Thinking about buying a home? While today’s mortgage rates might seem a bit intimidating, here are two solid reasons why, if you’re ready and able, it could still be a smart move to get your own place.

1. Home Values Typically Go Up Over Time

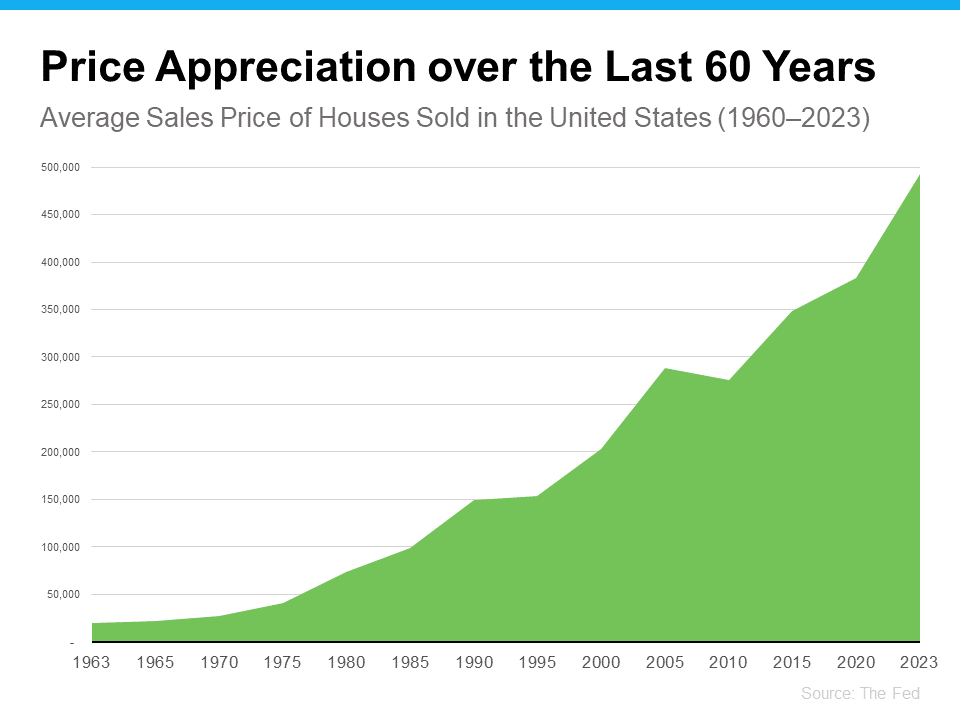

There’s been some confusion over the past year or so about which way home prices are headed. Make no mistake, nationally they’re still going up. In fact, over the long-term, home prices almost always go up (see graph below):

Using data from the Federal Reserve (the Fed), you can see the overall trend is home prices have climbed steadily for the past 60 years. There was an exception during the 2008 housing crash when prices didn't follow the normal pattern, but generally, home values kept rising.

This is a big reason why buying a home can be better than renting. As prices go up and you pay down your mortgage, you build equity. Over time, this growing equity can really increase your net worth. The Urban Institute says:

“Homeownership is critical for wealth building and financial stability.”

2. Rent Keeps Rising in the Long Run

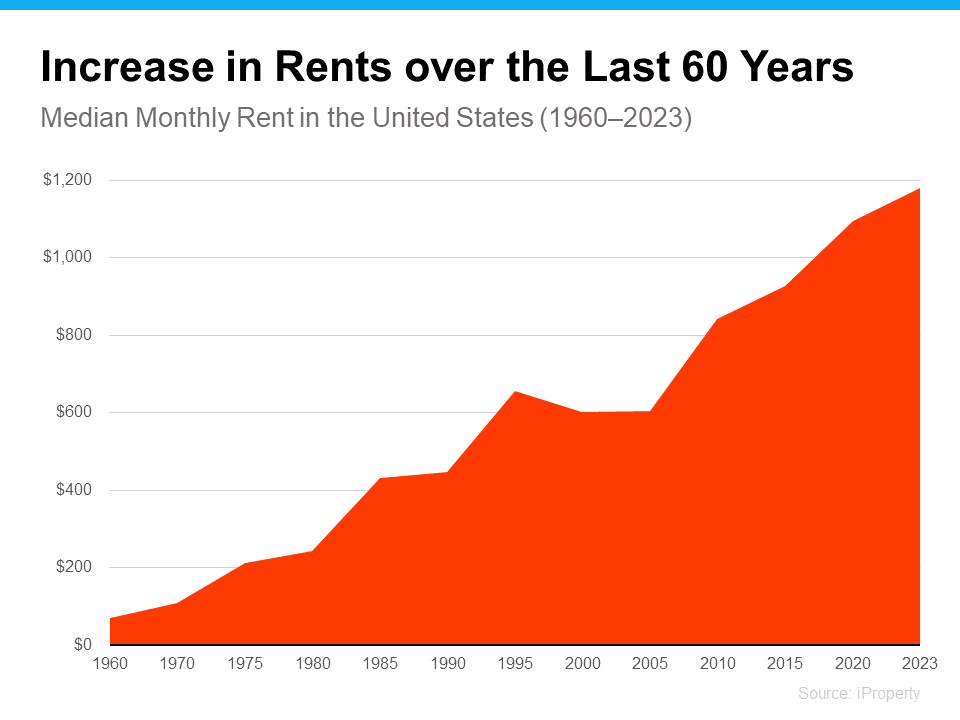

Here’s another reason you may want to think about buying a home instead of renting – rent just keeps going up over the years. Sure, it might be cheaper to rent right now in some areas, but every time you renew your lease or sign a new one, you’re likely to feel the squeeze of your rent getting higher.

According to data from iProperty Management, rent has been going up pretty consistently for the last 60 years, too (see graph below):

So how do you escape the cycle of rising rents? Buying a home with a fixed-rate mortgage helps you stabilize your housing costs and say goodbye to those annoying rent increases. That kind of stability is a big deal.

Your housing payments are like an investment, and you've got a decision to make. Do you want to invest in yourself or keep paying your landlord?

When you own your home, you're investing in your own future. And even when renting is cheaper, that money you pay every month is gone for good.

As Dr. Jessica Lautz, Deputy Chief Economist and VP of Research at the National Association of Realtors (NAR), says:

“If a homebuyer is financially stable, able to manage monthly mortgage costs and can handle the associated household maintenance expenses, then it makes sense to purchase a home.”