appraiser comes in, they look at things a bit more objectively. Their job is to assess the inherent value of the home, so they’re going to study the facts. Dustin Harris, Appraiser Coach, drives this point home:

“It’s important for everyone to understand that the appraiser’s job in the end is to remain that unbiased third party, to truly tell the client what that home is worth in the current market, regardless of what decisions have been made on the price side of things.”

In simple terms, while homebuyers may be willing to pay more, appraisers are there to assess the market value of the home. Their goal is to make sure the lender isn’t loaning more money than the home is worth. It’s objective, rather than emotional.

In a highly competitive market like today’s, having a discrepancy between the two numbers isn’t unusual. Here’s a look at the increasing rate of appraisal gaps, according to data from CoreLogic (see graph below):

Ultimately, knowledge is power. The best thing you can do is understand appraisal gaps may impact your transaction if you’re buying or selling. If you do encounter an appraisal below your contract price, know that in today’s sellers’ market, the most common approach is for the seller to ask the buyer to make up the difference in price. Buyers, be prepared to bring extra money to the table if you really want the home.

Above all else, lean on your real estate agent. Whether you’re a buyer or seller, your trusted advisor is your ally if you come up against an appraisal gap. We’ll help you understand your options and handle any additional negotiations that need to happen.

In today’s real estate market, it’s important to stay informed on the latest trends. Let’s connect so you have an ally to help you navigate an appraisal gap to get the best possible outcome.