Ron Kurtz

Executive

Realty Executives Premiere

Are you one of the many renters thinking about where you’ll live the next time your lease is up? Before you decide whether to look for a new house or another apartment, it’s important to understand the true costs of renting in 2022.

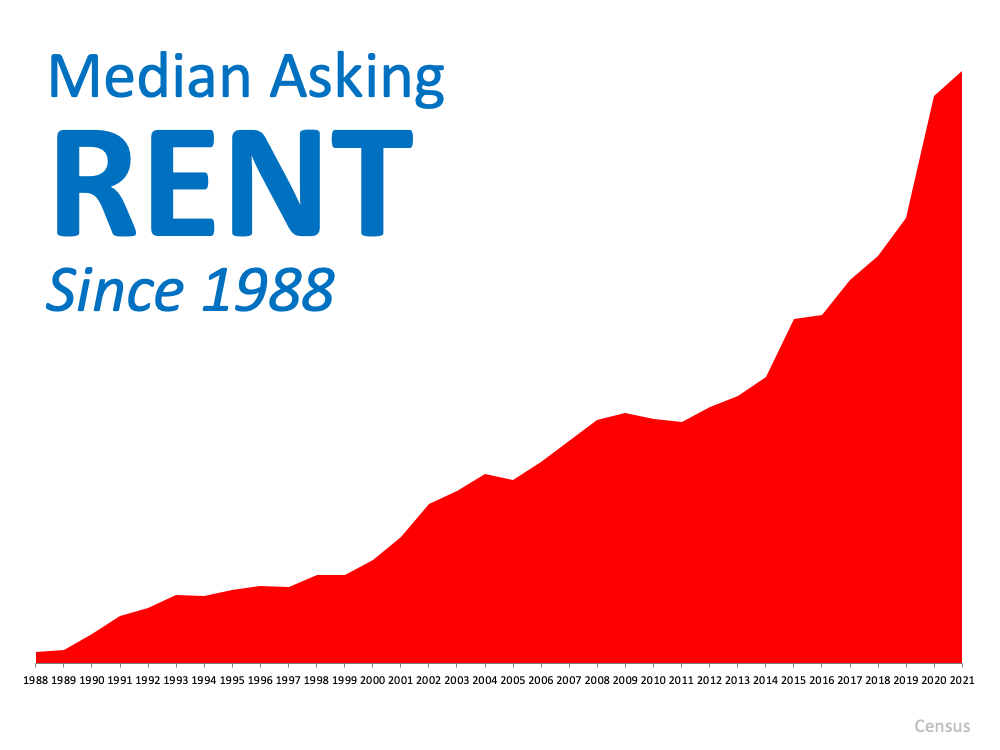

As a renter, you should know rents have been rising since 1988 (see graph below):

In 2021, rents grew dramatically. According to ApartmentList.com, since January 2021:

“. . . the national median rent has increased by a staggering 17.8 percent. To put that in context, rent growth from January to November averaged just 2.6 percent in the pre-pandemic years from 2017-2019.”

That increase in 2021 was far greater than the typical rent increases we’ve seen in recent years. In other words – rents are rising fast. And the 2022 National Housing Forecast from realtor.com projects prices for vacant units will continue to increase this year:

“In 2022, we expect this trend will continue and fuel rent growth. At a national level, we forecast rent growth of 7.1% in the next 12 months, somewhat ahead of home price growth . . .”

That means, if you’re planning to move into a different rental this year, you’ll likely pay far more than you have in years past.

If you’re a renter facing rising rental costs, you might wonder what alternatives you have. If so, consider homeownership. One of the many benefits of homeownership is it provides a stable monthly cost you can lock in for the duration of your loan.

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“. . . fast-rising rents and increasing consumer prices, may have some prospective buyers seeking the protection of a fixed, consistent mortgage payment.”

If you’re planning to make a move this year, locking in your monthly housing costs for 15-30 years can be a major benefit. You’ll avoid wondering if you’ll need to adjust your budget to account for annual increases.

Homeowners also enjoy the added benefit of home equity, which has grown substantially right now. In fact, the latest Homeowner Equity Insight report from CoreLogic shows the average homeowner gained $56,700 in equity over the last 12 months. As a renter, your rent payment only covers the cost of your dwelling. When you pay your mortgage, you grow your wealth through the forced savings that is your home equity.

If you’re thinking of renting this year, it’s important to keep in mind the true costs you’ll face. Let’s connect so you can see how you can begin your journey to homeownership today.

If you’re living on your own and looking to buy a home, know that you can make your dream a reality with thoughtful planning and the right team of experts. Research from Freddie Mac shows 28% of all households (36.1 million) are sole-person, and that number is growing. Over the past 40 years, the number of sole-person households has nearly doubled, and that’s a trend that’s expected to continue. According to Freddie Mac:

“Our calculation suggests that there will be an additional 5 million sole-person households in the United States by the next decade. This means 42% of the household growth will be contributed by sole-person households, . . .”

