GET FREE YOUR HOME EVALUATION!

CLICK BELOW .

https://cloudcma.com/api_widget/ea29bf625ddd802bc099db369ad5320b/show?post_url=cloudcma.com&source_url=ua

Housing Demand 2018: More Buyers Joining the Party

Housing market demand predictions: Demand 2018 will see stronger demand as young buyers have more savings to invest in a home and are getting closeer to being able to purchase a home.

Housing demand is also being supplemented by bankruptcy survivors who waited out their 7 year exile joining first time buyer millennials, all of whom are looking for houses for sale.

New Home Construction Starts: Still Strong in 2018

New home building shows continued strengths, and should pick up by late spring when builders see a return of demand. Last February’s demand was also subdued.

The cost of living is rising and it means workers and businesses in cities such as New York, Los Angeles, San Francisco, Seattle, San Jose, Miami, San Diego, and Boston may migrate to cheaper cities such as Houston, Austin, and San Antonio. This is where job growth is best and housing is cheapest.

The price of apartment rental in cities such as Seattle,long beach , and San Jose Rents are extreme examples of the migration out of high priced areas. With limited housing and a strong economy, prices in San Francisco and the Bay Area cannot fall.

Inflation, Labor Shortages, and Building Supplies

Labor shortages, rising mortgage rates, and higher lumber costs are looming which could mean house prices will rise. With nowhere to go, homeowners are resisting selling. The hope that the resale market will come to the rescue might be unrealistic and and perhaps even fewer resale houses will be for sale. This fall, new home sales have been brisk as reported by the Commerce Department.

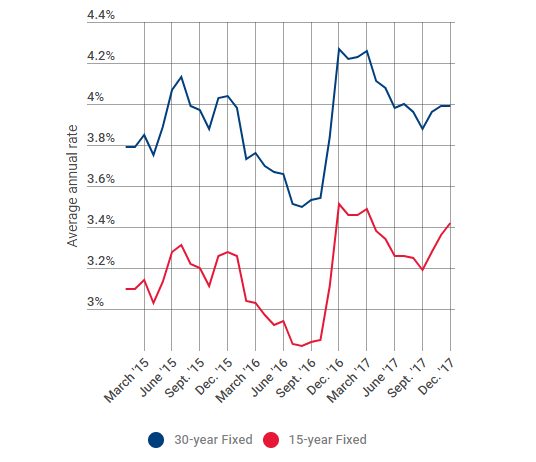

Mortgage Rates on the Rise

15 year fixed rate mortgages are still a bargain compared to historical averages. A home at these interest rates has to be considered a big savings, compared to the added price.

Housing Experts Predictions and a Lot More

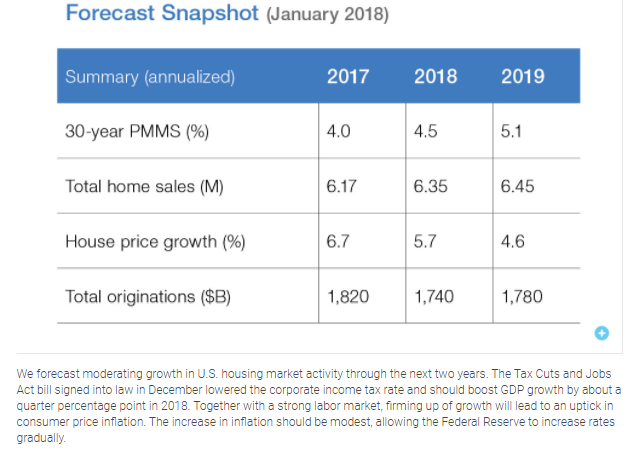

Let’s start off with the newly released 2018 Forecast from Freddie Mac. The predict a good year ahead with a solid 5% growth in price. They note that the aging population could keep demand subdued although limited housing for sale should create upward price pressure.

The need to refinance is low, homeowners aren’t too stressed out, and they’re using home equity to buy things which is good for the economy. Overall, Freddie Mac’s report is positive for 2018.

Home Sales Expect to Rise Nationally

Freddie Mac Predicts strong sales driven by moderating prices nationally.

image: http://gordcollins.com/wp-content/uploads/2018/02/freddiemac2018.png

Hottest Cities for Investment Value

This chart from NAR shows where employment growth is strongest and the ratio of recent employment growth to homes being built. That’s a great stat for rental property investors looking for investment income. Compare that to wage growth and actual price appreciation. Again the Bay Area shows the best outlook for employment which has to be your top signal. Salt Lake City, Denver, Tampa, Dallas, Cape Coral/Naples, Charlotte, Las Vegas, Houston, San Diego, and Grand Rapids have great :

| 20 Hottest Housing Markets, January 2018 (Realtor.com) | Rank (December) | Rank Change | Current Home Prices |

| San Francisco, CA | 2 | 1 | $1,249,000 |

| San Jose, CA | 1 | -1 | $875,000 |

| Vallejo, CA | 3 | 0 | $390,000 |

| Colorado Springs, CO | 4 | 0 | $270,000 |

| Midland, TX | 18 | 13 | $265,000 |

| San Diego, CA | 6 | 0 | $590,000 |

| Santa Rosa, CA | 7 | 1 | $310,000 |

| Sacramento, CA | 8 | 2 | $310,000 |

| Denver, CO | 11 | 2 | $400,000 |

| Stockton, CA | 5 | -5 | $289,000 |

| Modesto, CA | 10 | -1 | $295,000 |

| Dallas, TX | 14 | 2 | $360,000 |

| Fresno, CA | 12 | -1 | $205,000 |

| Los Angeles, CA | 16 | 2 | $759,000 |

| Columbus, OH | 9 | -6 | $140,000 |

| Chico, CA | 29 | 13 | $349,000 |

| Oxnard, CA | 21 | 4 | $505,000 |

| Santa Cruz, CA | 27 | 9 | $909,000 |

| Detroit, MI | 19 | 0 | $349,000 |

| Boise City, ID | 26 | 6 |

Here’s 8 Reasons Why People Are Still Eager to Buy Real Estate:

- home prices are appreciating and it’s a safe investment over the long term

- millennials need a home to raise their families

- rents are high giving property owners excellent ROI on rental properties

- flips of older properties continue to create amazing returns

- real property is less risky (unless you get over leveraged)

- the economy is steady or improving (although Trump’s letting his enemies cause too much friction)

- foreigners including Canadians are eager to own US property

- bankrupt buyers are over their 7 year prohibition from the last recession and they can buy agai

Short list of positive factors to bolster US Housing Market :

- modera

f which cities we should know about.

Here Panelists from the Urban Land Institution discusses 2017 and the next two year outlook:tely rising mortgage rates

- president Trump’s new tax plan

- low risk of a housing bubble / crash for most cities

- millennials buyers coming into the main home buying years

- a trend to government deregulation

- labor shortages pushing up costs of production and incomes

- the economy will keep going – longest positive business cycle in history

ARE YOU READY TO BUY OR SELL YOUR HOME

FEEL FREE TO CONTACT ME ANYTIME

I BE GLAD TO HELP YOU

323-864-5121

562-221-5566 ESPANOL

5822 Adenmoor ave

Lakewood ca 90713