If you fall into this category, here are three tips to help you achieve your homeownership goals.

When you buy a home on your own, you have to qualify for your loan based solely on your own finances and credit history. Investopedia says:

“. . . lenders will be looking at just one credit profile: yours. Needless to say, it has to be in great shape. It is always a good idea to review your credit report beforehand, and this is especially true of solo buyers.”

It’s important to find out your score so you know where it falls. If you’re not sure if it’s strong enough or where to focus your energy to improve it, meet with a professional for expert advice on your individual situation.

Next, look into down payment programs so you can get a feel for what you’ll need to save to buy a home. Rob Chrane, CEO of Down Payment Resource, explains:

“Buyers should discuss their program options with their loan officer and real estate agent to make sure they choose the program best suited to their personal needs.”

In this step, lean on the pros to determine what you’re eligible for and what’s right for you.

You should also spend time thinking about what you want. What type of home do you picture yourself in? To answer that question, Quicken Loans shares this advice:

“Think about your lifestyle, what you want out of your home and your needs. Is being close to work important? Do you need a lot of yard space? Do you want an extra bedroom that you can transform into a home office? Condo or detached home? Lots of space for entertaining? It’s all up to you (and your budget).”

Again, a professional can help you balance what you want and how much you should spend on your monthly housing costs to determine what type of home is right for you.

While buying a home solo can feel like a big challenge, it doesn’t have to be. If you lean on the professionals, they can help you navigate these waters and make sure you’re able to take advantage of the great opportunities in today’s housing market (like low mortgage rates) to buy your dream home.

The share of sole-person households is growing. If you’re looking to buy a home on your own, be confident that the dream is achievable. When you’re ready to begin your search, let’s connect so you have expert advice each step of the way.

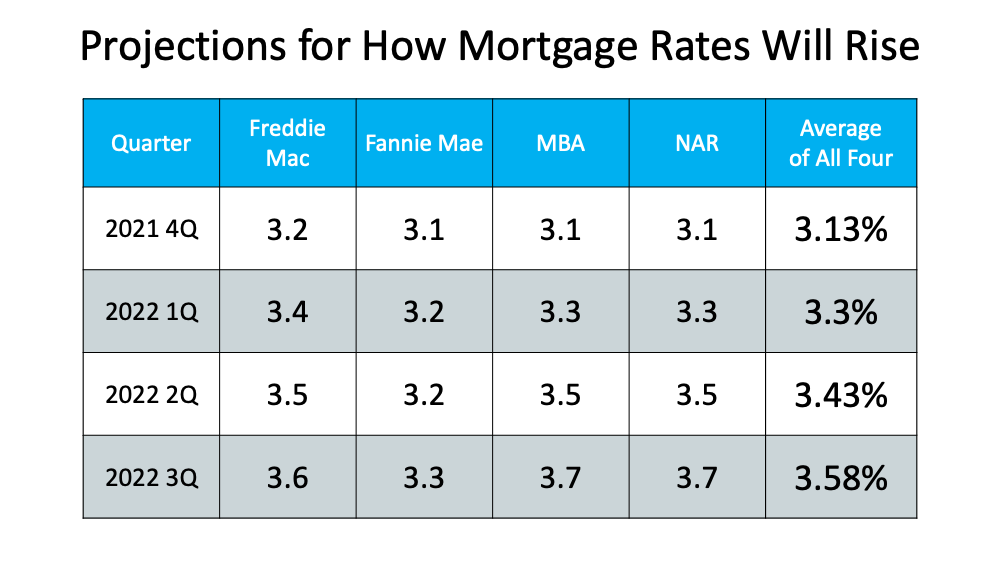

Last week, the average 30-year fixed mortgage rate from Freddie Mac inched up to 3.1%, and experts project rates will continue rising through 2022:

“The 30-year fixed-rate mortgage was 2.9% in the third quarter of 2021. We forecast mortgage rates to increase slightly through the remainder of the year and reach 3.0%, rising to 3.5% for full year 2022.”

If you’re thinking of buying a home, here are a few things to keep in mind so you can succeed even as mortgage rates rise.

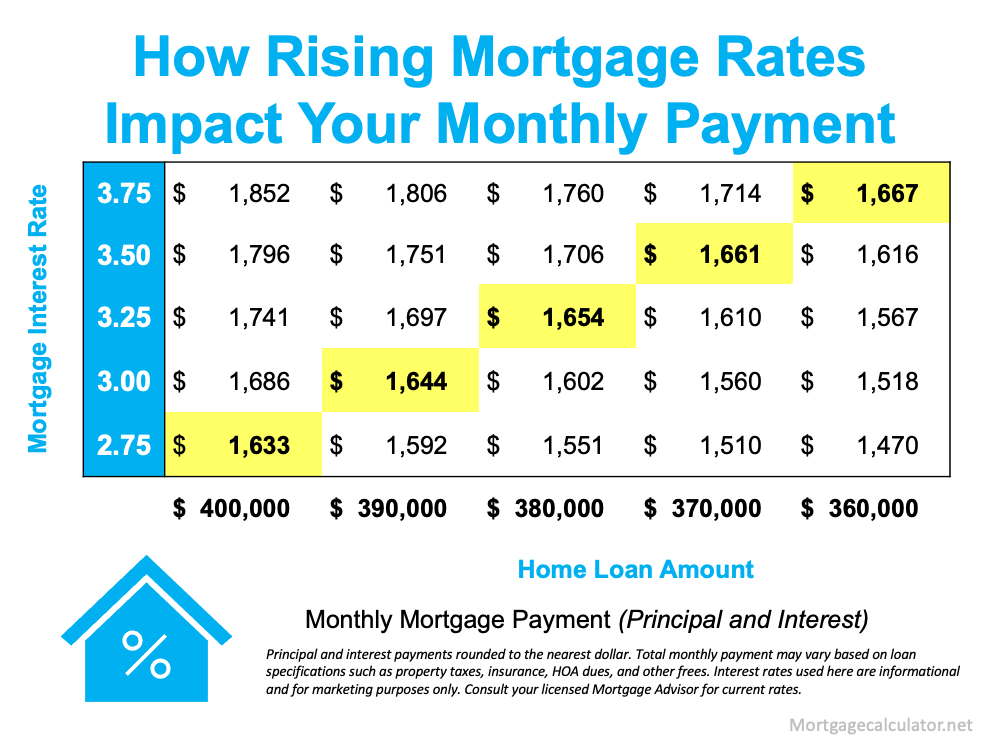

Mortgage rates play a significant role in your home search. As rates go up, your monthly mortgage payment increases if you’re buying a home, directly affecting how much you can afford. And even the smallest increase can have a large impact on your monthly payment (see chart below): With mortgage rates on the rise, you’ve likely seen your purchasing power impacted already. Instead of waiting and hoping rates will fall, today’s rates should motivate you to purchase now before rates increase more.

With mortgage rates on the rise, you’ve likely seen your purchasing power impacted already. Instead of waiting and hoping rates will fall, today’s rates should motivate you to purchase now before rates increase more.

You can use your newfound motivation to energize your search and plan your next steps accordingly so you’re prepared to act no matter what happens with mortgage rates. One way to do that: take rising rates into consideration as part of your budget.

Danielle Hale, Chief Economist at realtor.com, puts it best, saying:

“Smart buyers should consider calculating a monthly payment not only at today’s rates, but also at rates that are a bit higher so that they won’t be derailed by a sudden upward move. . . .”

You should also be ready to act when you find the home that meets your needs. That means getting pre-approved with a lender so there won’t be any delays when the time arrives.

The best way to prepare is to work with a trusted real estate advisor now. An agent can connect you with a lender, help you adjust your search based on your budget, and be ready to act quickly when it’s time to make an offer.

Serious buyers should approach rising rates as a motivating factor to buy sooner, not a reason to wait. Waiting will cost you more in the long run. Let’s connect today so you can better understand your budget and be prepared to buy your home even before rates climb higher.

As a renter, you’re constantly faced with the same dilemma: keep renting for another year or purchase a home? Your answer depends on your current situation and future plans, but there are a number of benefits to homeownership every renter needs to consider.

Here are a few things you should think about before you settle on renting for another year.

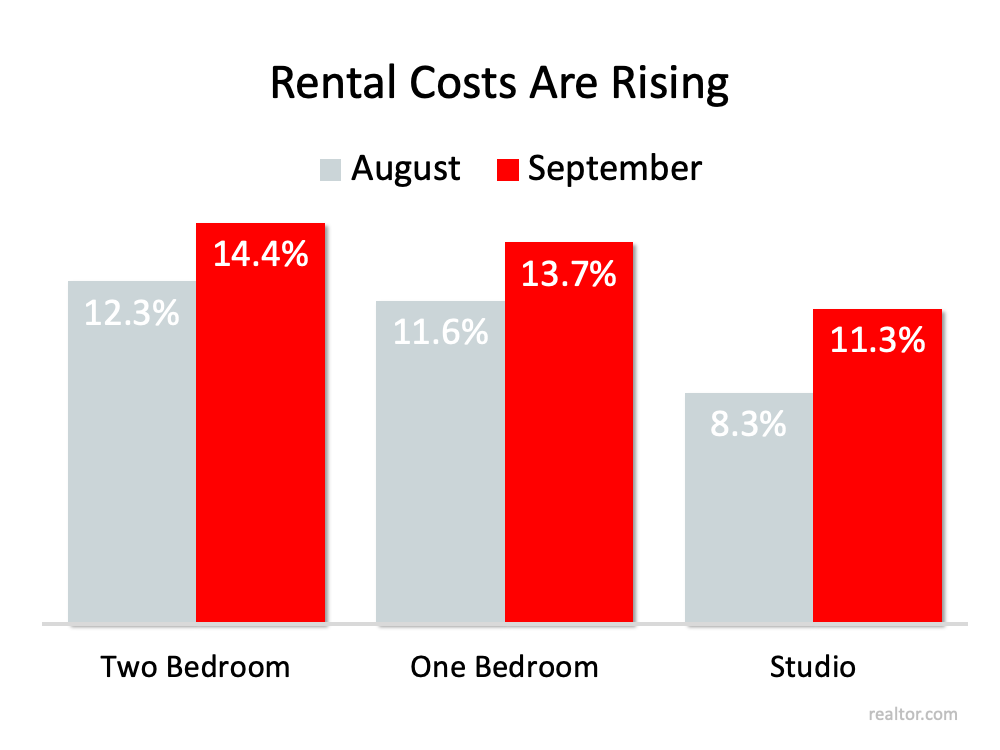

Rent increasing each year isn’t new. Looking back at Census data confirms rental prices have gone up consistently for decades (see graph below): If you’re a renter, you’re faced with payments that continue to climb each year. Realtor.com recently shared the September Rental Report, and it shows price increases accelerating from August to September (see graph below):

If you’re a renter, you’re faced with payments that continue to climb each year. Realtor.com recently shared the September Rental Report, and it shows price increases accelerating from August to September (see graph below): As the graph shows, rents are still on the rise. It’s important to keep this in mind when the time comes for you to sign a new lease, as your monthly rental payment may increase substantially when you do.

As the graph shows, rents are still on the rise. It’s important to keep this in mind when the time comes for you to sign a new lease, as your monthly rental payment may increase substantially when you do.

One of the most significant advantages of buying a home is the wealth you build through equity. This year alone, homeowners gained a substantial amount of equity, which, in turn, grew their net worth. As a renter, you miss out on this wealth-building tool that can be used to fund your retirement, buy a bigger home, downsize, or even achieve personal goals like paying for an education or starting a new business.

This is a big decision-making point if you want to be able to paint, renovate, and make home upgrades. In many cases, your property owner determines these selections and prefers you don’t alter them as a renter. As a homeowner, you have the freedom to decorate and personalize your home to truly make it your own.

You may choose to rent because you feel it provides greater flexibility if you need to move for any reason. While it’s true that selling a home may take more time than finding a new rental, it’s important to note how quickly houses are selling in today’s market. According to the National Association of Realtors (NAR), the average home is only on the market for 17 days. That means you may have more flexibility than you think if you need to relocate as a homeowner.

Deciding if it’s the right time for you to buy is a personal decision, and the timing is different for everyone. However, if you’d like to learn more about the benefits of homeownership, let’s connect so you can make a confident, informed decision and have a trusted advisor along the way.

Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house for your money. Within the last year, mortgage rates have hit the lowest point ever recorded, and they’ve hovered in the historic-low territory. But even over the past few weeks, rates have started to rise. This past week, the average 30-year fixed rate was 3.14%.

What does this mean if you’re thinking about making a move? Waiting until next year will cost you more in the long run. Here’s a look at what several experts project for mortgage rates going into 2022.

“The average 30-year fixed-rate mortgage (FRM) is expected to be 3.0 percent in?2021 and 3.5 percent in 2022.”

“Right now, we forecast mortgage rates to average 3.3 percent in 2022, which, though slightly higher than 2020 and 2021, by historical standards remains extremely low and supportive of mortgage demand and affordability.”

“Consensus forecasts predict that mortgage rates will hit 3.2 percent by the end of the year, and 3.7 percent by the end of 2022.”

If rates rise even a half-point percentage over the next year, it will impact what you pay each month over the life of your loan – and that can really add up. So, the reality is, as prices and mortgage rates rise, it will cost more to purchase a home.

As you can see from the quotes above, industry experts project rates will rise in the months ahead. Here’s a table that compares other expert views and gives an average of those projections:

Whether you’re thinking about buying your first home, moving up to your dream home, or downsizing because your needs have changed, purchasing before mortgage rates rise even higher will help you take advantage of today’s homebuying affordability. That could be just the game-changer you need to achieve your homeownership goals.

If you’re thinking of buying or selling over the next year, it may be wise to make your move sooner rather than later – before mortgage rates climb higher.